Credit Masterclass

Unpacking Credit with 3 Tools

$0

$195.99

1.50

Total Hours

Beginner

Course Level

About Masterclass

Banks don’t get repaid with ratios. They get repaid in CASH. Yet too often, bankers stay trapped in traditional analysis, missing out on how companies raise, use, generate, collect and protect the cash that ultimately pay the banks back

The masterclass takes you beyond the numbers with practical, easy, intuitive framework and visual models that have been field tested by experienced bankers.

Course Outline

- 01. Introduction

- Syn Yew and Fred

- What can we do for you?

- 02. 1 Framework, 2 Models

- The WHAT? Capital Life Cycle

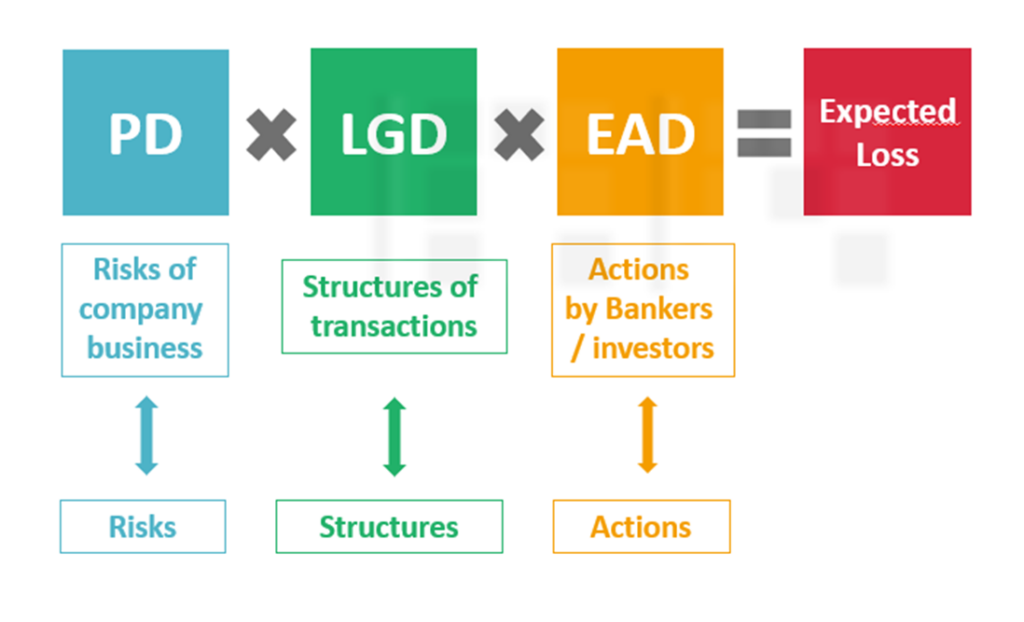

- The HOW? Syn Yew Risks-Structures-Actions RSA Framework

- The WHY? Syn Yew 5-State of Structuring Model

- 03. Q&A

What Bankers Say

Our core values are at the heart of all that we do.

Corporate Banker

“Analytical tools and visual models that link ratios to real life businesses. I finally understand the connections and can bring that to conversations with our clients.”

Credit Risk Manager

“Syn Yew’s approach made it very simple to understand complex finance and banking activities. He effectively accelerated the experience of bankers by at least 5 years.”

Internal Auditor

“The RSA framework makes decisions sharper. Risks, structures and actions that tied to Expected Credit Loss model is the clearest lens I have seen for us the internal auditors.”

Trade Finance Banker

“These concepts were explained thoroughly, which is really helpful for a person with no banking or finance background.”