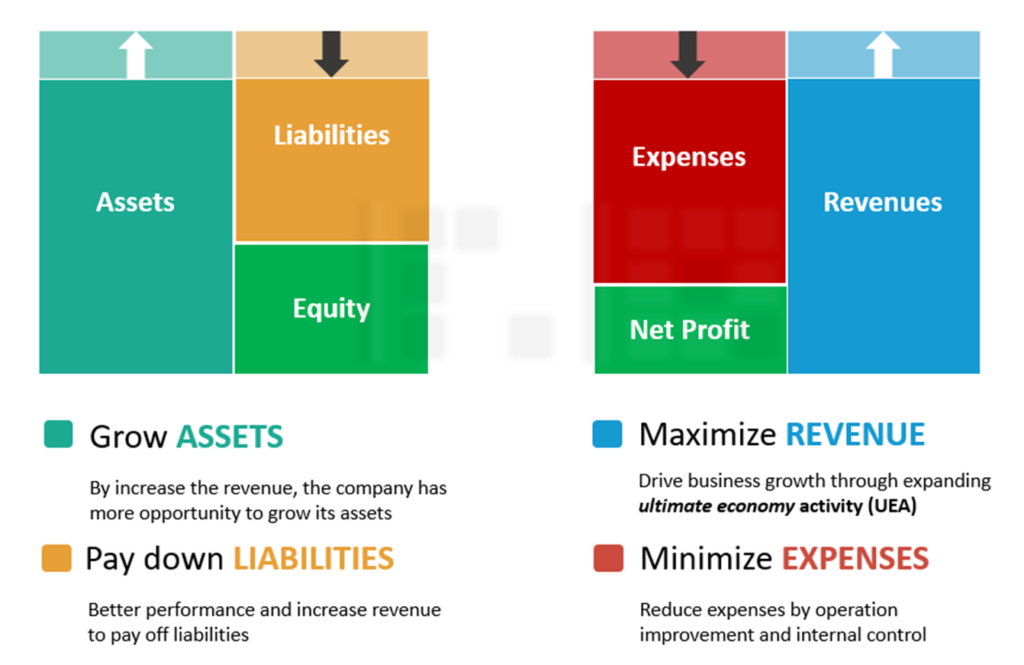

1. How do businesses grow?

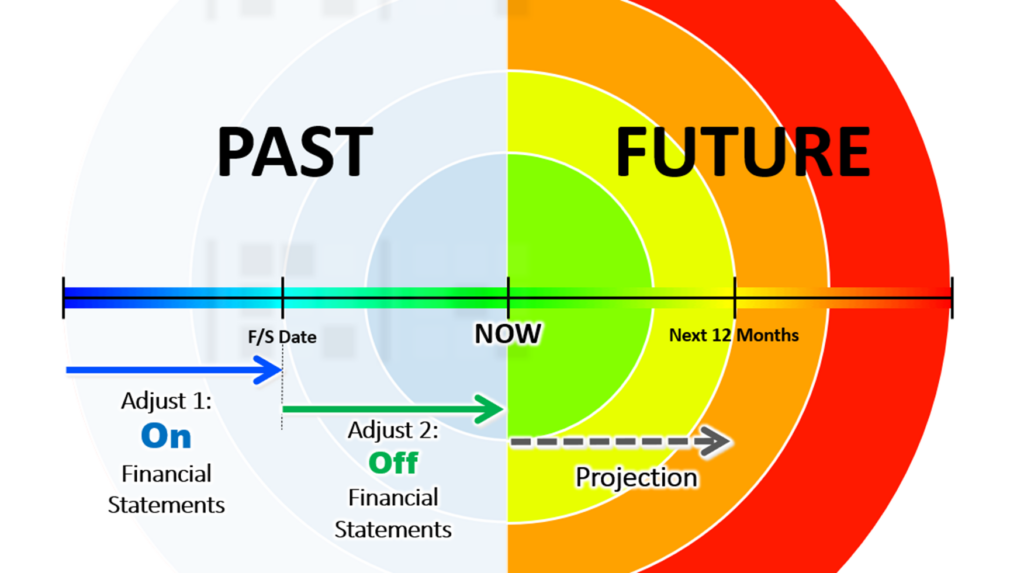

2. When do you adjust?

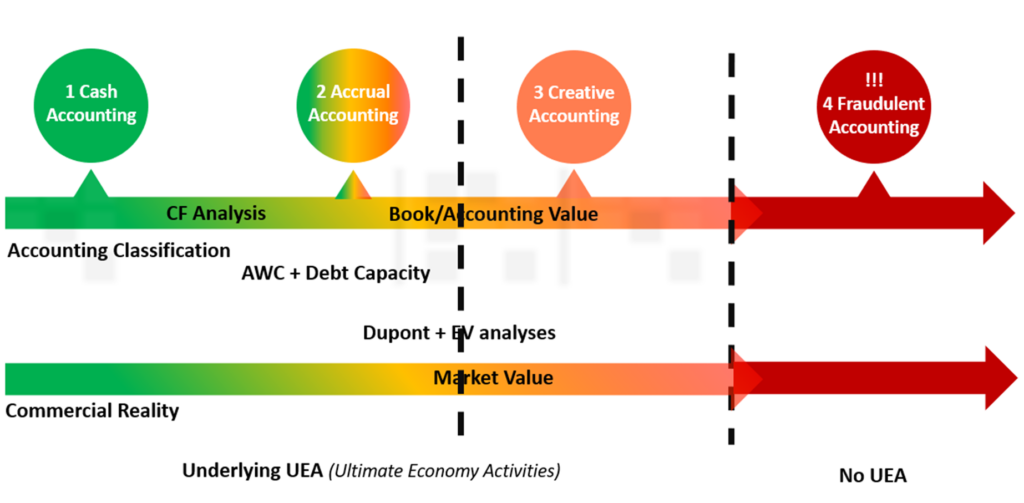

Accounting Classification vs Commercial Reality

Practical Tips

Audited Financial Statements

For entities that are audited, an auditor will form an opinion on the financial statements based on evidence obtained as part of the audit process. The auditor will then issue an audit report, which states its opinion on whether the financial statements are prepared in accordance with the applicable financial reporting framework.

For all opinions other than an unqualified opinion, the banker is expected to include notes in the spreading platform to document the auditor’s reason for qualifying the opinion. The possible forms of audit opinions are as follows:

Unqualified Opinion

An unqualified opinion indicates that the auditor has concluded that the financial statements are prepared, in all material aspects, in accordance with the applicable financial reporting framework.

Qualified Opinion

A qualified opinion indicates that the auditor, having obtained sufficient appropriate audit evidence, has concluded that misstatements, individually or in the aggregate, are material, but not pervasive. A qualified opinion would also be issued in situations where the auditor is unable to obtain sufficient appropriate audit evidence but concludes that the possible effects on the financial statements of undetected misstatements, if any, could be material but not pervasive.

Adverse Opinion

An adverse opinion indicates that, having obtained sufficient appropriate audit evidence, the auditor has concluded that misstatements are both material and pervasive to the financial statements.

Disclaimer of Opinion

The auditor would disclaim its opinion when, having obtained sufficient appropriate audit evidence, the auditor concludes that the possible effects on the financial statements of misstatements are both material and pervasive to the financial statements.

