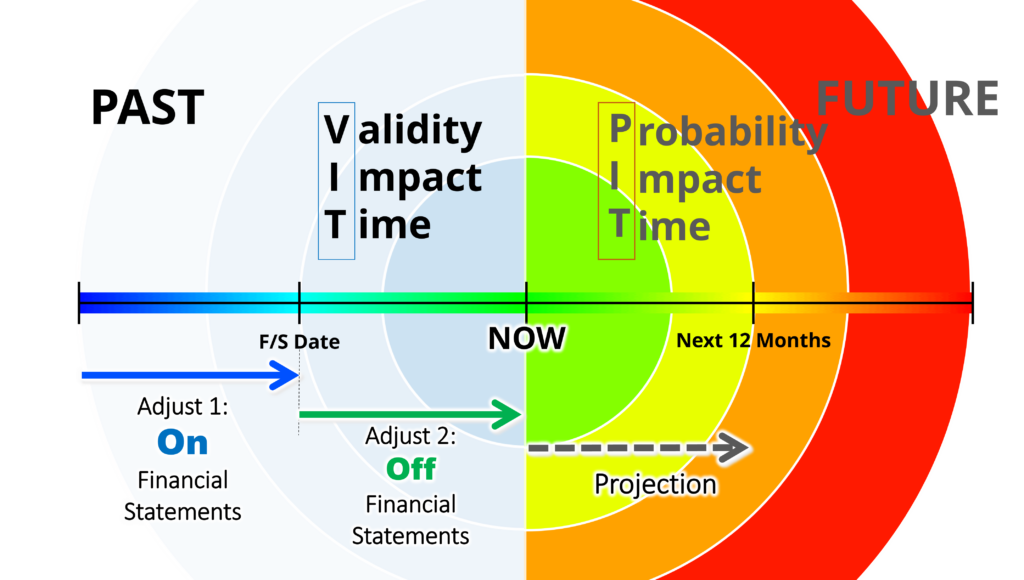

Time changes everything

A way to think about assessing B/S items

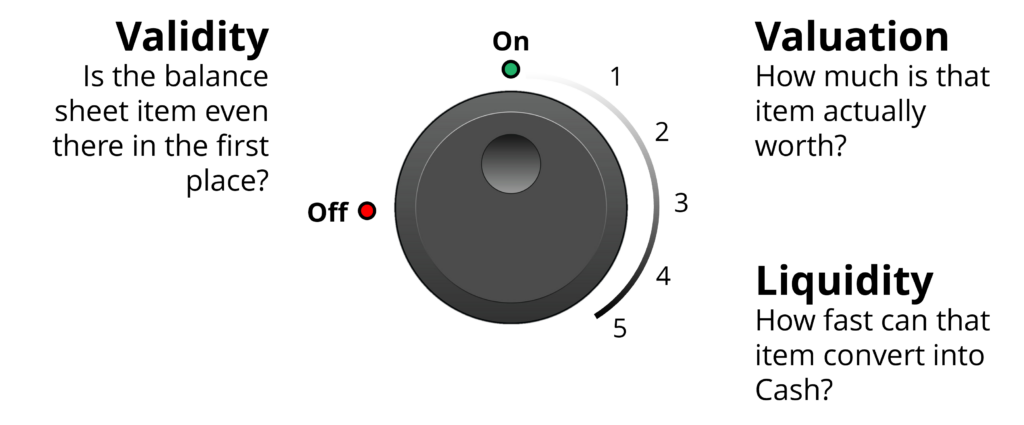

On-off Switch

Before you can even talk about magnitude, is the item even there?

Volume Control

Once the switch is on, how loud do you want to tune the radio?

