Who are the main parties?

- supplier

- buyer

- the bank

Identify the various counterparties involved and the flows of cash

Bank is able to provide additional financing to suppliers in the form of

- pre-shipment financing (to finance inventory build-up);

- post-shipment financing;

- financing the receivables

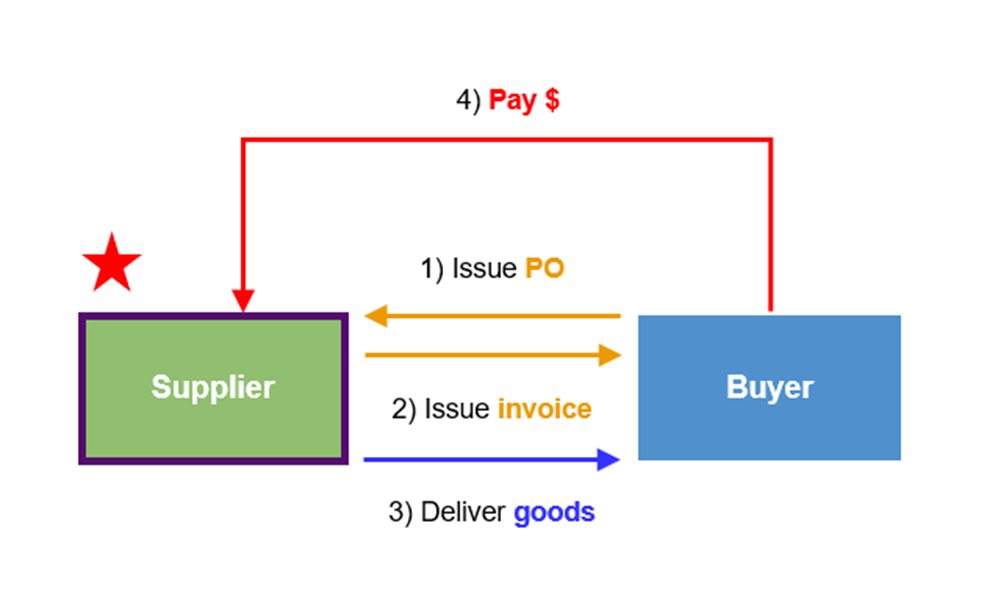

Trade (without financing)

