Business Development and Product Opportunities per Cash Driver Tool Description

This tool will help you complete the final column on the risk grid (Tool “Risk Grid”) and use your cash flow analysis knowledge to develop business opportunities for your institution

| Client Need | Products/Services (primarily banking) | |

| P (Profits) | – Ability to pay operating/interest expense on time – Ability to invest surplus cash | – Overdraft/short-term loan facility to meet cash flow shortfalls – Operating Leases – Place excess cash on deposit |

| A (ACC) | – Paying Suppliers | – Supplier checks – Import L/C – Documentary payments – Clean payments – FX hedging – ST Loans |

| – Production Cycle | – Post import financing – ST Loans – Inventory finance (on/off balance sheet) – Pre export finance | |

| – Sales cycle of products/services | – Buyer checks – Export L/C – Documentary collections – Clean collections – FX hedging – ST Loans – Accounts Receivable Securization – Factoring/Invoice discounting – Export financing | |

| C (Capex) | – Purchase of fixed assets | – MT loans(bilateral, syndicated, mezzanine, subordinated etc) – Leasing (financial or operational) – Arranging debt or equity finance through private placement – Financial advisory |

| – Production of new fixed assets | – Development loans – Project finance | |

| – Disposal of fixed assets | – Sale and leaseback – Purchase of fixed asset by SPV – Asset securitization | |

| E (Equity) | – Raising new/additional equity – Share buy back – Dividend Policy | – Financial / equity and debt capital advisory – Arranging / underwriting new issue (public or private placement) – Arrange debt to support new capital structure |

| D (Debt) | – Raising new/additional debt – Increasing rates – FX volatility | – Financial advisory – Arranging / underwriting new issue (public or private placement) – cash management (cash pooling, zero balancing) – Refinancing – FX hedging – Interest rate hedging – Swaps |

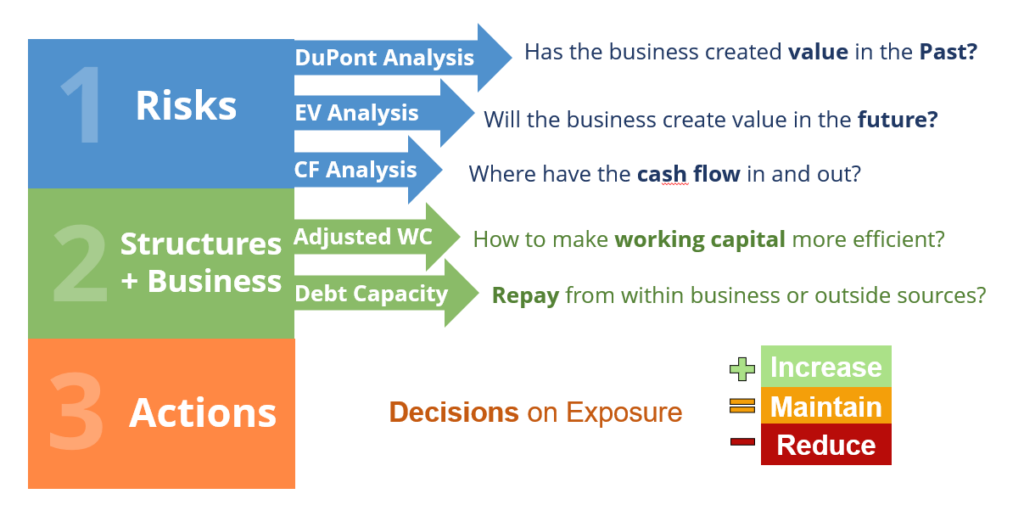

Value Approach

Analyzing Risks

| Analyse Risks | To Ask? |

| Dupont Analysis | – Is ROE exceeding COE? – Has the business created value in the PAST? |

| EV Analysis | – Will the business create Value in the FUTURE? Has the market value the business higher or lower multiples? – Discover capital market business |

Developing Structures/Discovering Business

| Develop Structures | To Ask? |

| NOA | – Is the business utilising adjusted working capital efficiently – Discover cash and trade business will improve NOA efficiency, adding value to the client |

| Debt Capacity | – Repayment sources: Internal/Intrinsic, external/extrinsic? – Repay with FUTURE cashflow over x years? – Repay with EXISTING assets? |

Taking Actions/Managing Exposure

| Take Actions | To Ask? |

| Decisions | – Managing Exposure (EAD) proactively 1. Allocate more to economic activities creating more value, reduce for those with declining value. 2. If were to increase exposure, should it be structured to be repaid with: •future cashflow (within debt capacity) •existing assets (beyond debt capacity) |

Discover Capital Market Business

3 Questions

- Raise Debt/Equity?

- Raise from whom?

- Raise how much?

A. Proposal for reducing/diminishing/insufficient equity

Strategic Alternatives

ECM / M&A Solutions

- Raise more equity from existing shareholders

- Raise more equity from new shareholders

- M&A change of control

– Raise more from new than existing - Restructure

- Exit

– Fail to raise sufficient equity

– Include care EWS

B. Proposal for increasing equity

- Leverage Equity – More debt / bond

- Swap equity with debt – dividend recapitalisation (more debt capital / less equity)