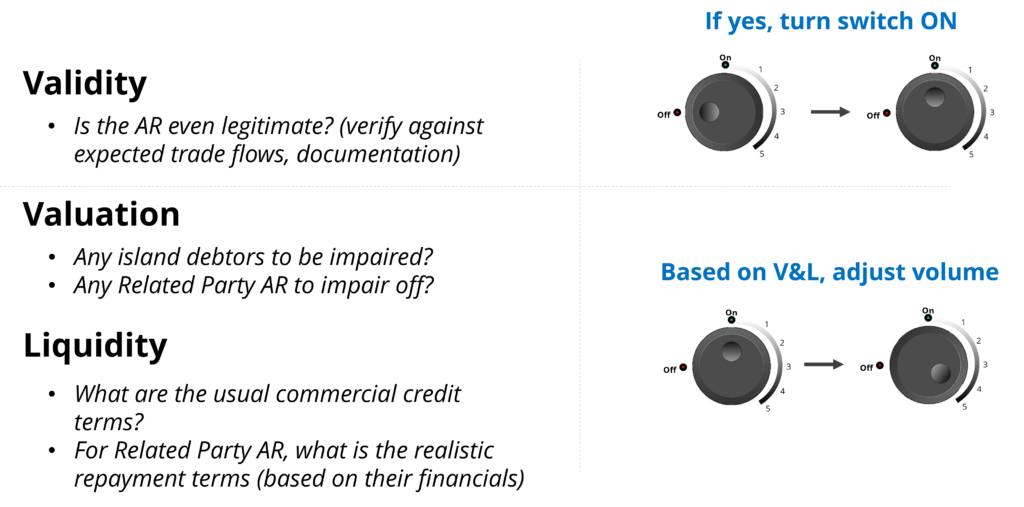

Validity, Valuation, Liquidity applied to AR

Validity, Valuation, Liquidity

Analysing financials (especially B/S items)

Validity?

- Is the item valid?

Valuation?

- How much is the item worth?

Liquidity?

- How fast does the item turn into cash?