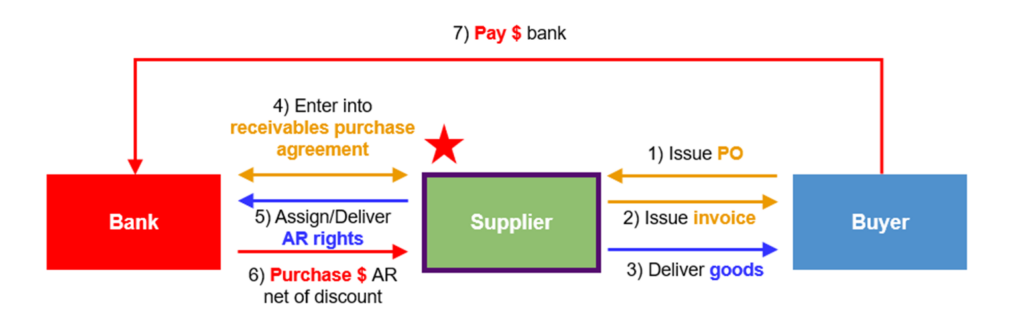

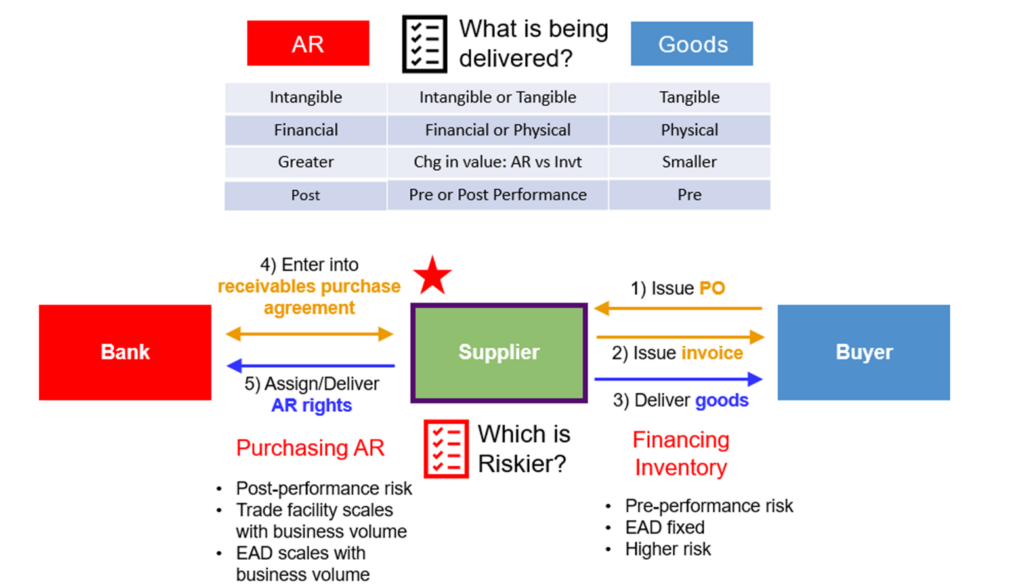

ARP – process flow

End to end transaction flow:

- Buyer requests goods and issues PO

- Supplier delivers invoice to buyer

- Supplier ships goods back to buyer

- Supplier enters into receivables purchase agreement with the Bank, where the Bank proceeds to purchase the invoices

- Supplier assigns rights to receive AR Proceeds to the Bank

- The Bank purchase AR net of discounted consideration

- Buyer pays the Bank at the end of the invoice period

Commercial benefits of trade finance products (accounts receivable purchase financing)

For Suppliers

- Receivables financing is a powerful tool for suppliers

- they may want to supply and sell to customers but are worried about concentration risk

- the bank can help with counterparty risk and concentration risk

Benefits

- Immediate liquidity

- What is the primary benefit of ARP to your client/supplier? immediate cash.

- With Buyers having a strong credit relative to the Supplier, what benefit does Supplier expect when he pays for the financing/immediate liquidity? Cheaper pricing

- Cheaper cost of financing

- If buyer is stronger, will the bank offer a higher / lower rate of financing? Lower

- If buyer is stronger and aware of the ARP financing, what will it ask for?

- Being aware that the Supplier is getting better cheaper funding costs, what will Buyer Demand/expect to benefit from its own relatively stronger credit to Supplier? Better terms/ refund/ lower pricing too!

- OR under what commercial situation, that the buyer can demand a longer credit term? When buyer is stronger or weaker?

- presence of a stronger buyer is giving supplier access to cheaper funds, best form for commercial arbitrage

- In the Bank, the hurdle rate for ARP is lower than RCF

- More reliable liquidity sources in a financial crisis

- How regular is a financial crisis?

- What do banks do during such crises?

- Increase or reduce exposures?

- During a financing crisis, Comparing regular RCF/other trade financing vs ARP, which will bank more likely to maintain?

- During the same crisis, do the companies need MORE or LESS funding?

- Who will appreciate or see more such crises/younger or more senior folks? Bosses or employees?

- Then you go, you get to speak with the bosses who appreciate such advice…. Cementing your role as a trusted advisor. NOT just bargaining with the finance dept on the $50 fee waivers…

- And you get to help your clients at the same time as your bank.

- Alternative sources of financing when capital markets dry up, e.g during GFC

- Do you believe we are getting into a crisis, in a crisis or getting out of one?

- Improved financial metrics

- EPS or ROIC driven clients: what does ARP take off /reduce from their balance sheet?

