Overview

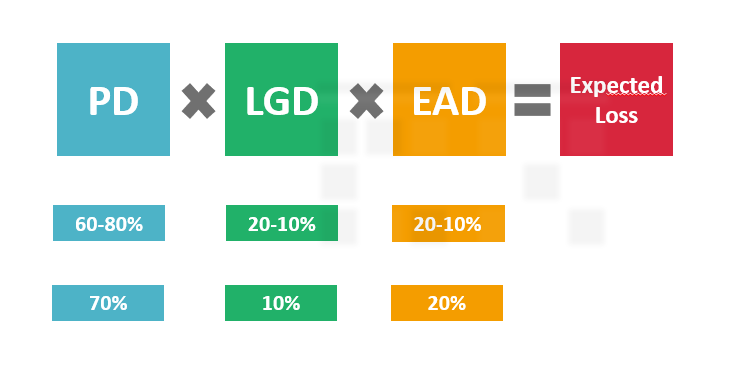

Definitions and parameters

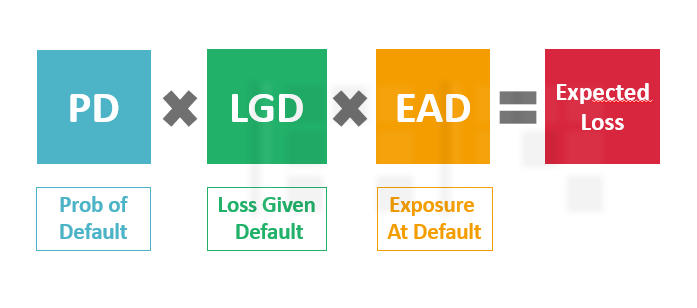

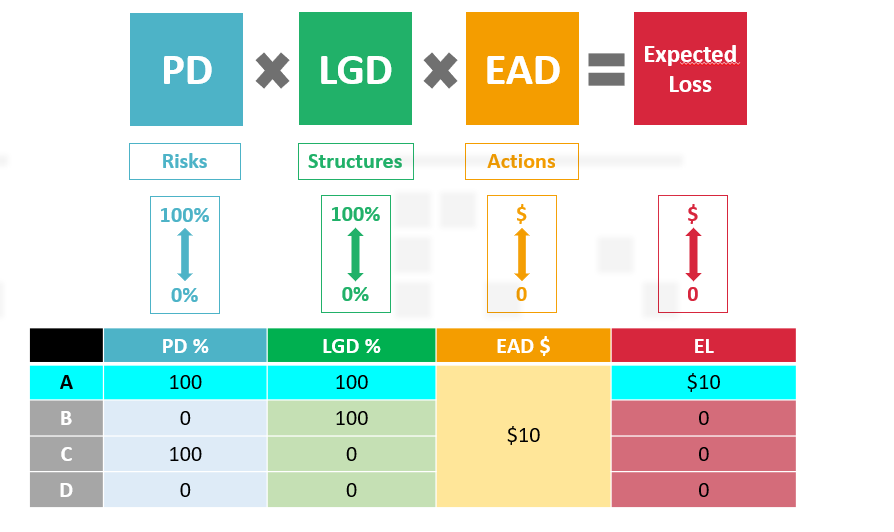

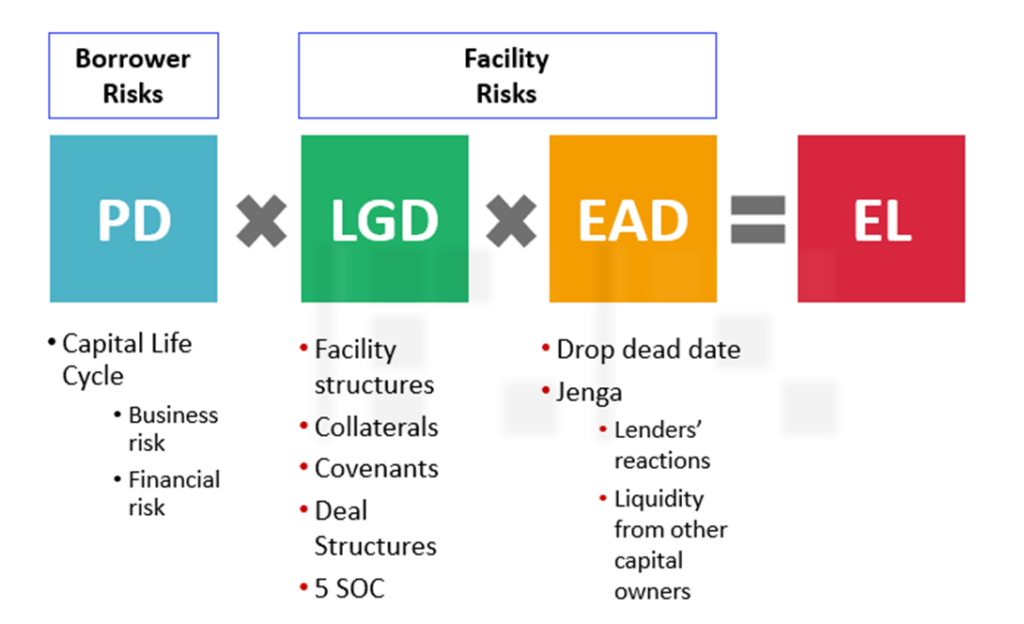

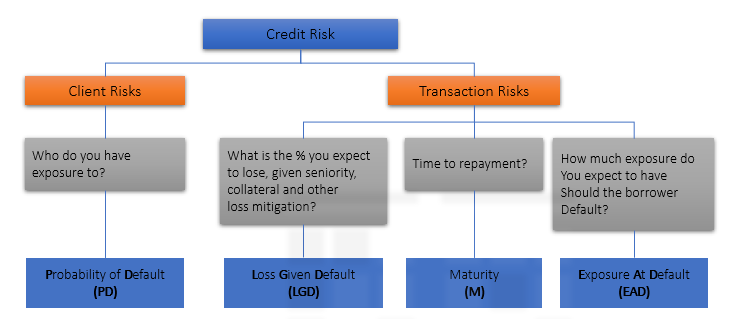

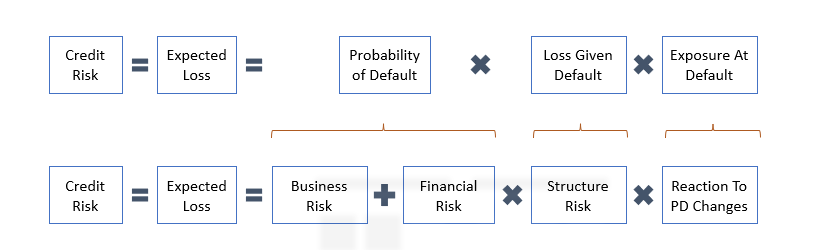

- PD = The probability of the counterparty defaulting within the next one year.

- Represented as % (0% – 100%)