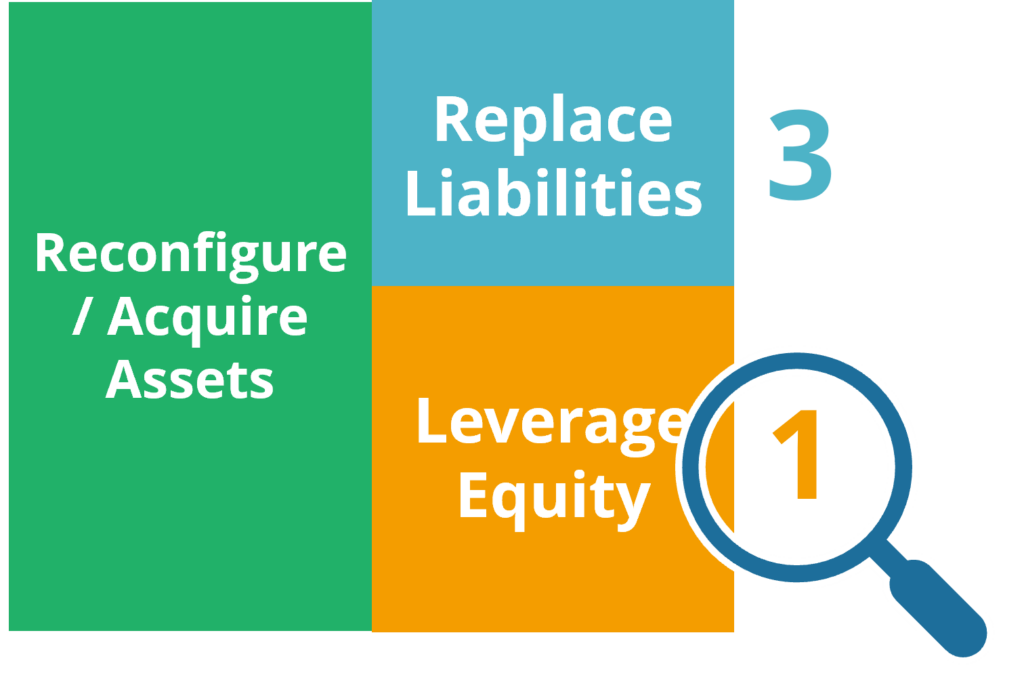

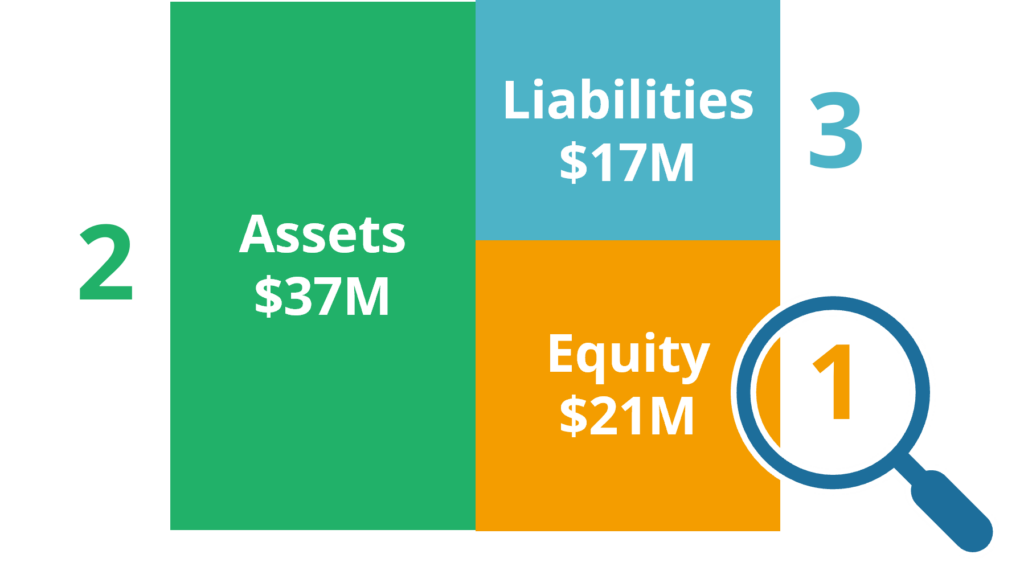

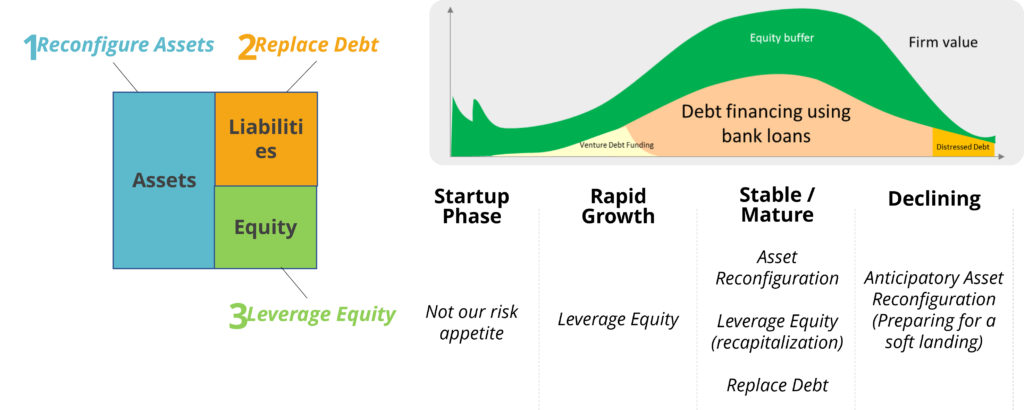

Identifying opportunities

Validity?

- What is a viable opportunity?

Valuation?

- How much?

Liquidity?

- For how long?

Example

Validity?

- Leveraged buyout

- By company’s managers

Valuation?