- Provides off balance sheet financing (improves returns cosmetically)

- Support of the Bank’s client in new markets

- Do suppliers prefer existing buyers or new buyers? In order to grow, new buyers?

For buyers

- Potential for improved trading margins

- Sharing the benefits of cheaper financing based on buyer’s credit standing

- Longer credit term, improving working capital

- Supplier can offer better trade terms to buyer and help the operating margins of the buyer

- Tightening supplier buyer trading relationships

- From a buyer POV, it allows ARP assignment/notification because it wants a shorter or longer term trading relationship?

For banks

- Value of real time information

- With 24/7 information on their trades between suppliers and buyer, does the bank have Greater or Lesser visibility of the trading relationship?

- Monitor the receivables on real time basis (instead of waiting for review)

- Enable buyer and supplier to improve trading visibility

- Greater advance rates

- Compare to financing against other sort of “borrowing bases” such as inventories: will the supplier get a higher / lower FQ /advance ratio? higher

- Improved bank capital management

- Tighter operational control

- Typically lower loss given default (LGD)

- Higher / lower risks? Require higher or lower capital

- Improved mutual visibility between the Bank, the Supplier, and its Buyers

- Improved operating visibility on trade flows by enabling client to access the Bank’s electronic platform

- Tighten relationship between 3 parties.

- In digital banking, being so well connected between Supplier, Buyers, Bank, we are in a what system? Ecosystem

For the Banker

- More time to cross sell to Supplier – from one product to multiple products.

- Cross sell to Buyers

- From one-off to long term relationship – sticky

- Deal with Senior management instead of junior staff

- From higher risks to lower risks – improve credit quality

- Gain industry knowledge – greater credibility

- More likely to meet KPIs for bigger, regular bonus and promotions

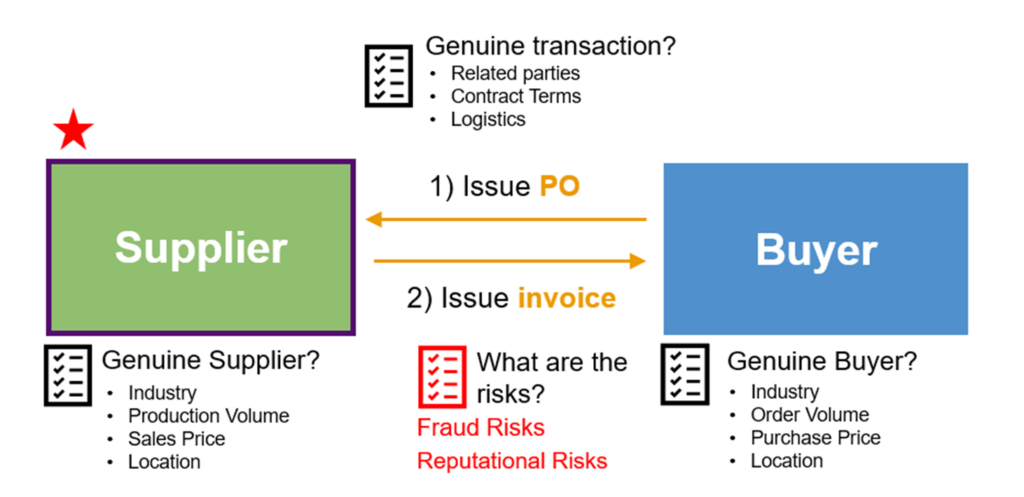

Identifying Risks

Initial Contract docs: 1) PO and 2) Invoice

Mitigation to check genuine transaction: To make them our client, more information = lower risk

Fieldwork/Due Diligence for us

- Identify UBO, office location etc

- Our responsibility to investigate underlying transactions

What are the key characteristics that govern underlying trade relationships as between suppliers and buyers?

