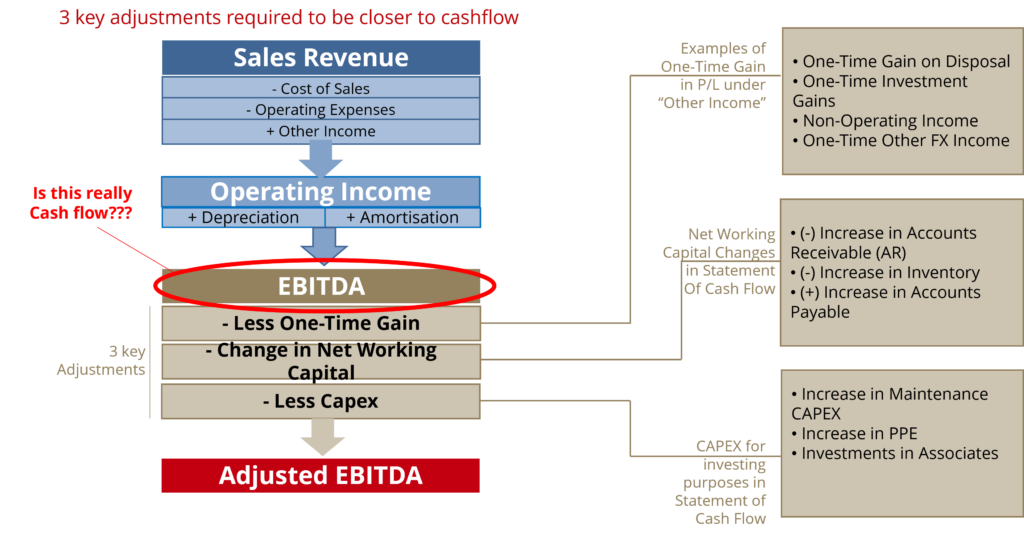

EBITDA is NOT cash flow

- EBITDA is used in commonly used ratios such as DSC (EBITDA/CPLTD) and leverage (debt/EBITDA), but it does not capture key items such as interest, taxes, working capital and capital expenditures that affect a company’s cash flow

- EBITDA – Taxes – Increase in NWC – Capex – Other operating investments = Free Cash flow available for debt service

- To calculate DSC,

- Make adjustments to current cash + expected incoming + expected outgoing

- Expected outgoing expenses (how elastic are these expenses. Non- discretionary and inelastic)

- Equity injection (personal equity) – See promoters’ track records in terms of how willing he is to fund

