Difference between Commercial Banking for SME and Corporate Banking for large corp

One often misused argument that the bankers from Commercial Banking will always use, is that we don’t need to check so many things to make a credit decision. The truth is that credit principles using cashflow fundamentals is similar no matter what size of the company! What’s more important is to still link back to cashflow and payback.

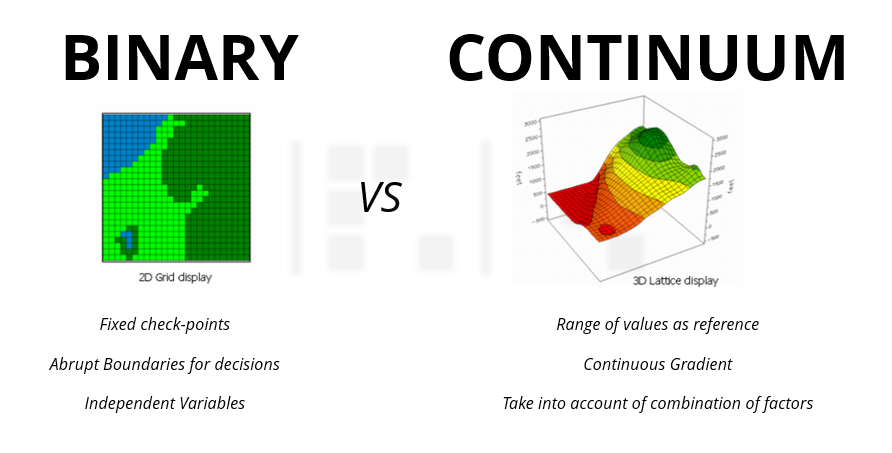

- Credit should be viewed as a continuum – it’s a confluence of factors from Equity Buffer, Ultimate Economic Activity, Promoter TNW that support each case

Binary vs Continuum Data

Similar to dynamic continuum, credit decisions shouldn’t be made on a binary basis. It will become a checklist if bankers are interested to know what are the binary requirements that need to be fulfilled in order to have the credit approved. Instead, credit decision should be viewed as a continuum – it’s a confluence of factors from Equity Buffer, Ultimate Economic Activity, Promoter TNW that helps support each case.

“Conservative” Estimation

For example, Tall man of 5m vs. “conservative” estimate of 2.5m

- We know for sure that this is not true given the general population’s height

For example, Customer’s revenue of 5m vs. “conservative” projection of 2m

- Whether this is indeed “conservative” or not, we need support from data

- Based on past data as reference + forecasting on future financials based on solid justifications

The Shiny Ball

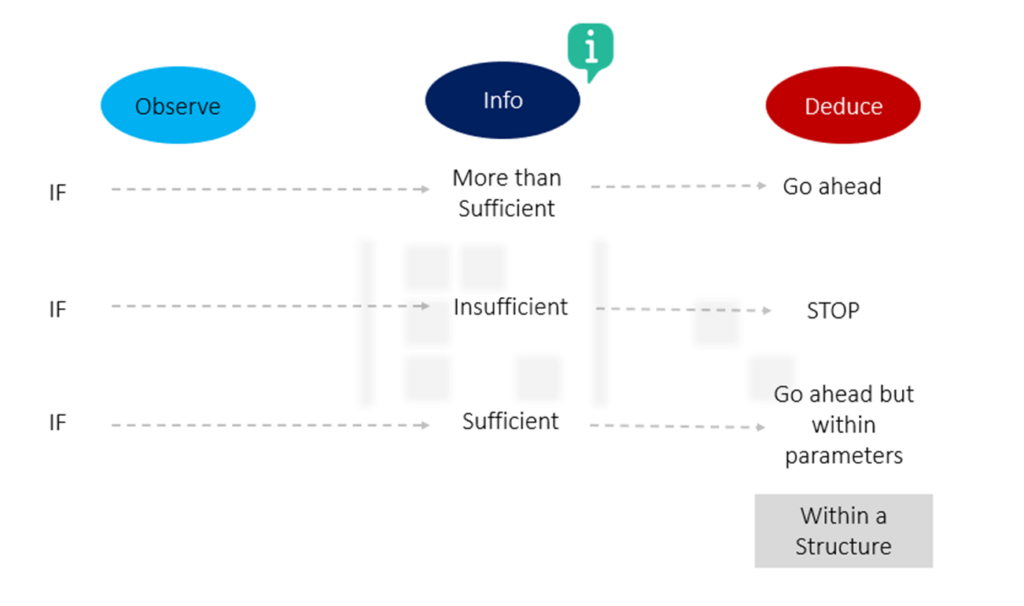

Observe – Info – Deduce