- LGD = The share of an asset that is lost if a borrower defaults.

- Represented as % (0% – 100%)

- EAD = The immediate loss that the lender would suffer if the counterparty fully defaults on his debt.

- Represented as $

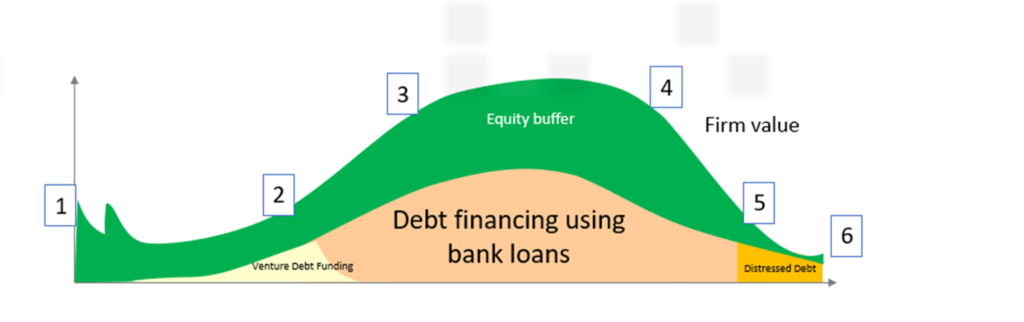

Reimagined EL model

Theoretical outcomes

Link to Daniel Dolphin

Time allocation

How much time to be allocated to each?

