CREDIT/ CASHFLOW

Golden Rule: Credit analysis comes first before any discussions.

No fish-market bargaining. All must be backed by Credit / Cashflow.

Know Your Customer, Know Your Cashflow

Not only do you have to know your customer, you also have to know your Cash Flow!

Know-Your-Client → Ultimate Beneficiary Owner (UBO)

Know-Your-Cashflow → Ultimate Economic Activity (UEA)

Objective: To obtain the most efficient allocation of resources

Identifying potential KYC issues – Steps to take

1. Google → Borrower name and website, company structure, related companies, company

- KYC of other subsidiaries, companies, relatives, investor

- Other sources: LinkedIn of promoter profile, Chinese/India news sources (instead of just relying on Google)

- KYC of suppliers and customers (companies that they procure from and companies that they are selling to)

2. Reasonable banker checks

- Cross-border checks, get overseas branches to conduct searches

- Verify address (PO box)

- Genuine business

- Documentary proof of commercial agreement

- Conduct background checks with industry contacts such as trade associations

- (Beware) Bank checks are not positive indicators (vested interest for you to refinance so that they can get out)

- Check with PB on AUM with the bank and the type of AUM – encumbered or otherwise?

- Verify end-to-end trade docs against transactions. Conduct due on key suppliers and key buyers so you know that there wont be circular motion of trade finance facilities

- PO Box

- Offshore companies registered in tax havens

- Trade hitlist – suppliers not on pre-approved list

Identifying potential KYC issues – Key Lessons

1. Insufficient Equity in Business to Support Proposed Requests

- Net worth is defined as shareholders’ equity plus Subordinated shareholders’ loans

- Extra due diligence is required when accepting collaterals from counterparties with negative net-worth in light of fraudulent preference consideration (Section 362 Insolvency, Restructuring & Dissolution Act)

- When debt obligation of a borrower is fully supported by unconditional, irrevocable and legally enforceable corporate guarantee from related parties, including parent companies, will analyze the pro-forma consolidated financials of the group ie the borrower and the guarantors.

- Examples of Discouraged Credits:

- Legal, effective and structural subordination

- Counterparties with negative net worth

2. Identify sources of funds for repayment

- Casino/Gaming (Refer to Prohibited Credits)

- Any exceptions to financing of military equipment and casino gaming establishments must be cleared by Compliance who shall determine whether escalation is required.

- Examples of Prohibited Credits:

- Casino/Gaming

- Military equipment

3. Availability of collateral should not be the primary credit consideration

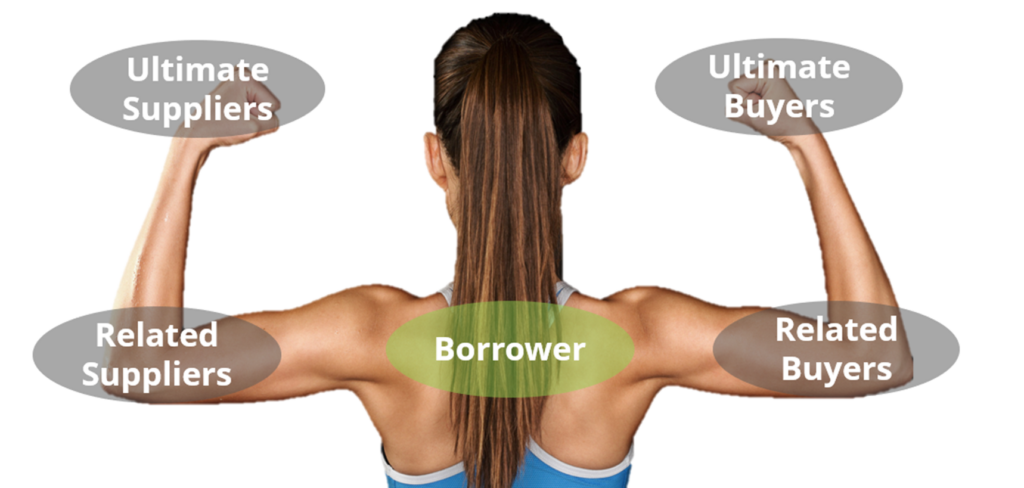

Identifying UEA: Around the world in 80 days

Fahran’s Flex

To identify UEA