PD Analysis: EBITDA =/= CASHFLOW

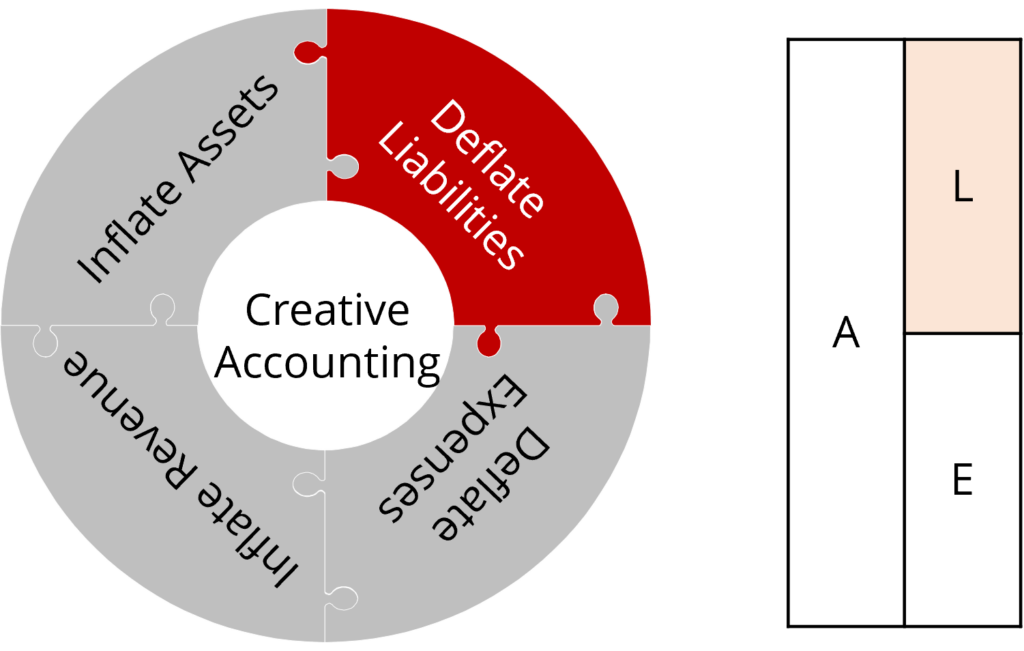

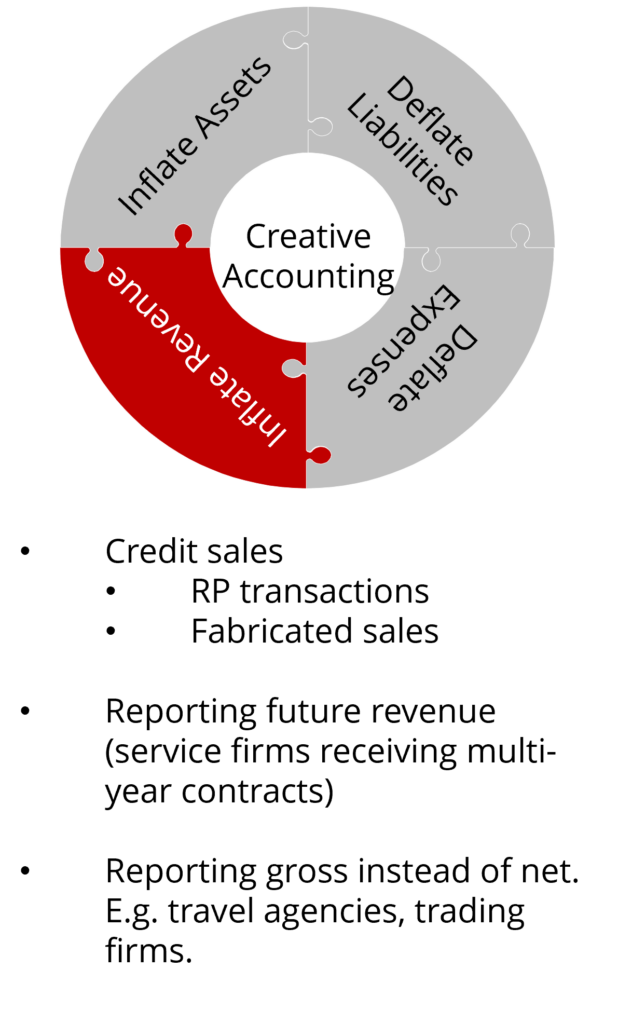

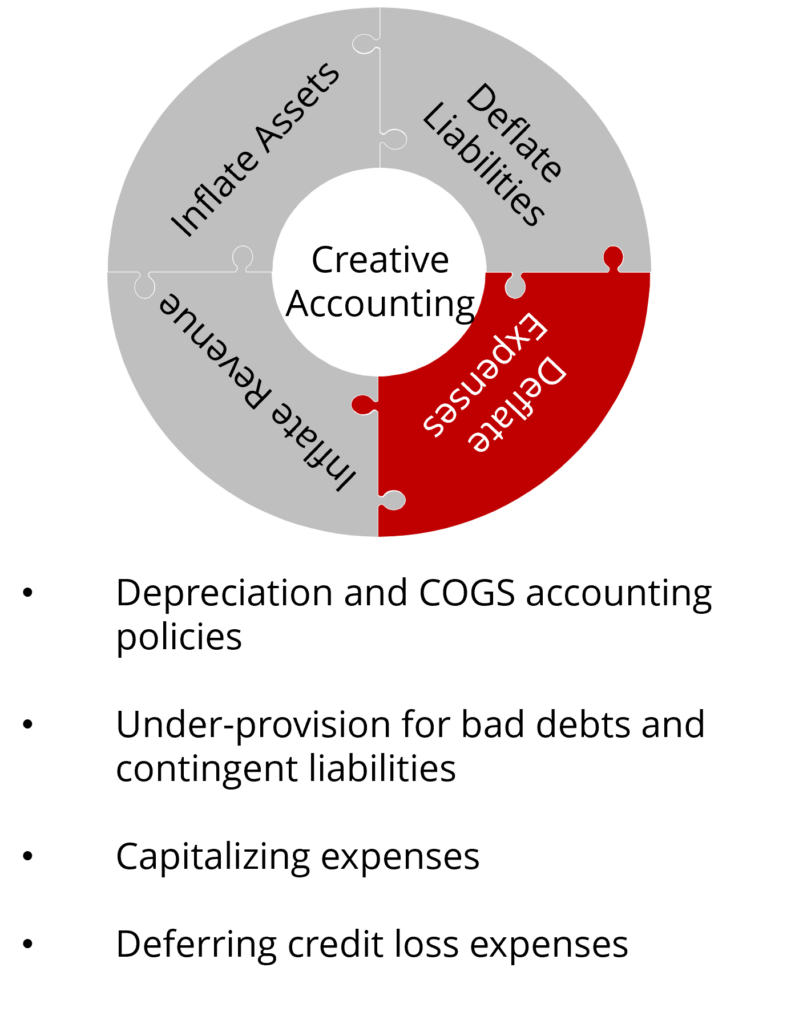

Adjustments to Financial Statements

Moody’s adjustments to financial statements

- Defined benefit pensions

- Operating leases (off-BS, only lease expense on P/L)

