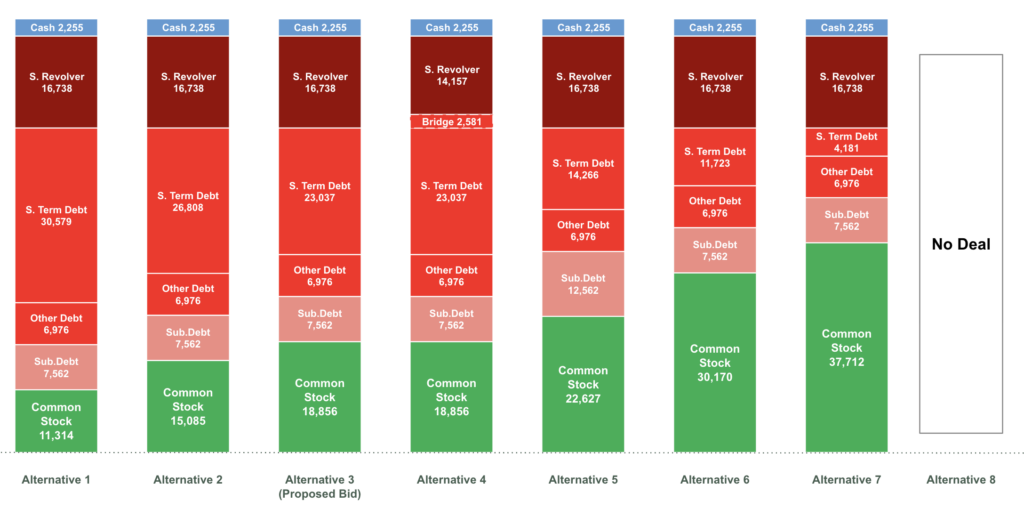

We are now going to work through 8 deal alternatives.

Acquisition financing decisions involve balancing multiple objectives:

- Ensuring sufficient funds to complete the transaction, including purchase price, refinancing of existing debt, and transaction fees.

- Optimising the capital structure to maximise returns on equity while managing financial risk.

- Aligning with strategic objectives, such as maintaining financial flexibility, credit ratings, and stakeholder confidence.

Analyse the 8 different capital structure scenarios for the GBP 75.4 billion Tesco transaction. These scenarios vary the mix of debt and equity financing, demonstrating how changes in leverage affect:

- The size of the required equity

- Return on equity (ROE)

- Financial risk and flexibility

- Feasibility of the transaction

Scenario 3 (Base Case) represents the initial proposed structure, while Scenarios 1 and 2 explore more aggressive leverage with reduced equity contributions, and Scenarios 4 to 7 explore increasing levels of equity with corresponding reductions in debt. Scenario 8 illustrates a “no deal” outcome, where the equity requirement is too large to achieve acceptable returns.