Credit Bases v Counterparty

Contracts – Points to note

Coverage

- What commitment(s) does the contract cover?

- Sufficient to determine losses and hence damages/compensation if breached?

- E.g. Is there unit price and volume stated? Otherwise, it is merely a MOU

Length

- How long is the contract for?

Renewal

- Has there been regular renewals?

Relationship

- Long standing relationship or new relationship?

Exit Clauses

- Notice period (time)

- Fines or Cancellation Fee (quantum)

- Sufficient to pay indiscretionary expenses and tide over the period until borrower finds a substitute?

Which is better?

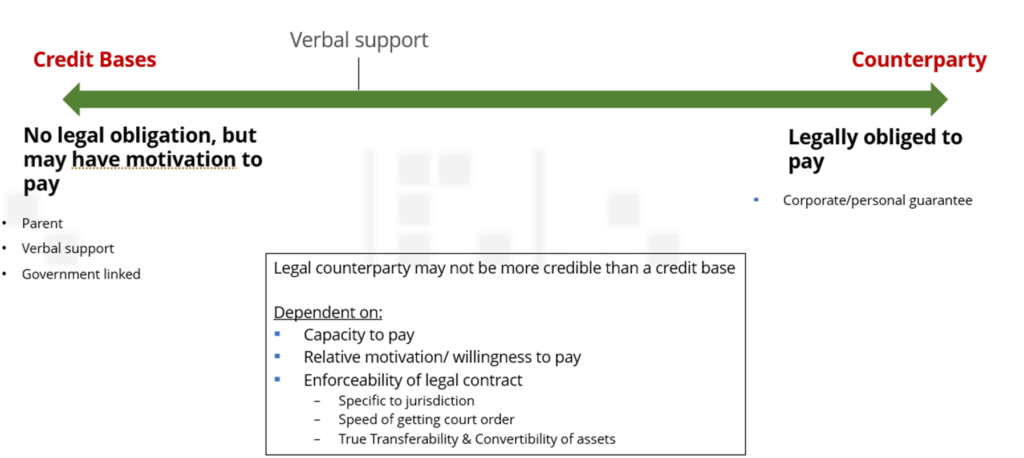

De-facto – in reality, as a matter of fact

- Long-standing relationship

- By law no

- By fact yes

De-Jure – by right, according to law

- Legal “iron-clad” contract

- By law yes

- By fact no

On whom do we focus our analysis?

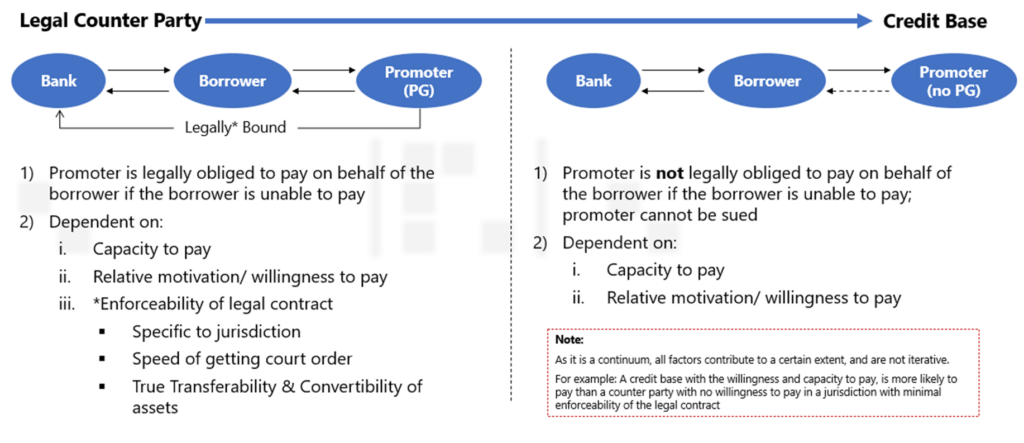

Legal Counterparties

- Primary obligor(s) and any secondary obligor(s), i.e. any party against whom the bank / investor has direct or indirect legal recourse wither on first demand or conditionally.

Credit Bases

- Any other party with whom the bank/ investor does not have a direct legal relationship but whose financial health has a direct or indirect impact on the ability of the primary & secondary obligor to complete it debt service obligation throughout the life of the credit exposure

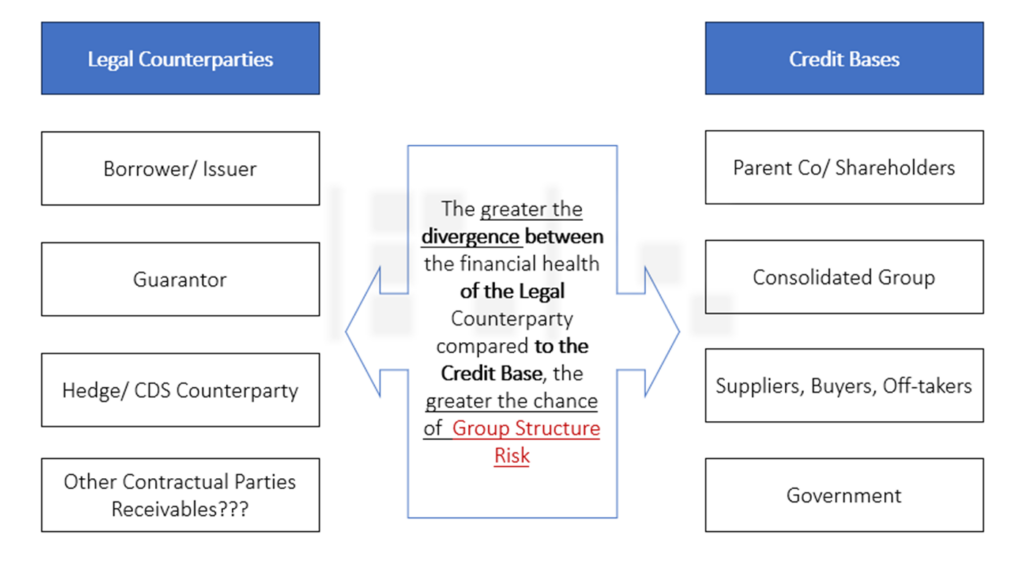

Legal Counterparties and Credit Bases

- Establish strength of group first (consolidated figures)