- Objective: retaining existing/viable debt to equity capital structure

Discover Cash and Trade Business – focusing on Adjusted Current Assets

| FUTURE | Trad and Cash Products |

| AR | ARP, Export LC Discounting |

| Inventory | Financing Buyers |

| Other CA / Costs In Excess of Billing | BG, Payment gtee |

| Due from RP | Financing RP |

| AP | LC term, DA, payment gtee, Supply Chain Financing |

| Other CL | |

| Due to RP – trade and non-trade | |

| Billing in excess of costs |

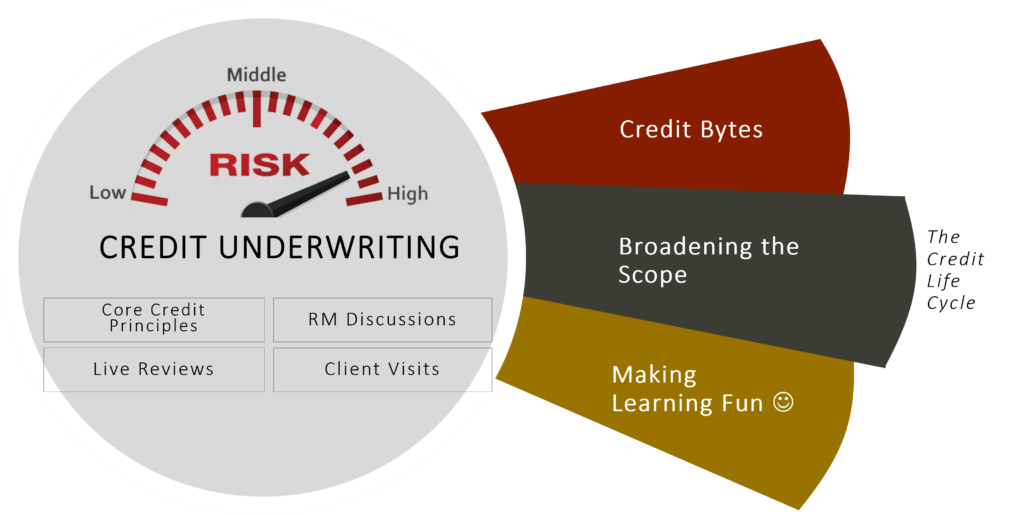

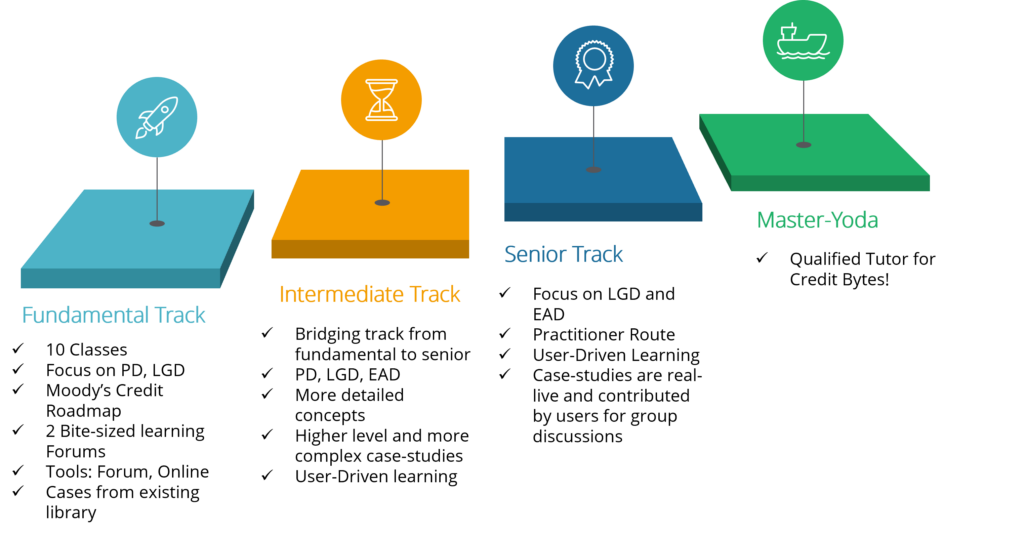

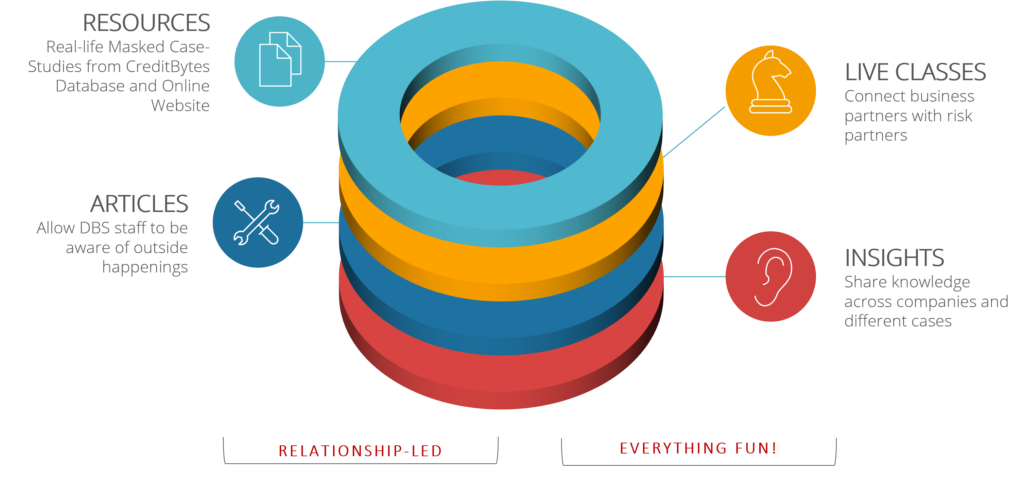

Structured Learning for Credit Analysis

Review of the Credit Bytes Learning Roadmap

3 Key Learning Tracks

Live Case Studies with Key Learning Points