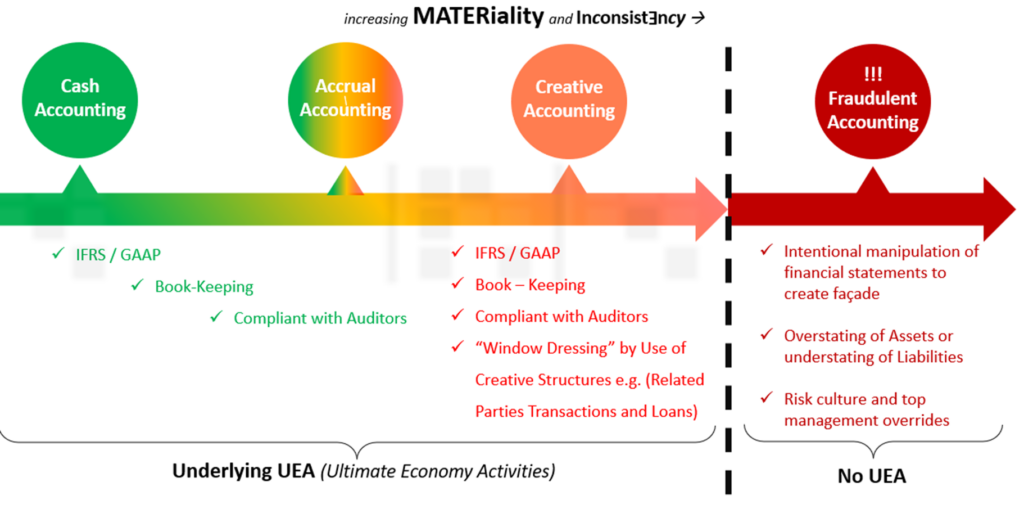

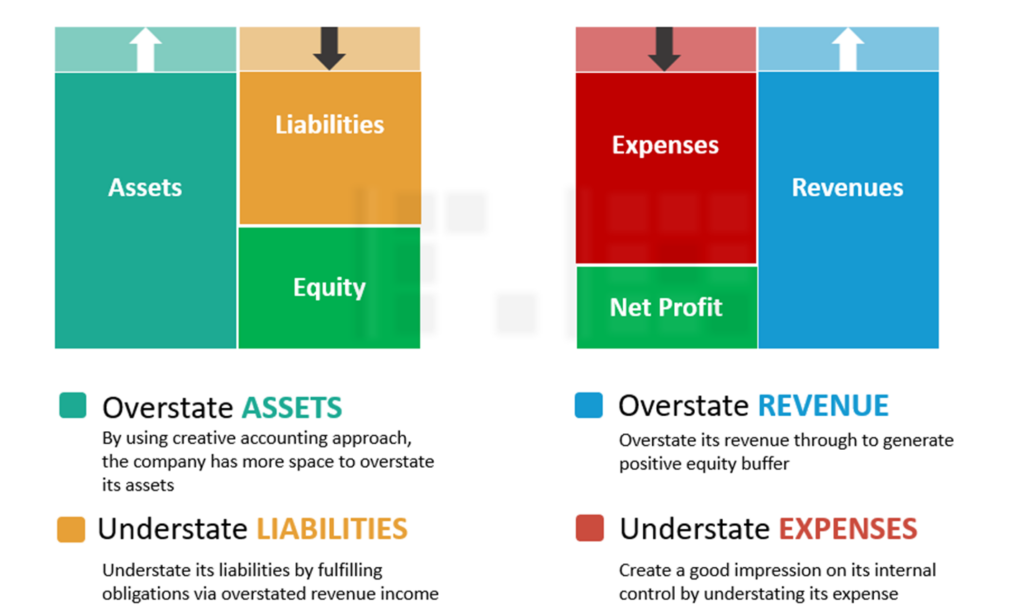

3. Creative accounting to Fraudulent accounting

4. Time changes everything

Practical Tips

Unaudited Financial Statements

Financial statements of unaudited companies may come in the following forms:

Reviewed Statement

An entity that is not audited may engage a practitioner to conduct a review to enhance the degree of confidence of intended users regarding the preparation of its financial statements. The procedures performed in a review are substantially less than those performed in an audit and the practitioner does not express any audit opinion.

Compiled Statement

A compilation engagement is when a professional accountant is requested to assist with the preparation and presentation of the financial information of an entity. The practitioner is not required to verify the accuracy or completeness of the information provided by management.

Company Prepared Statement

This refers to any internally prepared financial statement that does not have any statement or report by any professional accountant or practitioner attached to it. Company prepared statements can be in varied formats and generally these do not include any detailed notes.

Projection Statement

A projection statement is a forecasted financial statement of an entity. Projection statements may be prepared by the entity or by the RM.