- Assess whether our exposure is to a strong or weak part of the group (unconsolidated figures)

- Comparison of comparative financial strength of Legal Counterparty and Credit Base gives your initial indicator of the level of Group Structure Risk:

- Weak Legal Counterparty and strong credit base

- Strong Legal Counterparty and weak credit base

- Is consolidation policy distorting the picture?

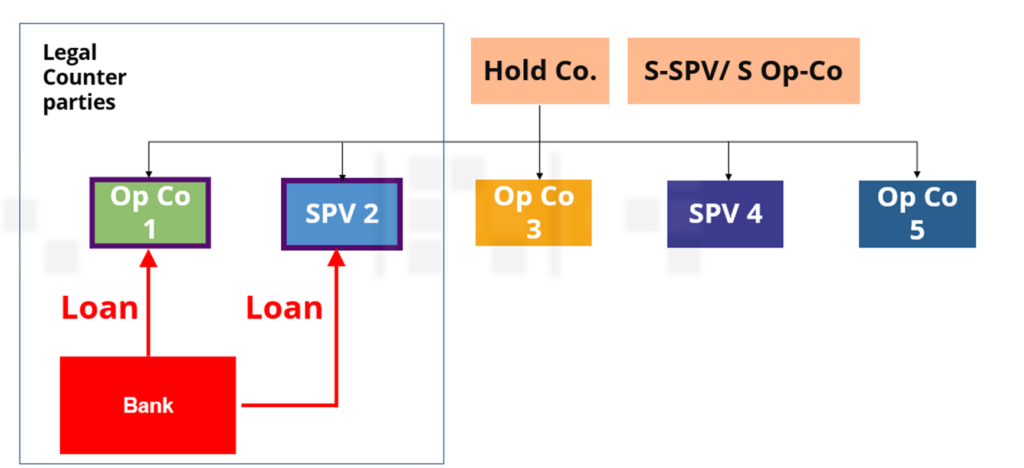

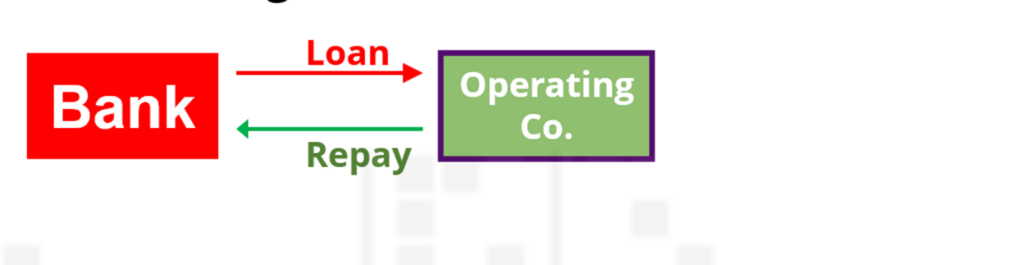

Bank lending to 1 borrower

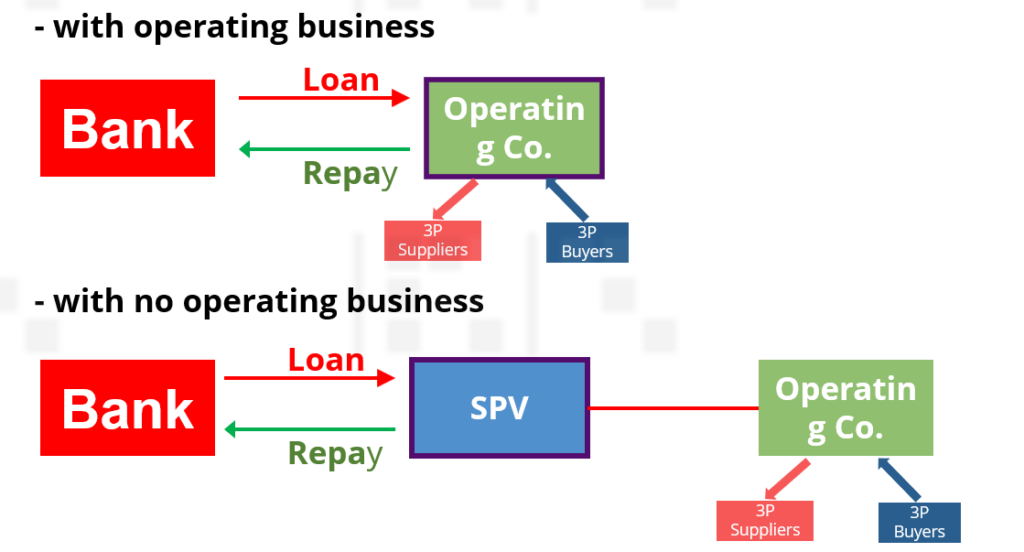

Bank lending to 1 borrower with –

Bank lending to multiple borrowers within a Group