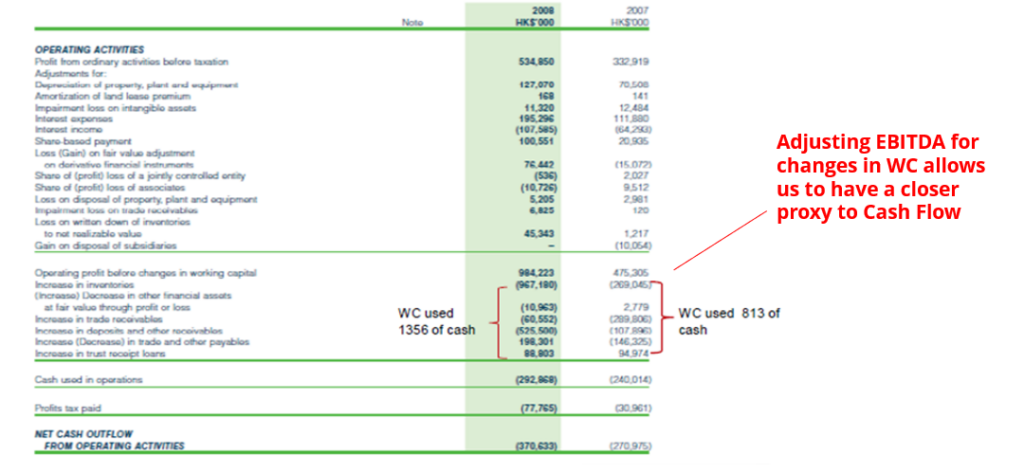

Side note: EBITDA as an imperfect proxy for Cashflow

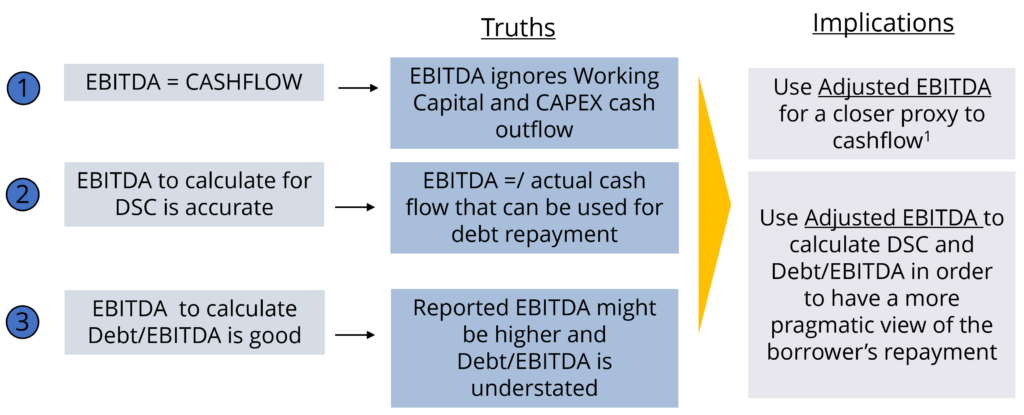

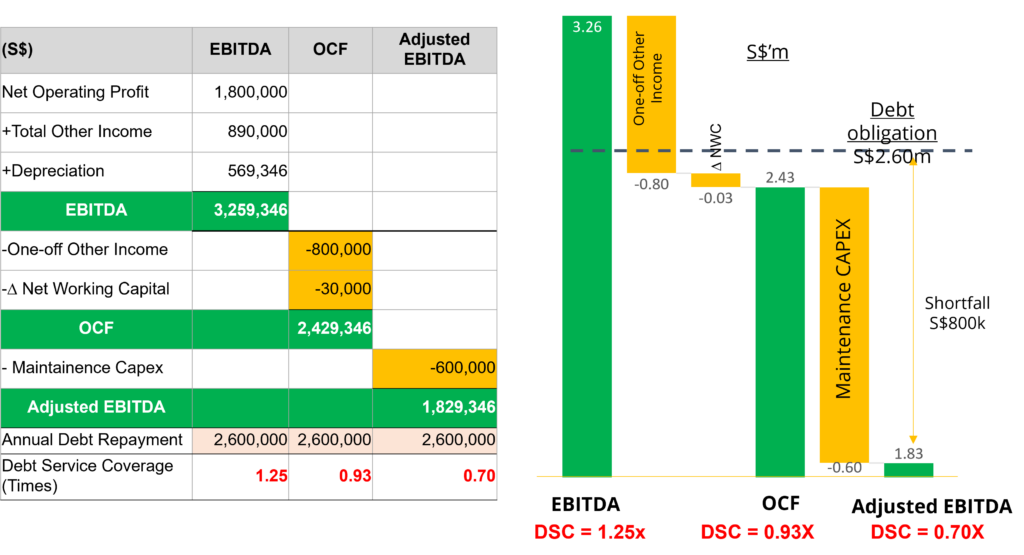

- This distorts the some rating models and ratios that have EBITDA as the main cash flow component such as debt serving factor (DSC)