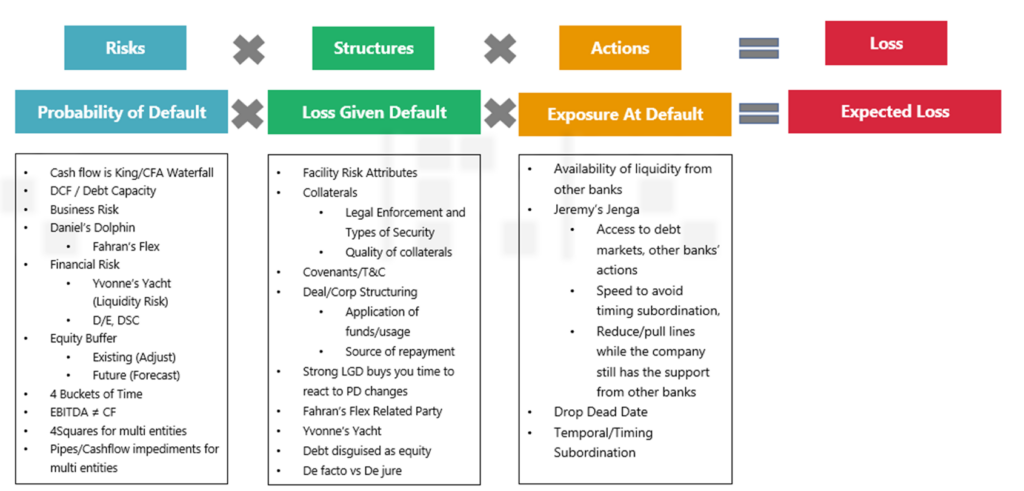

Index page for components of PD/LGD/EAD

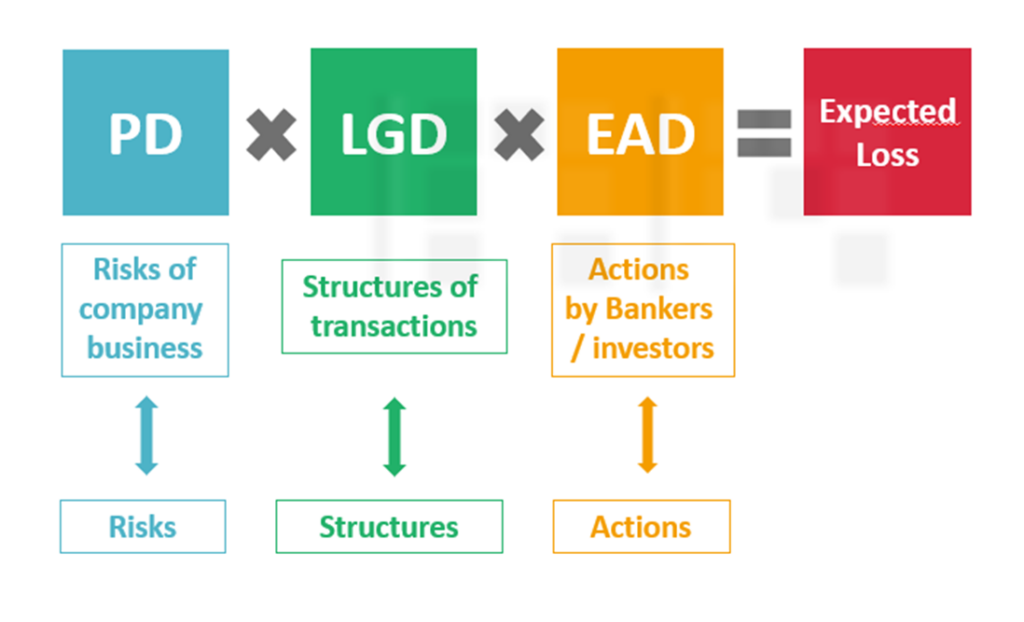

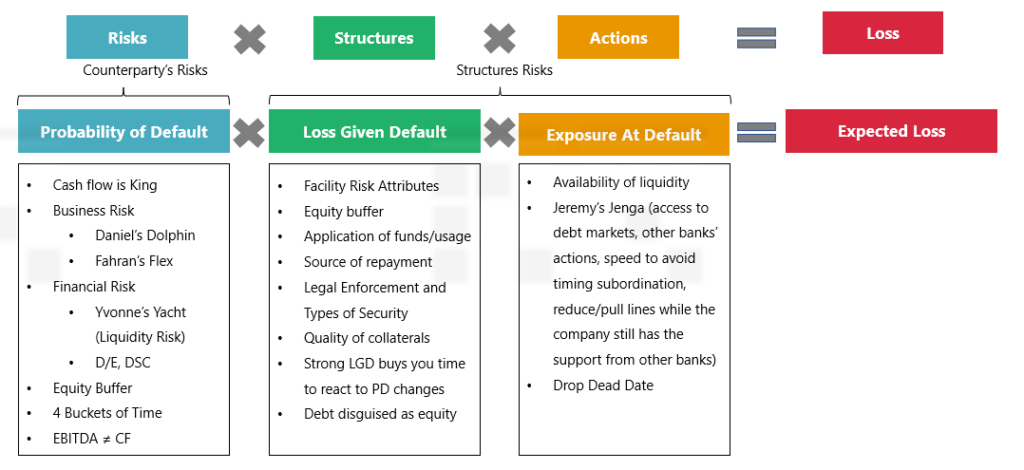

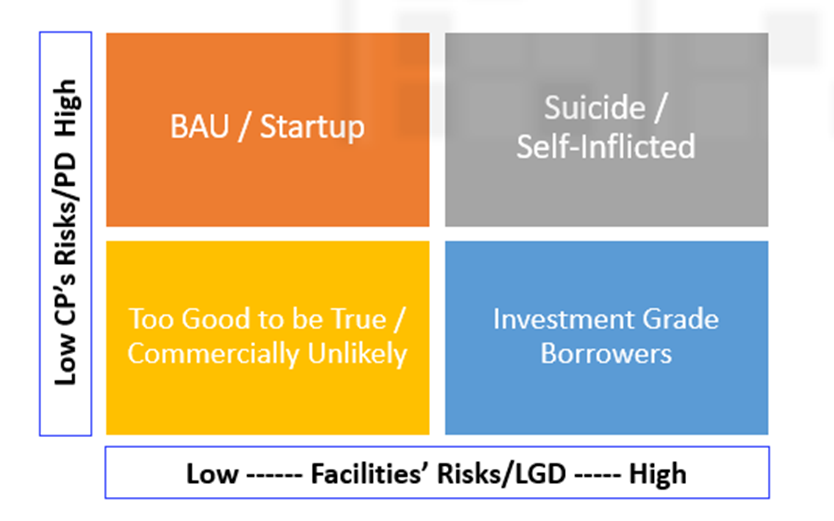

EL model customised for counterparty level

- Counterparty’s risks is also known as Obligor Risk

- Structures risks is also known as Facility Risk

All credit risk considerations can be organised under this framework

Key Framework of Expected Loss Model

- Most important is the Dynamic PD (changes over time)

- LGD and EAD flows from the analysis of dynamic PD

- First, credit analysis in terms of borrower’s dynamic PD is essential (make a yes/no decision)

- Before having any other discussion relating to LGD or EAD issues (e.g. collateral, drop dead date)

