Deep Dive Liabilities + Equity B/S Analysis

- Reclassifying the liabilities + equity side of the balance sheet to better understand the sources of capital and Jeremy’s Jenga

Common Mistakes

- Networth definition includes loans due to directors but does not exclude loans due from directors

- Never find out why audited accounts are qualified

- Review on unchanged basis = don’t need to re-assess needs of clients against the financials

- Double counting of rental savings

- Never find out what is other income when other income consistently is the factor for positive NPAT

Capital Structure

- What is the firm’s leverage ratio?

- What kind of debt has the firm taken on?

- What is the firm’s DSC ratio?

- Has the firm been deleveraging?

- Has the promoter been using his own funds to pump into the business? If so, is he scraping the bottom of the barrel?

- Has the promoter recently raised funds through rights issues/private placements?

- Is the firm listed? Is its MV the same as its BV?

Deep Dive Assets B/S Analysis

- Reclassifying the asset side of the balance sheet to better understand the company

Asset Conversion

- Concerns the payback period of asset. Focus on the cash conversion cycle and LT cashflows (total assets)

- Land vs. Equipment

- Inventory (consider if it is perishable)

- Note the limitations of accounting classifications

CAPEX

- Be aware that the firm may dispose assets to increase CFI rather than spend on new assets

- Can the asset (land, real estate, machinery) be sold at a market value higher or lower than its historical value?

- Liquidation of assets lengthens the DDD

- However, consider if this liquidation affects future UEA!

- Companies that are making losses (profitability) are usually unable to replace equipment and asset base

