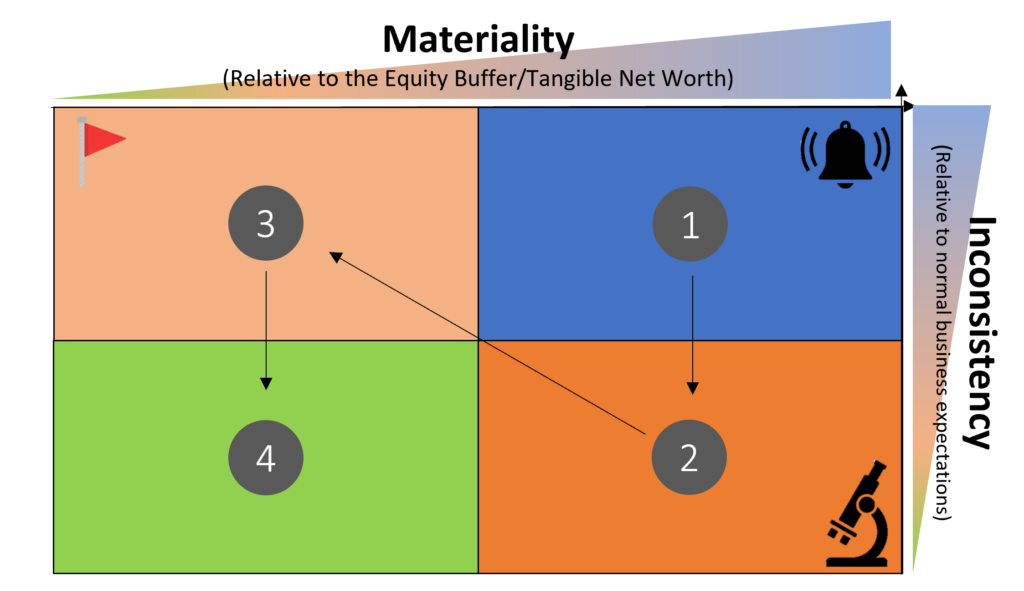

Investigate in order of priority

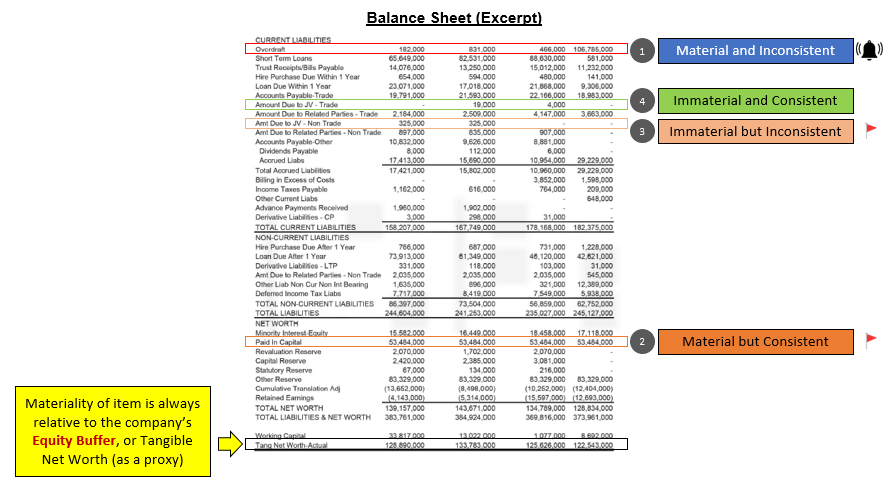

- Material and Inconsistent

- Material but consistent

- Immaterial but inconsistent

- Immaterial and consistent

- Prioritize which items of financial statements warrant additional information

- Prioritise questions to ask clients

- Prioritize questions to ask bankers

- Analysts should be investigated 1 and 2

- But 3 (Red flags) is equally important if time permits as it potentially leads to 1 and 2.