- EBITDA ignores WC and CAPEX cash outflows

- EBITDA is not actual cash that can be used to repay debt obligations

- Adjustments often have to be made to make DCS calculations more realistic

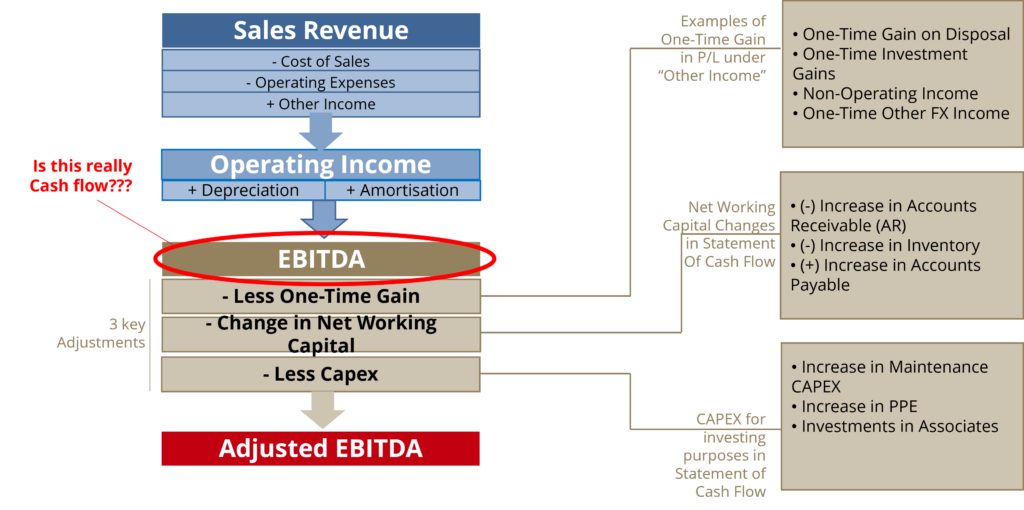

- Less one time gains

- Change in NWC

- Less CAPEX

EBITDA =/= Cashflow

Combining Daniel’s Dolphin and 4 Buckets of Time

Application of PACED: Profitability

Discretionary vs non-discretionary

- Non-discretionary capex

- Usually inelastic, required to sustain the operating capacity of the business à to be fully factored / provided for out of annual free cashflows

- Discretionary capex

- •Can be flexibly reduced or deferred without materially affecting the operating capacity of the business à can be partially factored / provided for out of annual free cashflows

- Elasticity of operating costs may be used to moderate volatility of operating cash inflows

- Inelastic: Rent, personnel expense, audit expenses, non-discretionary expenses

- Elastic: Selling and general administrative expenses, director’s compensation

Elasticity of debt wall

- Inelastic – public bond interest payment and principal maturities, which have to be repaid or else there would be material doubt to the financial viability of the borrower

- Elastic – f&f, shareholder loans, which can be negotiated to be repaid on a later date or restructured with greater ease

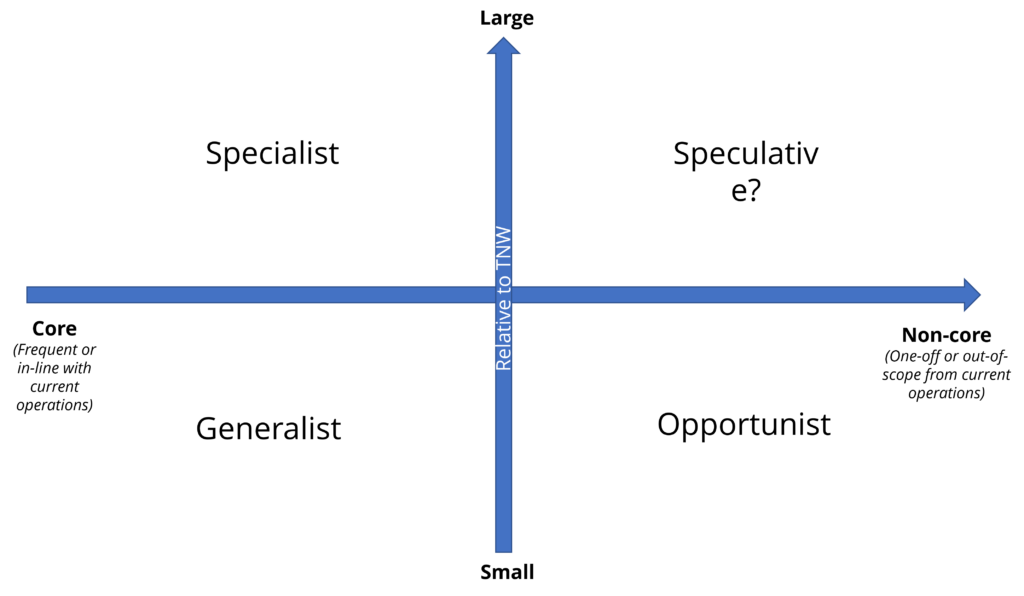

Opportunistic – generalist – specialist

- Opportunistic – one-off investment endeavour that is closely related to an existing line of business