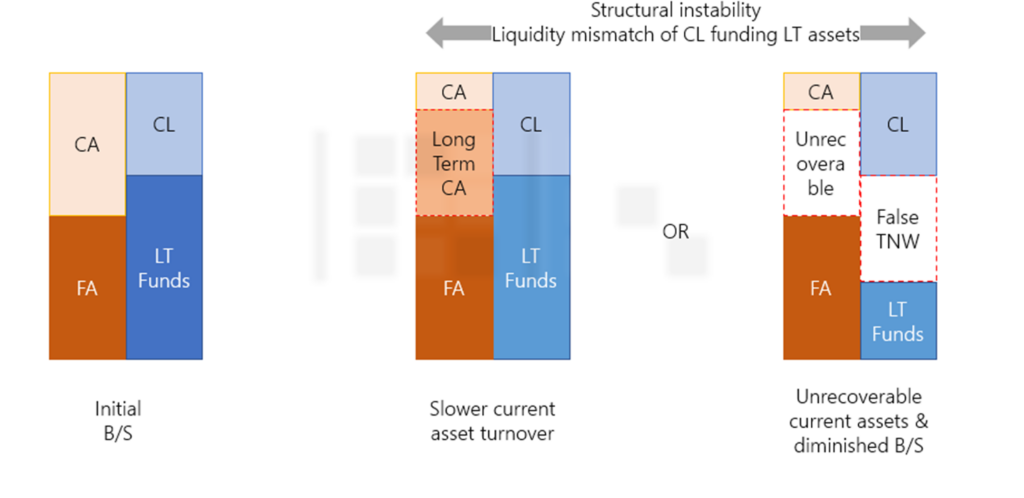

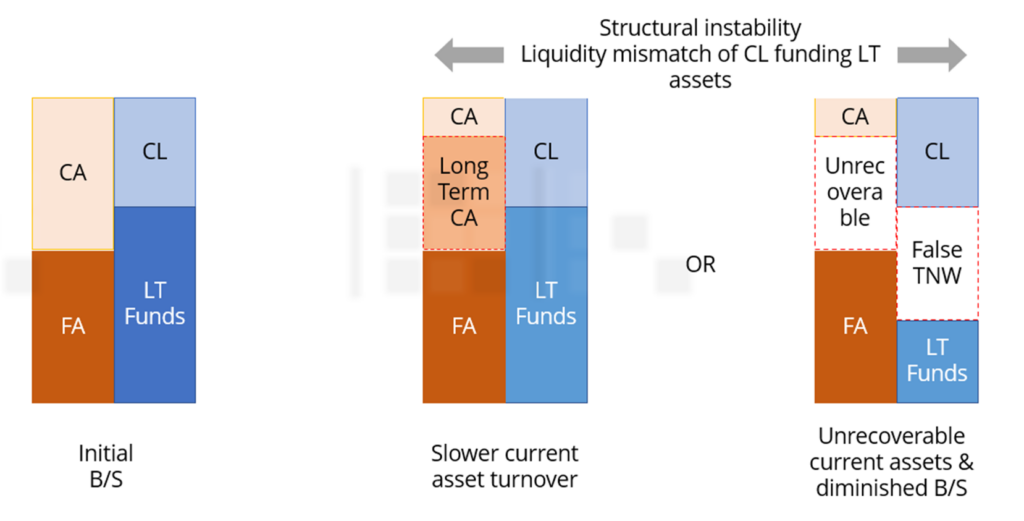

Structural weakness – “Non-current” / Unrecoverable CA

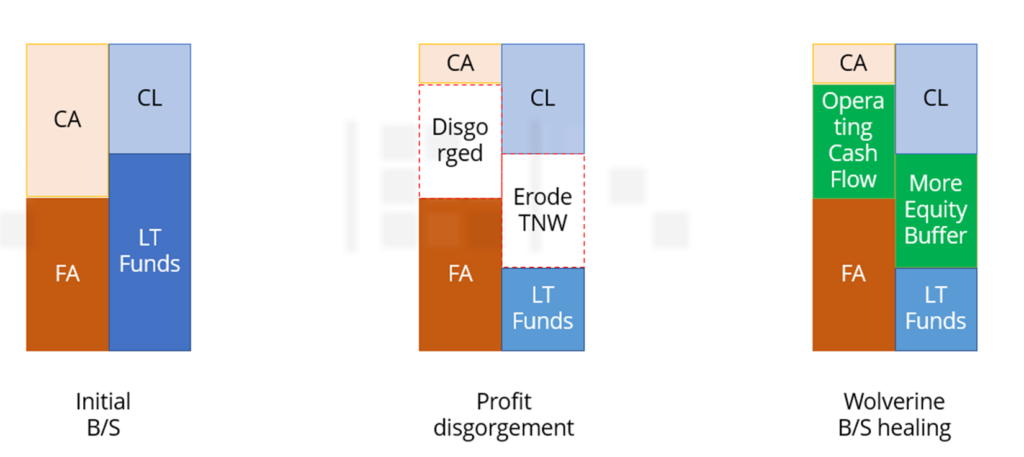

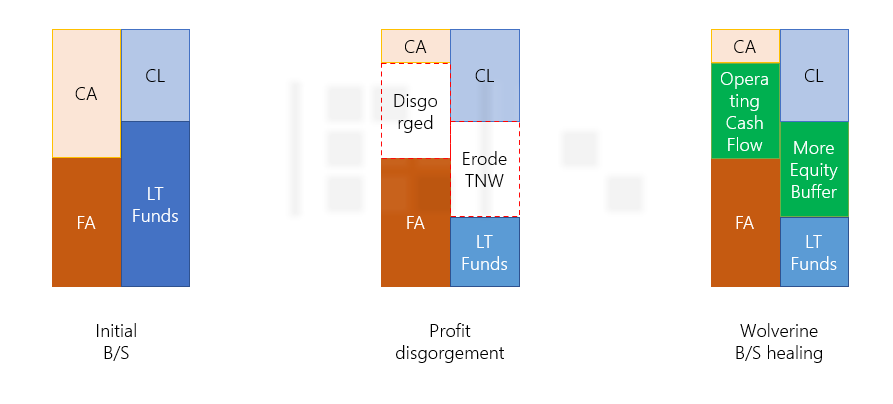

Wolverine – Repairing B/S post recapitalisation

Deep Dive AR/AP Analysis – spot the Grey Rhino

- AR and AP analysis can show you more than what you can see in the 3 financial statements. If you know how to use it to your advantage, you can spot the grey rhino and ask the right questions that can have a substantial change to your credit analysis.

Accounts Receivables

- Quality of AR

- Country

- Currency

- Ageing (any island debtors?)