- Be a bona fide transaction of goods and services not subject to international or local sanctions governing counterparties or goods/services

- Free and clear of any lien or form of encumbrance

- Be ‘arms length’ between supplier and buyer

- Intercompany transactions need to be highlighted and agreed with the Bank’s credit approver (avoids risk of over invoicing or transfer pricing and the resultant dilution of the receivable value)

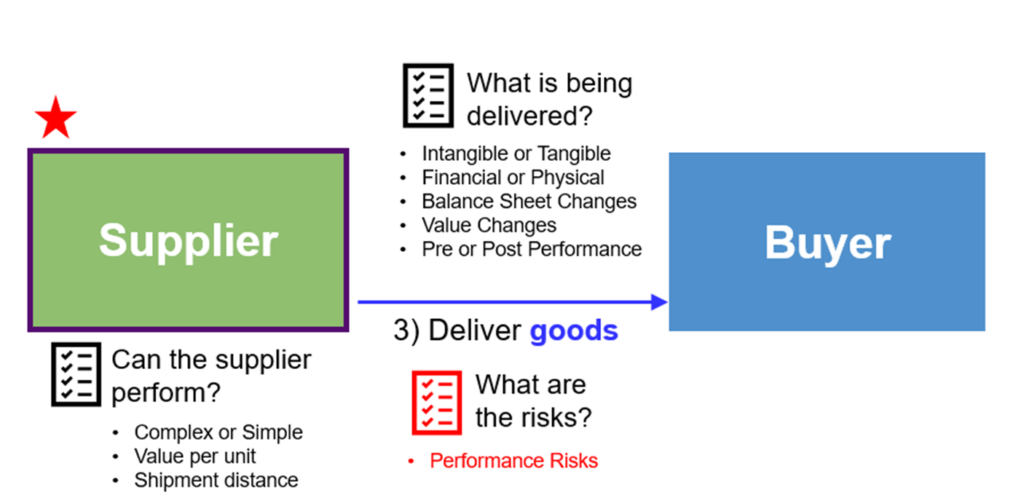

3) Shipment of Goods

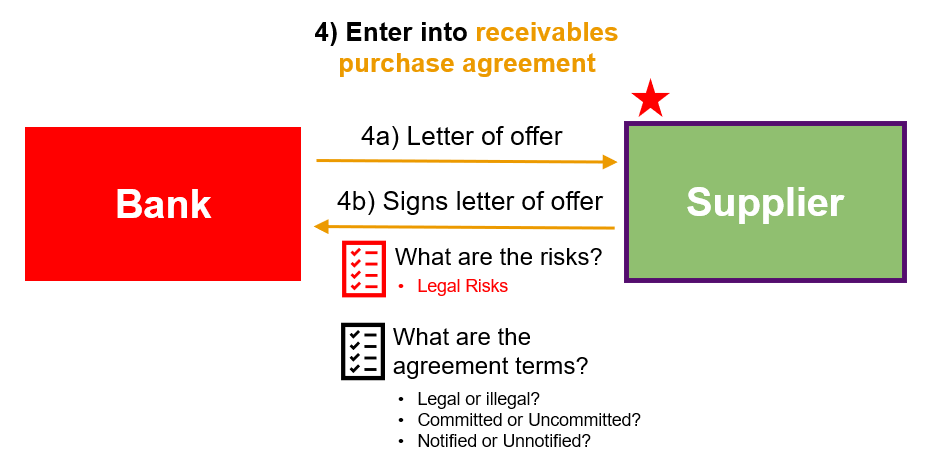

Second Contract: 4) ARP Agreement

Agreement terms

- Legal/Illegal

- Ultra vires (Beyond the powers): Describe an act which requires legal authority or power but is then completed outside of or without the requisite authority.