- Finance leases

- Capitalised interest

- Capitalised development cost –> MOST IMPORTANT

Capex

Planned

– Maintenance (hard to reduce, depends on elasticity)

– Incremental (may be reduced)

Committed

– Timing

– Financial Consequences (break cost)

3 sources of finding out planned and committed capex

– Regulatory requirement for management disclosure

– Analysts own estimates (Eg. taxi companies need to replace after 10 years)

– Ask customer (RM’s call report) - Interest expense related to discounted LT liabilities other than debt

- Hybrid securities

- Securitisation

- Inventory on a LIFO cost basis

- Consistent measurement of funds from operations – different measures of working capital

- Unusual and non-recurring items

- Unusually large transactions (creating revenue, costs or cash flows) that management does not expect to recur in the foreseeable future

- Other analytical non-standard adjustments

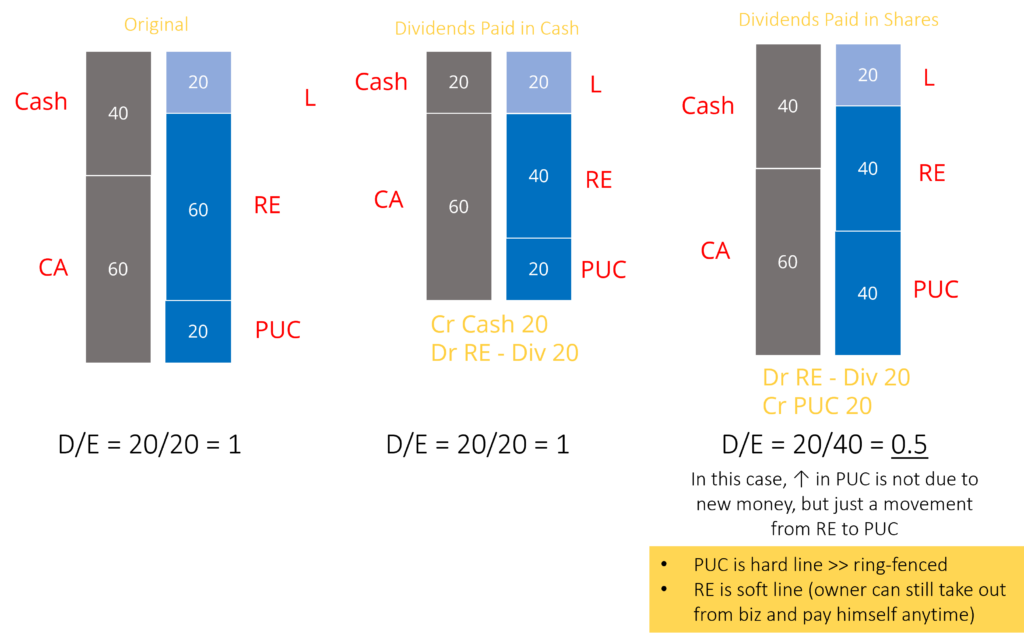

** DETERMINE IF THESE ADJUSTMENTS ARE MATERIAL RELATIVE TO EQUITY BUFFER

Why equity buffer? Because it affects D/E ratio which can change the credit rating