- Estimate sale valuation to be $10M to $20M

- Maximum EBITDA to be around $3M

Liquidity

Assuming DSCR = 1x

- Tenor to be between 4 to 7 years

Opportunity Identification

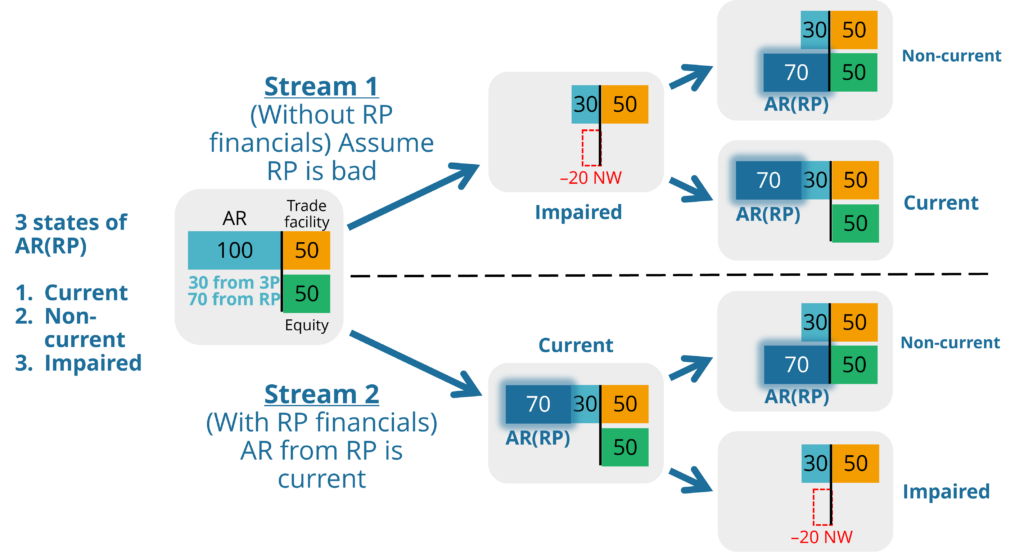

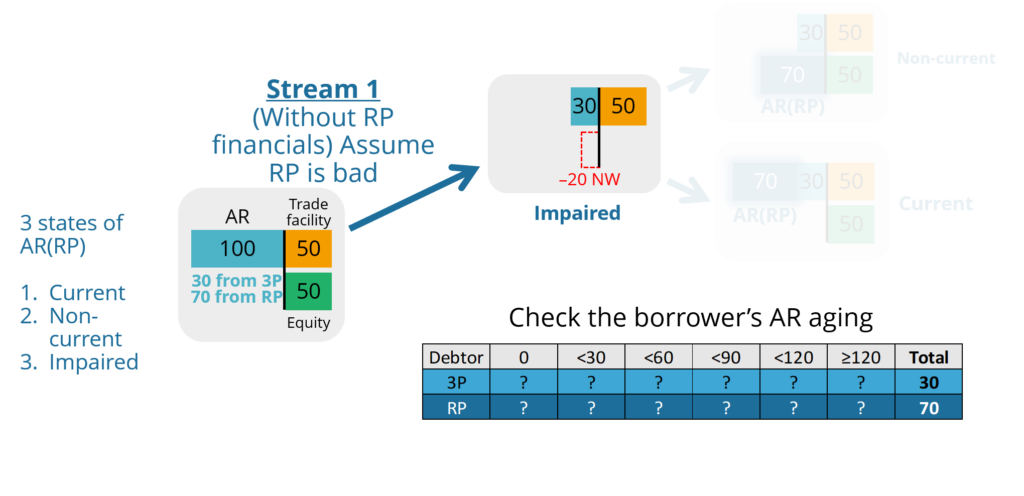