- Committed/Uncommitted

- Should be documented on uncommitted basis, so that we can get out at any stage, giving us better credit risk control

Sometimes your client will want committed facilities, e.g. when they are expanding to unknown market, they want to have assurance on line of credit

Duality of uncommitted facilities…once the money is paid out… as good as “committed”

- Should be documented on uncommitted basis, so that we can get out at any stage, giving us better credit risk control

- Notified/Unnotified

- NoAs are sent after client signs the agreement (RPA) and prior to implementation of the deal for notified ARP

For non-notified ARP, the Bank requires the Client to submit an undated signed NoA

And the Bank sends only if there is overdues more than [60] days past due or when there is adverse info

- NoAs are sent after client signs the agreement (RPA) and prior to implementation of the deal for notified ARP

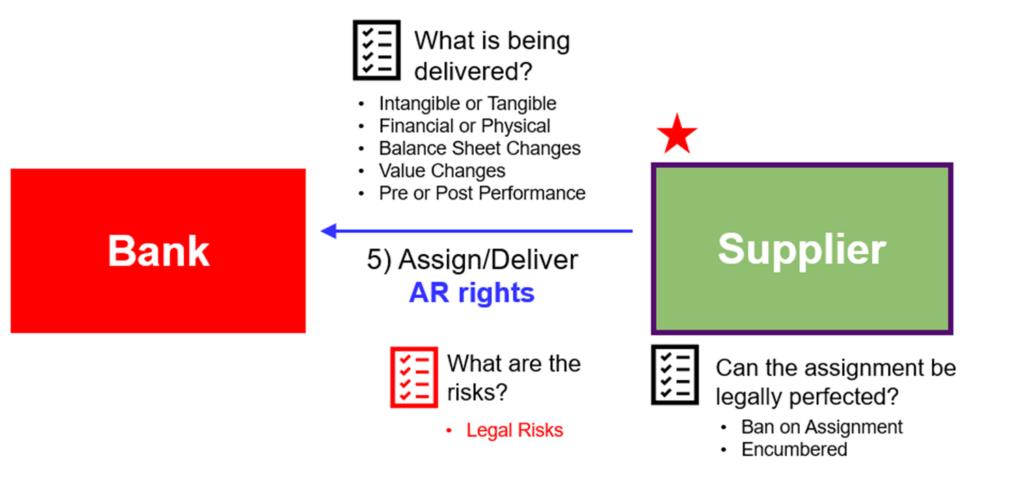

5) Assignment of Rights

Mitigation: Ban on assignment

- Accredit ourselves

- Ask supplier to request for waiver

- Illegal in some countries (e.g US)

Mitigation: Encumbered

- Register our interest individually, time consuming and manual

- Future potential: Blockchain

1st: when the AR being assigned to the Bank, yo u would want the assignments to be Perfect without encumbrance.

2nd: AFTER the AR is assigned to the Bank, you would want the assignments to be LEGALLY enforceable

How are the rights to the collections of the receivables legally transferred to the Bank? (these deals are typically unsecured)

- Unless something goes drastically wrong, buyers will always be sweet to their suppliers

- The supplier’s rights to receivables collection are legally assigned in full to the Bank pursuant to a receivables purchase agreement, between supplier and the Bank