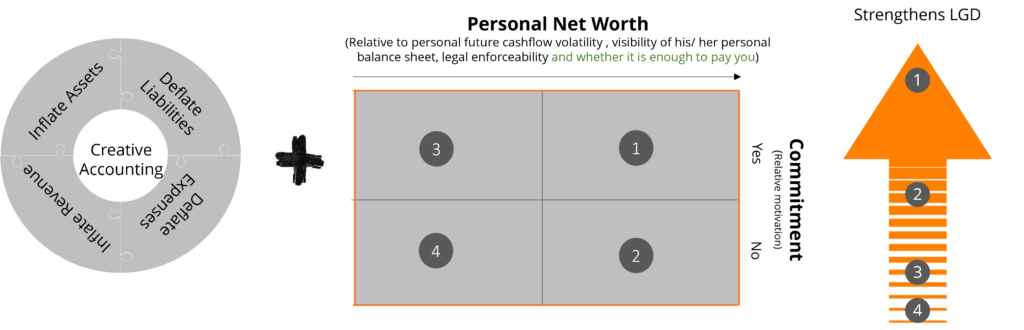

Dividends – In Cash VS Shares

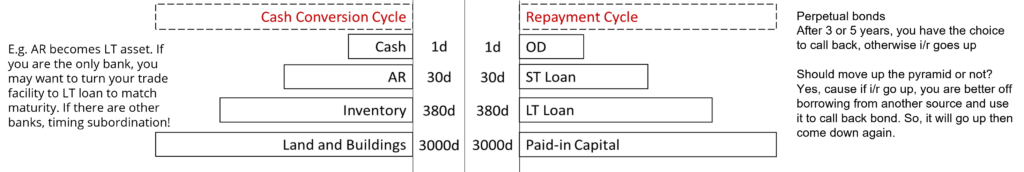

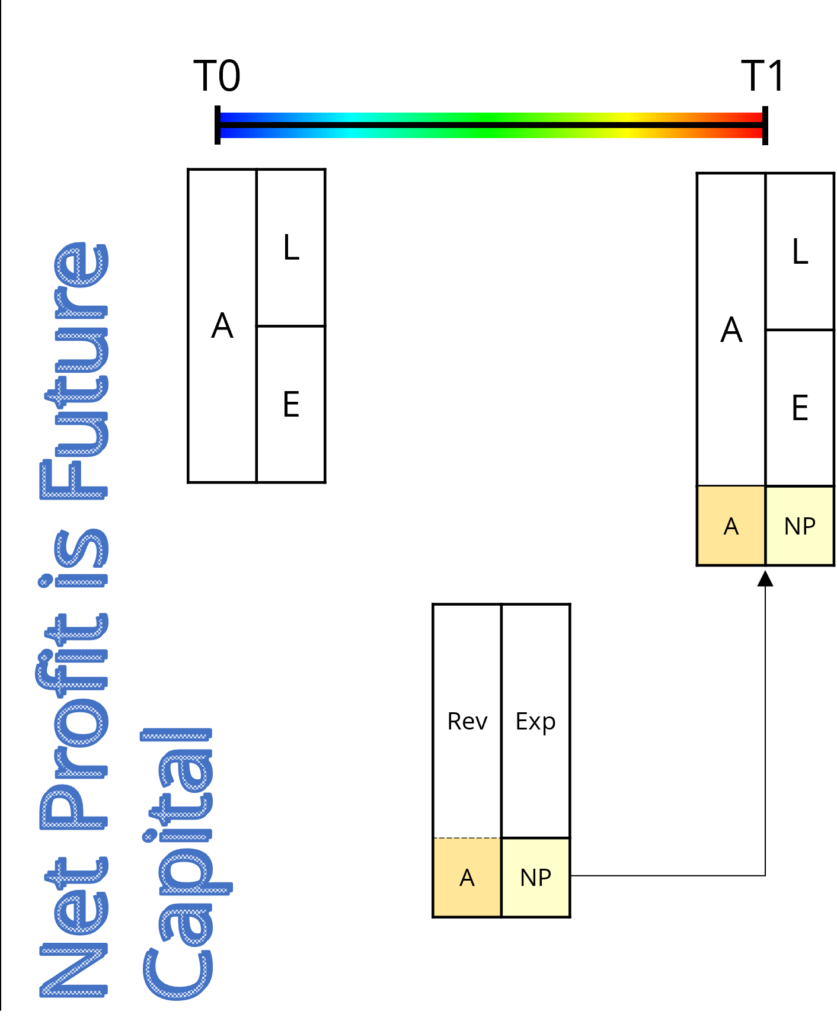

The “Ideal” Balance Sheet

- Cash conversion on the asset side is exactly matched with repayment cycle on the liabilities side

- Current ratio is not useful because it ignores maturity mismatches within the 1 year bucket

- Some current assets may have to move down the pyramid

- Eg. Obsolete Inventory, Imparied AR, etc

- Even cash is not always immediately available (eg. cash in different currency or location or units)

- Long term liabilities may come due immediately

- If a ST trade creditor sue, other loans may come due immediately

- Covenant and credit events

- Bullet repayment

What is the adjusted equity buffer?

- Overvalued assets (involving non-market valuation)

- Intangibles (e.g. brands or goodwill)

- Inventory (e.g. biological assets)

- Land and properties (less of a concern in SG)

- Accounts receivables

- RP balances vs. RP transactions (elasticity)

- Island debtors

- Types of concentration risks

- Irretrievable assets (T&C risk)

- Contingent liabilities/ hidden liabilities à more likely to crystallize at declining stage

- Warranty obligations or anticipated litigation loss

- Environmental/ third party claims, e.g. kampong head

- Labour union claims under negotiation

- Operating leases

- Liabilities disguised as equity: substance over form, when is the repayment date?

- Perpetual preference stocks

- Strategic vs. financial investors (e.g. SME – “friend’s investment”)

- Pension obligations (increase discount rate for NPV calculation)

Other Practical Considerations

SME Free flow of capital between natural and legal entity