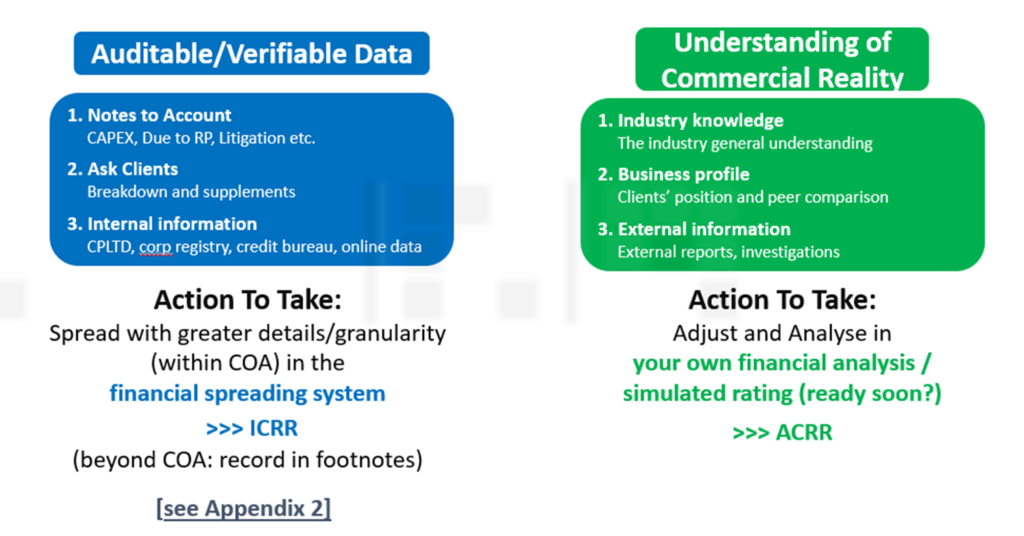

5. Spread or Adjust?

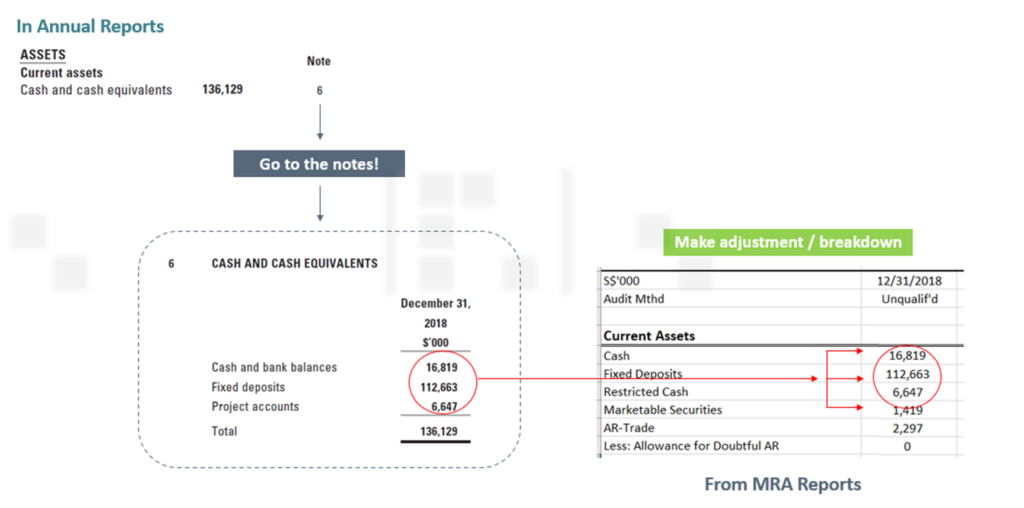

Making adjustments : Notes to Accounts

Practical Tips

Notes to Financial Statements

The notes to accounts are an integral part of the financial statements which contain important details. Information that may be provided in the notes to financial statements includes:

- Breakdown of the balances of key accounts

- Disclosure of significant accounting policies

- Disclosure of related party transactions

- Disclosure of off-balance sheet items

- Disclosure of post-balance sheet events

6. What happen if adjustments are not made?

Misclassification of Rating

For large corp, they are typically rated at investment grades and above such as BBB- and better. Even if they were misrated and should be downgraded, they will go into sub-investment grades and below.

For SME companies, their initial crediting ratings are typically below investment grades, ie junk to start with. If they were mis-rated and should be downgraded, their ratings will go into default range.