Comparison: Deliver Rights VS Deliver Goods

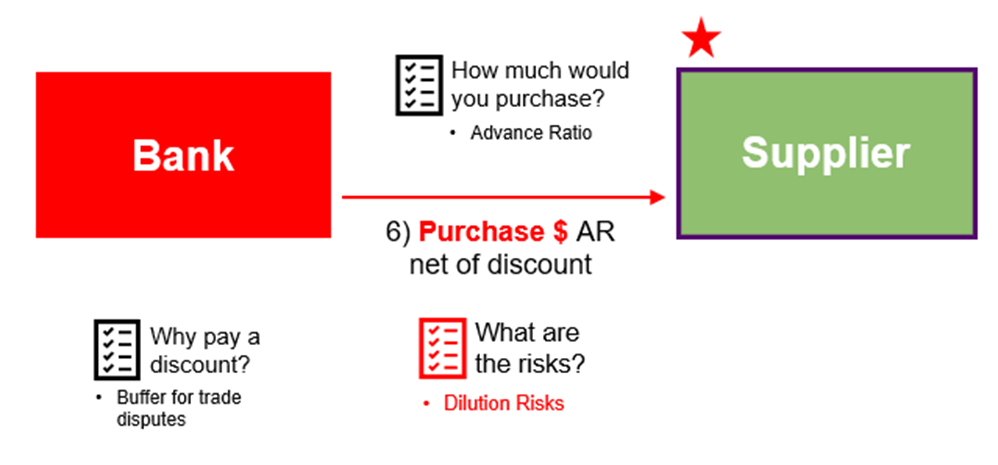

6) Purchase of AR

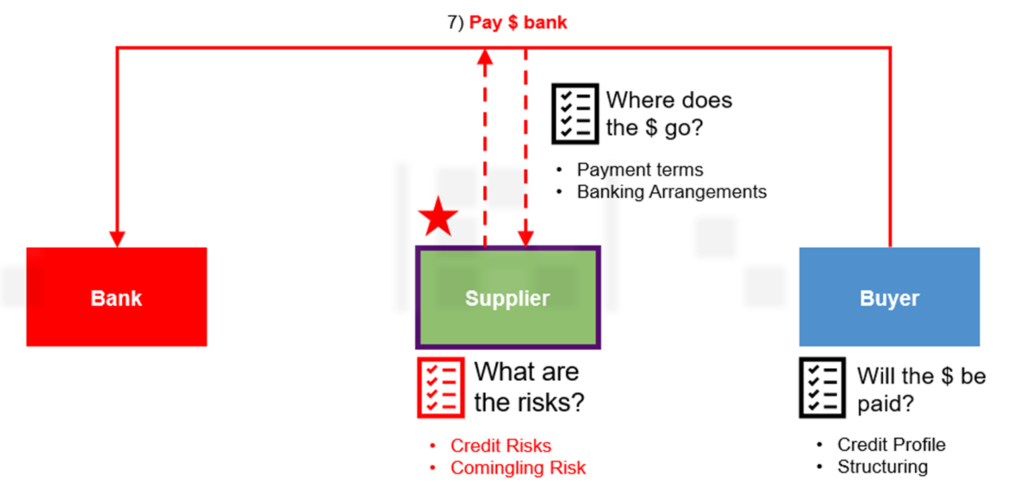

7) Pay $ to Bank

Will the $ be paid:

- Question: Who should be stronger credit between buyer/supplier

Mitigations if buyer weaker:

- ARP with recourse

- Insurance to tighten the structure

Comingling Risk

- Which account do you prefer the buyer pay into? the Bank’s

- Is it common not to pay into the Bank’s account?

- If not to the Bank’s accounts, what risk do you see? Commingling

What is commingling risk? How is it controlled in accounts receivable purchase financing?

- Arises when funds owing to suppliers are comingled with other operating cash before being remitted to the Bank (dilution)

- If the supplier is the Collection Agent, the Commingling Risk is mitigated if the supplier owned bank account has been properly pledged and “blocked” in favor of the Bank.

- No commingling risk if buyers are notified of the Bank’s interest in the Receivable under a disclosed facility (and further instructed to remit the funds directly to a the Bank’s owned collection account).

First contract: Determines Payment terms/payment account

Regular contract: Indicate payment terms > happen before we finance, difficult for us to change

- Unlikely to change the banking arrangements as those are arranged when the 1st contract is signed > supplier does not want to confuse the buyer + we might not be cash management bank for supplier

What procedures can help monitor and manage the servicing and collections of receivables?

- Paid into the Bank or the Bank held account irrespective of whether transaction is disclosed or undisclosed to buyer

- Nature and styling of the account need not be disclosed to buyer

- If transactions is arranged by a 3rd party bank, collection account can be either in the name of the agent bank or with an account control agreement signed by buyer, account holding bank and agent bank