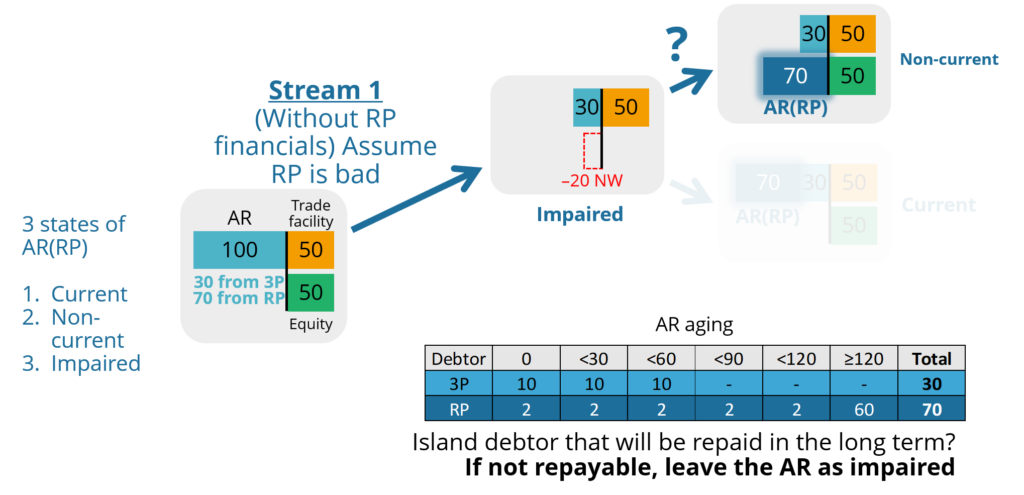

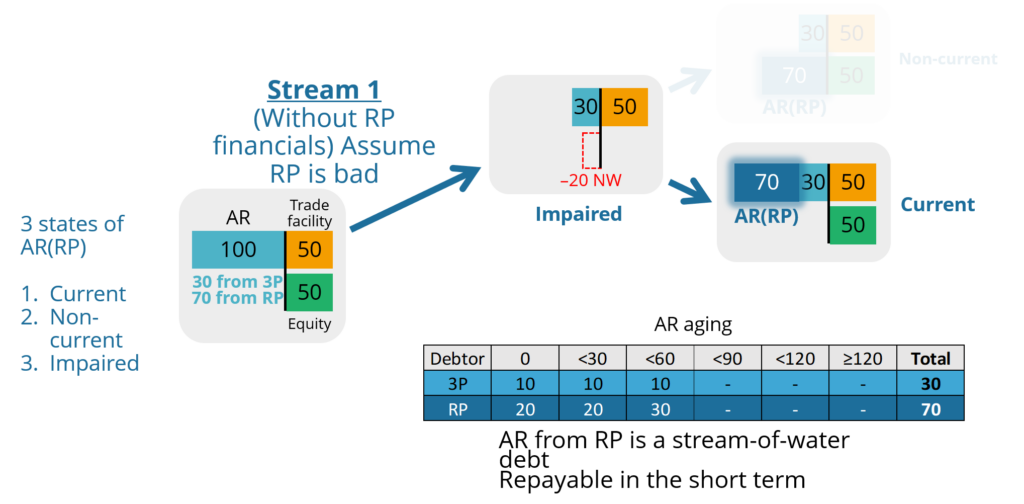

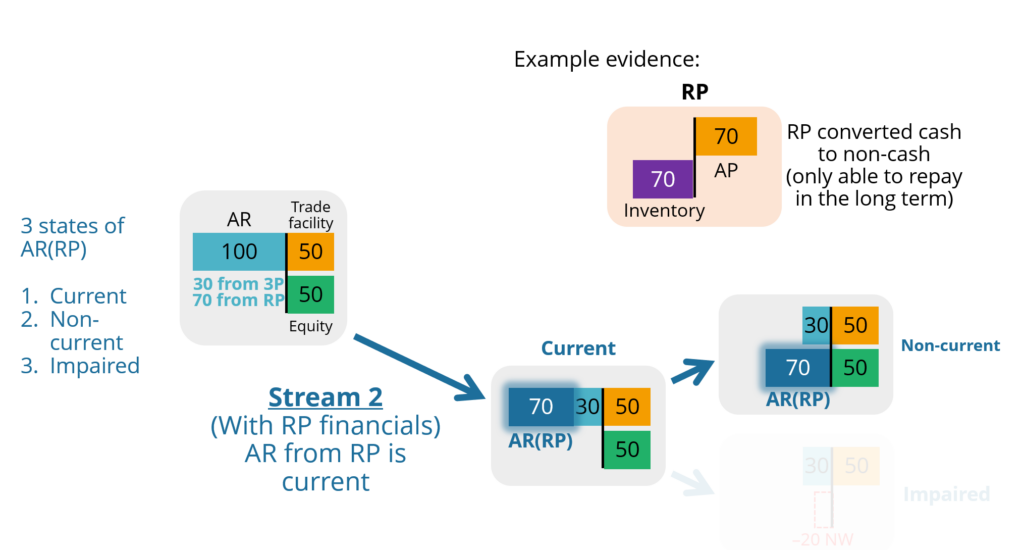

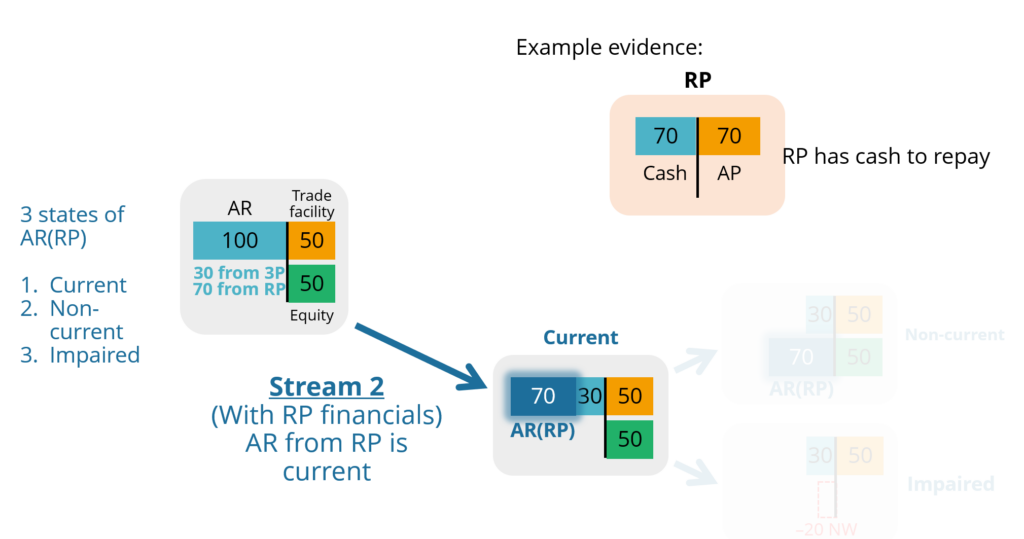

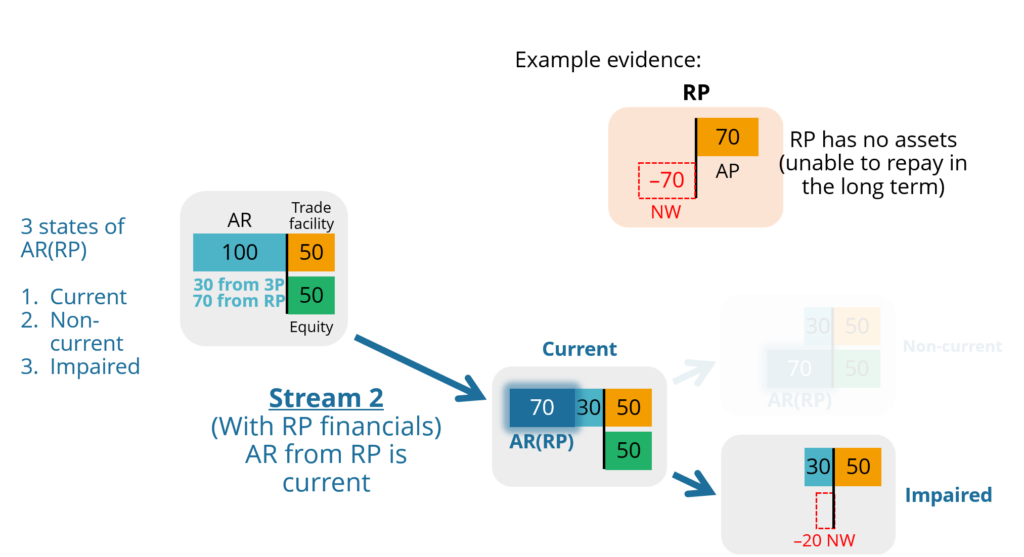

Assessing AR from RPs

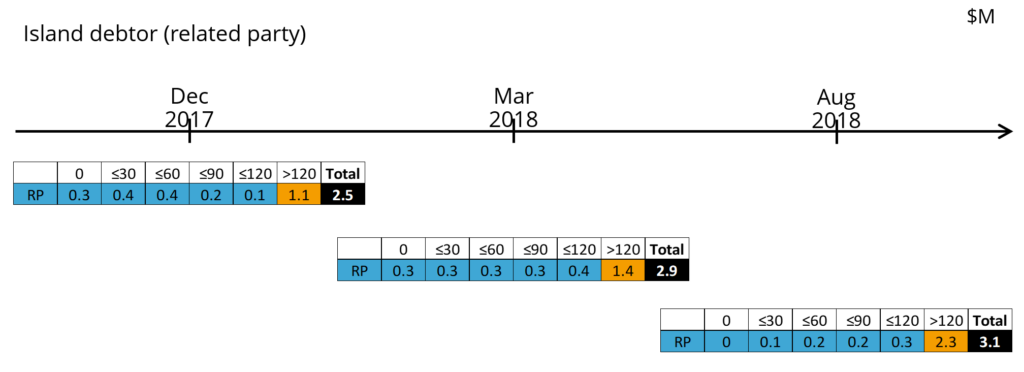