7. Two different pictures

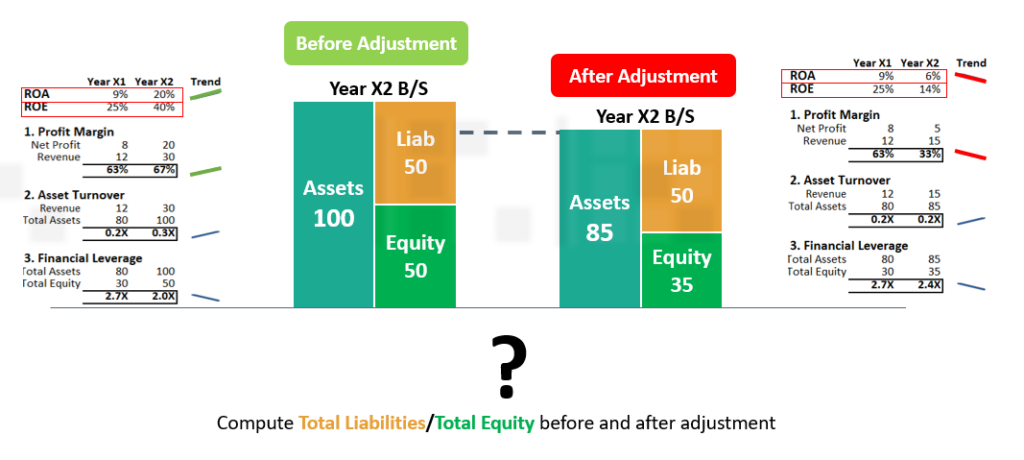

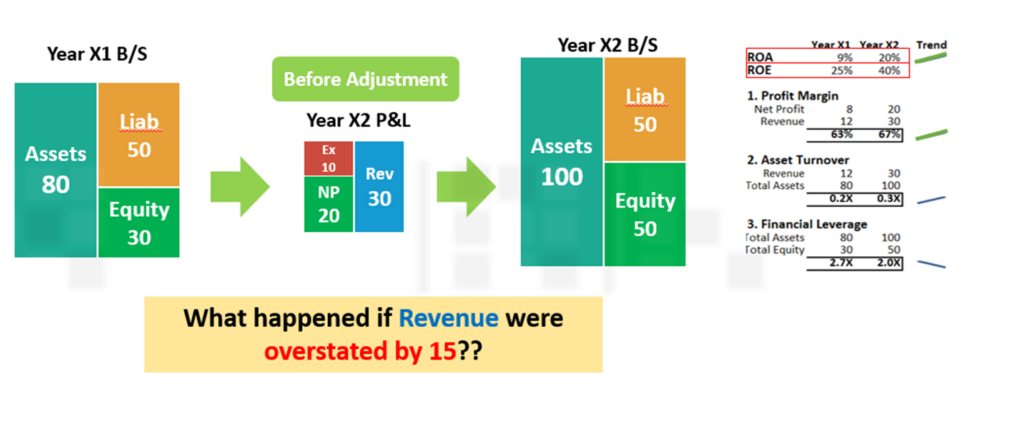

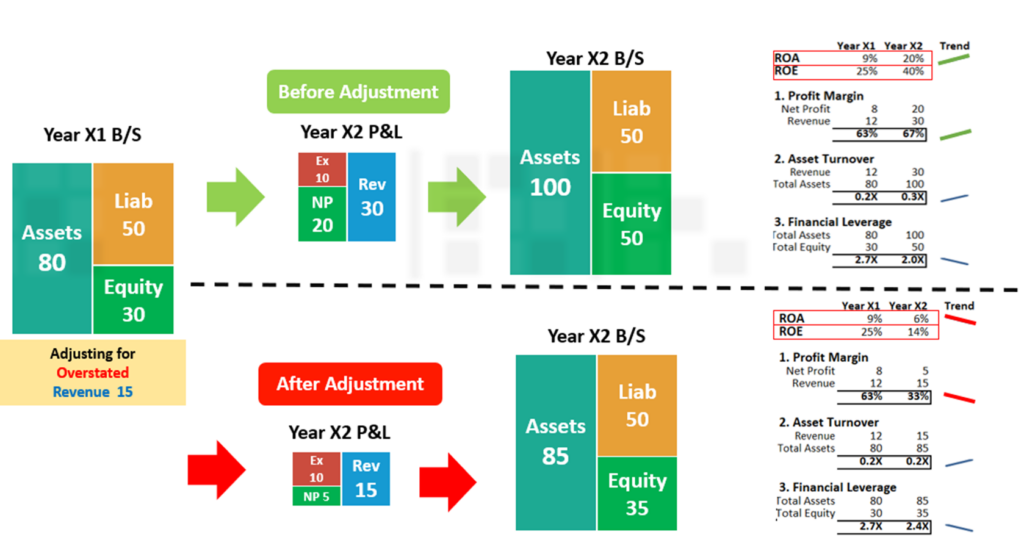

Before Adjustment: ROA, ROE growing

After Adjusting for overstated revenue: ROA , ROE declining

Two different pictures