- Rule #1: ALL must be backed by CASHFLOW

Other views of EL framework

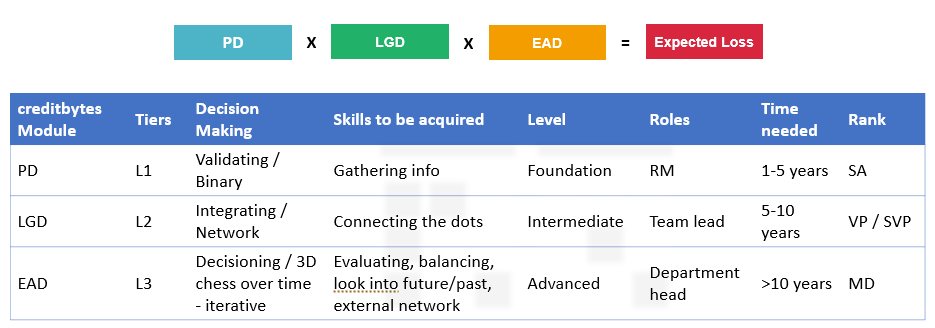

Minimising expected loss with 3 tiers of understanding

Draw linkage between the 3 tiers to show progression with the equation

What is credit risk and how is it measured?

Credit Risk can be decomposed and is driven by a number of factors

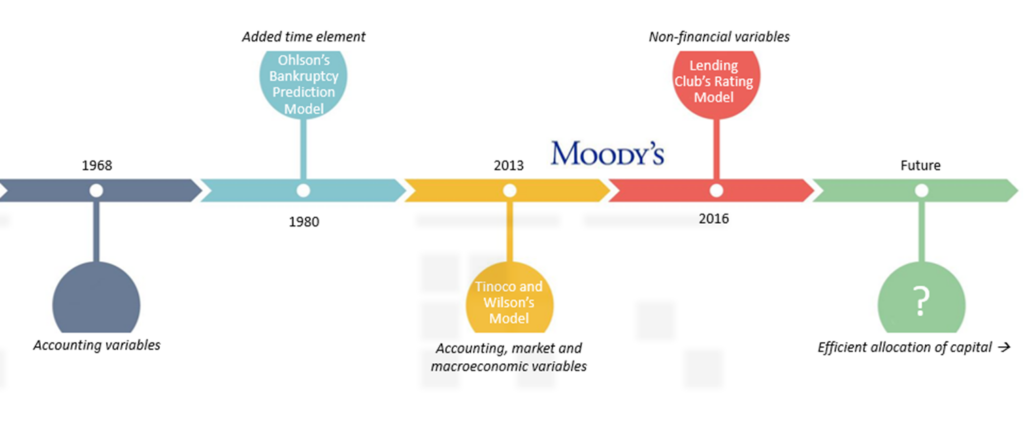

The Evolution of Financial Distress and Bankruptcy Prediction Models

Difference Between S&P and Moody’s

1. Identify the main difference between S&P’s and Moody’s rating methodologies.

2. Are we closer to S&P or Moody’s?

Answer:

- An S&P ratings seeks to measure only the probability of default. Nothing else matters — not the time that the issuer is likely to remain in default, not the expected way in which the default will be resolved. Most importantly, S&P simply doesn’t care what the recovery value is — the amount of money that investors end up with after the issuer has defaulted.

- Moody’s, by contrast, is interested not in default probability per se, but rather expected losses. Default probability is part of the total expected loss — but then you have to also take into account what’s likely to happen if and when a default occurs.

- S&P is usually the first to downgrade a rating

- Some banks’ rating methodologies is similar to S&P rating in measuring only the probability of default, while others follow Moody’s more closely.

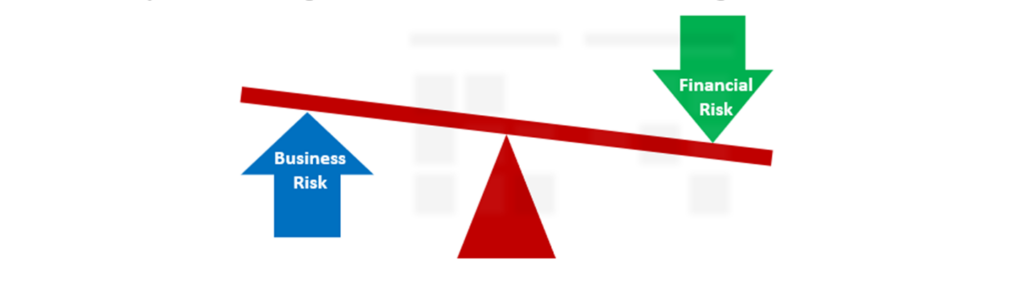

Companies with high business risk cannot also afford high financial risks.