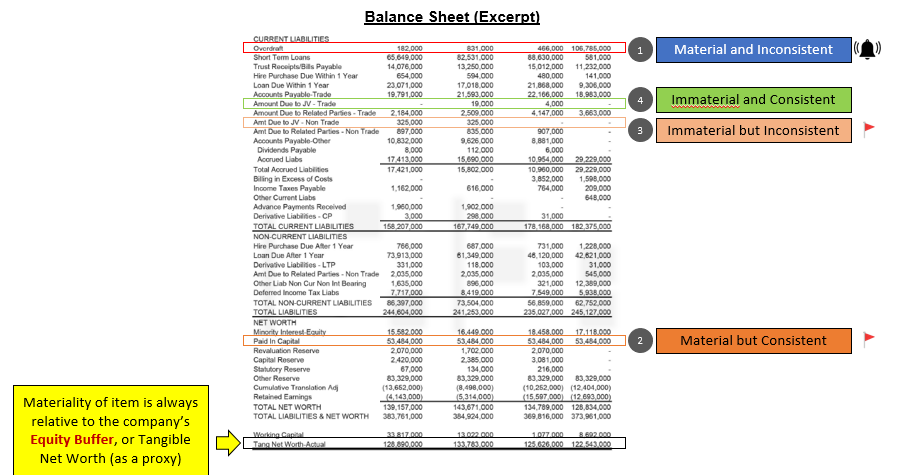

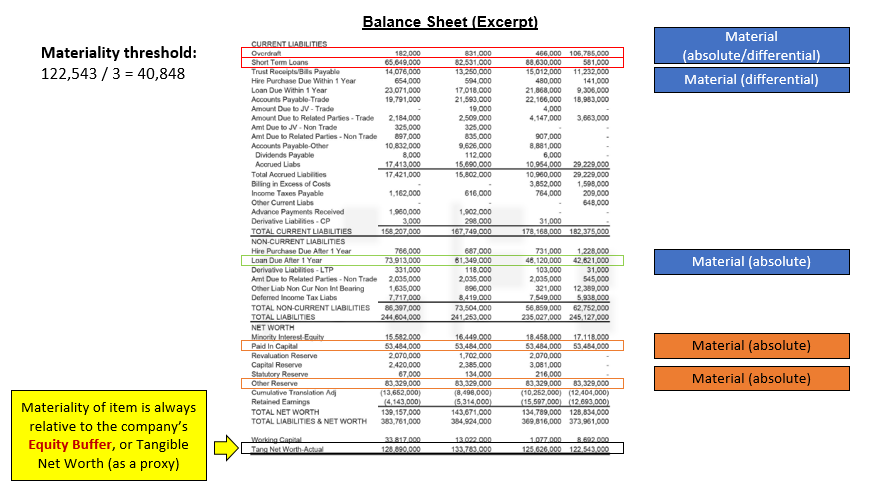

Materiality relative to company’s EQUITY BUFFER. For example:

Materiality

If the material item were found to be invalid (non-existent) as it is a binary state (either valid or invalid / exist or non-existent).

We will reduce the starting TNW by that amount, obtaining new reference point for materiality.

Approach

- Reference for materiality is dynamic.

- Starting with latest (as in 4BOT – FS date) book/accounting TNW, tangible net worth, and then adjust iteratively to obtain “true”/adjusted equity buffer.

Why one-third of TNW/EB?

| Debt | Equity | D/E |

| 3 | 3 | 1.0 |

| 3 | 2 | 1.5 |

| 3 | 1 | 3.0 |

One-third threshold should also be computed accumulatively. We should examine different/related items that may add up to 1/3.

The materiality threshold is applied to:

- an item in absolute amount and

- the variance in that item (differential: differential BS)

The MIM Analysis should be done across multiple periods, not just the most recent 2 periods.

If we apply MIM on balance sheet, the differential balance sheet analysis will have covered the cash flow.

Materiality on Balance Sheet – Capital Structure

Inconsistency

1.Internal: relative to information on hand

- Financial

- Non Financial

Contradictions of information on hand. This is what we typically referred to for human analysts with limited time.

2.External: relative to

- yet to obtain

- unverifiable to information

- expectation

- industry norms

- business practices

Can be shown up with Peers Analysis

Most challenging as time consuming, can be supplemented by AI, ML, analysts’ reports, data/info providers

Inconsistency: Internal Financial Inconsistency

Materiality-Inconsistency Matrix (MIM) future state

With AI/ML, big data, auto algorithms, etc, the MIM items could be auto generated and prioritise for human analysts to investigate further.

Can AI /ML conduct its own investigations?

Yes, likely with numerical inconsistencies with regular patterns. We should some financial dataset and ML for Proof of Concept. There are some situations the human motivations may be beyond ML.

Analysis of MRA

- Identify key sources of error: (i) Quality of financials, (ii) Spreading of MRA, (iii) Interpretation of MRA financials by users (RM and Credit Memos)

- Completeness & reliability, misclassification of items, years of historical data etc.

- Quick Identification of items that are material and consistent

- Materiality relative to the company’s EQUITY BUFFER – Rule #2

- Equity Buffer is the safety net available to the bank

- Equity Buffer = Share Capital + Retained Earnings (and Collateral)

- Basic Link Between Rule 1 and 2:

- Cashflow and its effect on Retained Earnings

- There is obviously more to this:

- Types of CFs

- CFO, CFF, CFI

- PACED Analysis

- Adjustments to identify the real equity buffer

- Leakages/Consolidation

- Core/Non-Core to UEA

- Financial Statement Adjustments

- AR (bad debt), Inventory, NCA/CA

- Types of CFs

3 Key Sources of Errors in MRA

- Original Financials – Quality of Financial prepared by borrower

- Spreading of MRA

- Interpretation by Users

Adjusting TNW (F/S date) to Equity Buffer (Now)

- Before F/S date : based on information available from the F/S including notes to the accounts, making changes to TNW(F/S date) to derive at adjusted TNW (F/S date).

- From F/S date to Now : as information are not easily available, other techniques are required to obtain information:

- Client visits with substantive call reports

- News reports

- Bank statements

- Industry / buyers / customers feedback

- Non-traditional data sources: Google / social medias

Common Mistakes

- Net worth definition includes loans due to directors but does not exclude loans due from directors

- Never find out why audited accounts are qualified

- Review on unchanged basis = do not need to reassess needs of clients against the financials

- Double counting of rental savings

- Never find out what is other income when other income consistently is the factor of positive NPAT

Looking at the financials

Balance Sheet Structure

- Capital structure over time

- Type of debt?

- Shareholders’ funds…How much left?

- Listed/unlisted

- Debt/Equity

Servicing Structure

- Need to make adjustements to EBITDA

- EBITDA / (Interest + CPLTD)

Equity Buffer

- Is there enough equity buffer?

- Make adjustments to financial statements

- Adjust for 4 Buckets of Time

- Leakages/Black holes in consolidation?

- AR or inventory impairment? Loans to RP? Island debtors?

- Are the assets at the correct level within the pyramid? Cash Conversion Cycle?