- RP

- Trend

- Consider credit terms

- Assess and adjust materiality of AR from related parties against TNW, affects leverage/gearing ratios, affects rating

- Discontinued business outstanding AR generally uncollectible (debtors do not have incentive to pay as they are no longer dependent on B for supply)

- Industries like retail and restaurants should not have long AR (red flag if ARDOH is long)

- AR is a source of cash for subsequent repayment of bank debt

- Compare AR across a few periods (identify if any key debtors are dropped off indicates cessation of relationship will impact B’s topline

- Unique cases

- Individual Chinese names instead of corporate names Why? Remittance issues

- Conduct enhanced due diligence, AML issues

- Obtain invoices and payment records to match / trade docs

7 Types of AR Concentration Risk

- Geographical

- Capital controls – stop buying foreign currency, don’t want domestic currency to flow out

- Transfer and convertibility risk

- Product

- Buyer (number of debtors)

- If you sell to different subsidiaries under the same Group.. Depends on how big and reliable each subsidiary is. Whether each subsidiary can be regarded as a separate

- Are there similar patterns in terms of non payment? Island debtors

- Currency

- Must see the ultimate buyer… UEA… the buyer (AR debtor) sell in local market, will have currency risk (if material)

- So even though the AR aging lists SGD only but UEA may have currency risk (especially if you see foreign companies in the AR aging)

- See the historical depreciation of the currency – knock it off by worst case (eg. 30% or 50%) and see if the equity buffer can take it

- Long term decline.. No point waiting

- AR aging bucket

- On a portfolio basis whats the normal range

- Buyer Industry

- Credit quality of buyer

- If your buyer are the Bank’s customers, will have info

- Use credit bureau

- For property financing, you want to check on the tenants

- Sometimes, the credit quality of your buyers are very good such that it serves as credit enhancement (eg governments or government agencies)

Look out for the Island Debtor

- •Look for possible asset impairments (i.e. AR): (1) is it a one off default? (2) single outlier? (3) is it industry practice to have long AR DOH?

- Compare AR listing and look at each company transaction across months à identify AR provision MoM

- Is there a pattern in the single AR list (Materiality relative to Equity Buffer)

- Are there changes across AR lists?

- 6 correlation attributes of AR ageing: Debtor, Industry, Geographical, Currency, Credit Rating

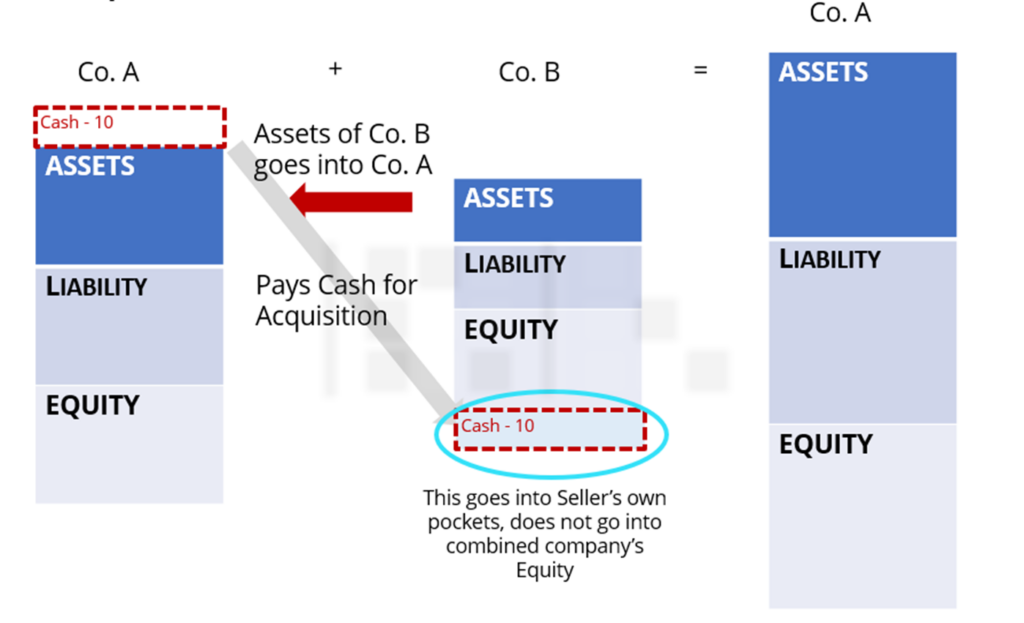

Acquisition

Structural weakness – “Non-current” / Unrecoverable CA

Wolverine – Repairing B/S post recapitalisation