- Generalist – Wide ranging and diversified portfolio of businesses, usually of relatively lower knowledge / technical sophistication, which can be accommodated by the entity’s TNW

- Specialist – Highly sophisticated and technical / niche business of the company

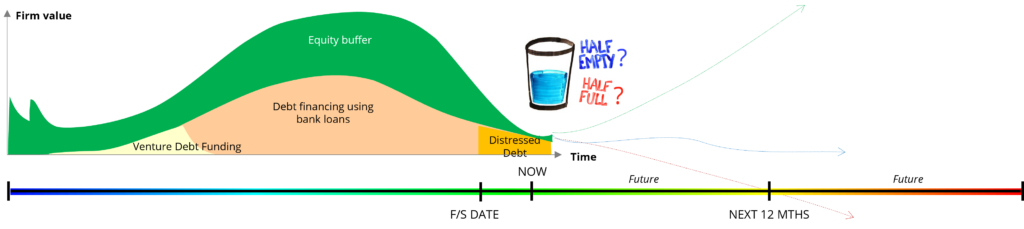

Half filled glass – Half full or half empty?

For the same set of financials, company can be growing or declining

Where is it on the Dolphin?

Negative cash flows…How to decide if we are funding for growth or funding for losses?

- See the past and the future

- Has there been a downward/upward trend?

- Growth in sales vs growth in assets?

- Order book, upcoming projects, contracts

- Contract timing, contract value

- PIT: probability, impact, timing

- Look at business activity, volume of customers Operation Parameter Tracking

- Is company breaking even the fixed cost? Is (VR – VC) increasing such that is can cover fixed cost?

- Is the fixed cost growing too much that it exceeds the gross margin?

- How elastic are fixed costs and variable costs?

- Do they have a positive gross profit which is widening?

- Increases in revenue drivers? Reduction in cost drivers?

Variable revenue – variable cost > Nondiscretionary, inelastic fixed expenses

- Are you funding for growth or are you funding for losses?

- Has there been a downward trend over the last few years?

- Has the company’s sales been flat while asset levels are rising? (More rigorous analysis required here)

- Has there been an upward trend over the last few years?

Key Lesson: Simply looking at MRA financials and/or relying on TMRACs is clearly inefficient as this ignores the time factor and nuances of businesses.

Introduction: Debunking the 3 main misconceptions of EBITDA

Moody’s: Follow the cashflow, not EBITDA

- Out of the top 10 critical failings of using EBITDA, Moody’s noted:

1. EBITDA ignores one-off non-cash gains

2. EBITDA ignores changes in working capital

3. EBITDA does not consider the amount of required reinvestment (CAPEX) - Moody’s says in “EBITDA: Used and Abused”, Calculating EBITDA can be open to interpretation and an agreed-upon understanding of EBITDA and its limitations is becoming more crucial

- The use of EBITDA and related EBITDA ratios as a single measure of cash flow without consideration of other factors can be misleading as it can be manipulated through aggressive accounting policies

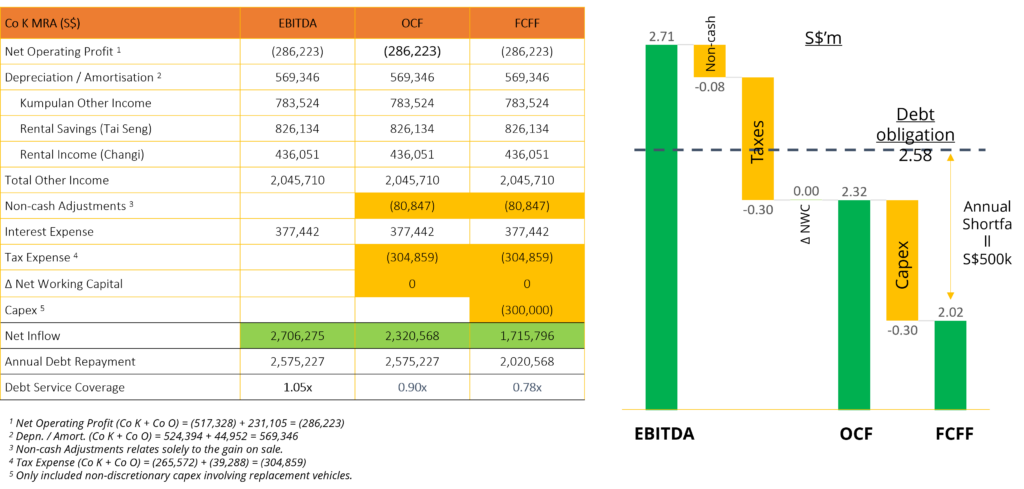

Profits vs Cash Flow – How successful is the company in converting profits into cash for debt servicing?

3 key adjustments required to be closer to cashflow

Hypothetical example SME Coy

Example – The Double-Edged Sword of Growth

- Closer tracking of Working Capital shows an increase in inventory and receivables that are not paid to Peace Mark as Cash Flow