TOOL E8

This tool helps you identify key risk messages from the analysis of the Asset Conversion Cycle (ACC).

For key ratios:

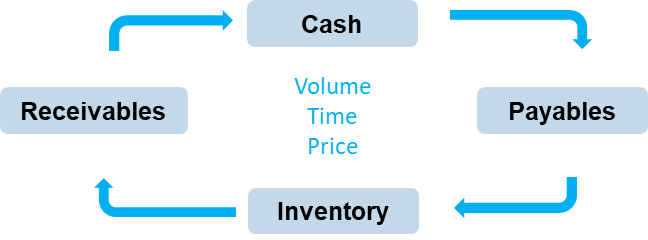

Asset Conversion Cycle (ACC)

• Efficiency of current asset usage. What do accounts receivables and inventory turnover ratio trends reveal?

• Relationship with buyers and suppliers. What does accounts payables turnover ratio trends reveal?

• What do accounts receivable and inventory trends reveal about business risk?

LIQUIDITY CRUNCH WARNING SIGNS

ACC becomes shorter and generates a one-off cash injection, when:

• encouragingly, there is more efficient working asset management;

OR

• worryingly, the client is in trouble because of:

‒ volume and/or price reductions;

‒ Pressure to delay payments, reduce purchases and/or inventory, and speed up receipts.

Always check when ACC generates cash. It is usually one off and may not be the result of efficiency