TOOL E10

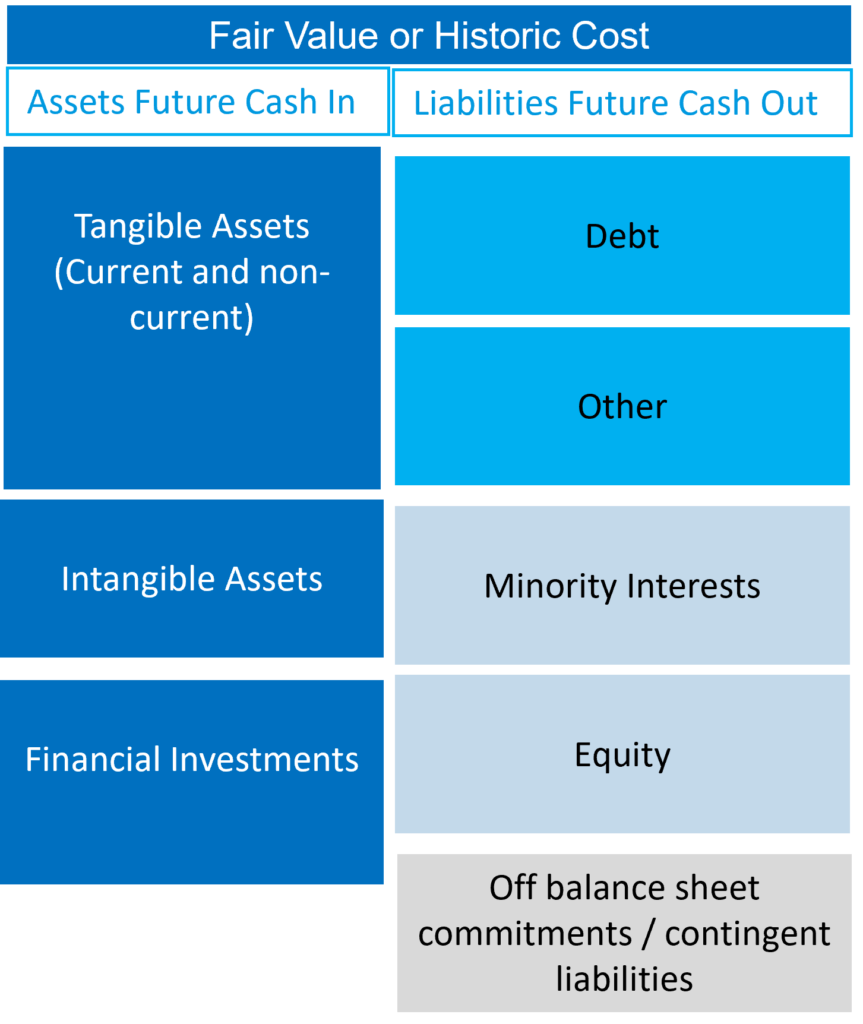

This tool provides you key questions for assessing the quality of the capital and the strength of the balance sheet—by examining the quality of assets and also the tenor / stability of liabilities and equity.

Tangible Assets (Current and non- current)

Is the mix of assets right for the business activity and optimal operating cycle?

Are the assets able to generate sustainable operating profit?

Do assets have sustainable value independent of the business’ performance?

Can assets be liquidated quickly into cash without loss in a stress scenario?

Debt

- Can it be serviced and/or refinanced?

- Does the debt maturity profile match operational cash flow?

What back-up facilities are available? What is the relative debt priority? - Is the funding structure suitable, given the asset quality, structure of liabilities, and business risk profile?

Other

- Is it stable? Do they have prior access over any assets?

Minority Interests

- Do they have prior access to good quality assets?

Equity

- Is it sufficient for unexpected losses and industry volatility?

- Access to additional equity, if required?

Off BS commitments/ contingent liabilities

- What is the true leverage of the business?

The Balance Sheet is more of a cost statement than a value statement!

Note

• Check equity for dividends declared, equity options of convertible bonds and parking reserves i.e.

- Translation

- Revaluation

- Cash flow hedge

- Assets available for sale

• Be aware of debt for equity like instruments

• Consider the impact of accounting policies on

- Asset valuation

- Capitalisation of costs

- Consolidation(core associate & Minority Interests)

- Off balance sheet liabilities

• Check funding and currency matching