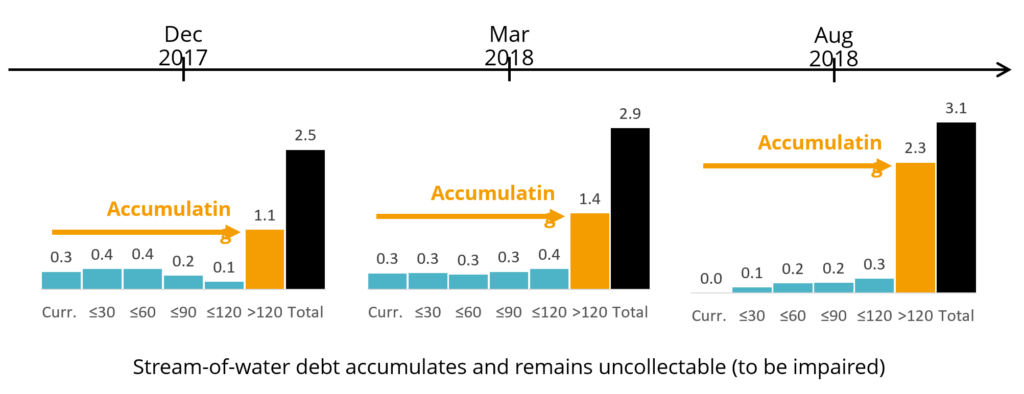

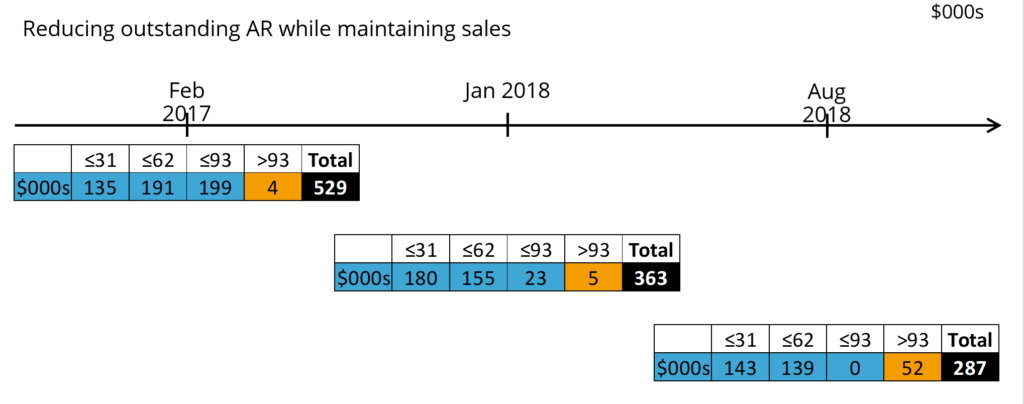

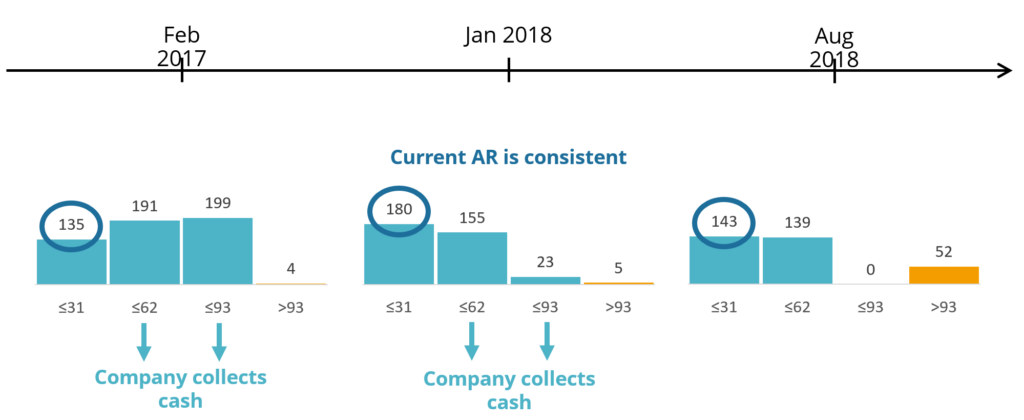

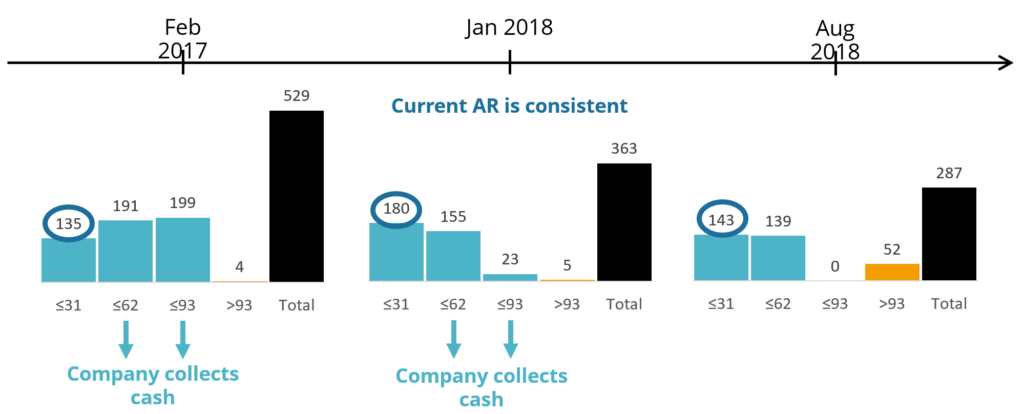

Longitudinal changes in AR aging

Common Mistakes

- Net worth definition includes loans due to directors but does not exclude loans due from directors

- Never find out why audited accounts are qualified

- Review on unchanged basis = don’t need to re-assess needs of clients against the financials

- Double counting of rental savings

- Never find out what is other income when other income consistently is the factor for positive NPAT

3 Key Sources of Errors in MRA

- Original financials – Quality of financials prepared by borrower

- Spreading of MRA

- Interpretation by users