Introduction

Return on Equity (ROE) is widely considered the single most important performance metric for assessing a company’s ability to generate returns from shareholders’ investment. However, relying solely on this aggregate measure can obscure the underlying drivers of performance. The DuPont Analysis framework, developed by the DuPont Corporation in the 1920s, addresses this limitation by decomposing ROE into its fundamental components, providing a more nuanced understanding of a company’s financial performance.

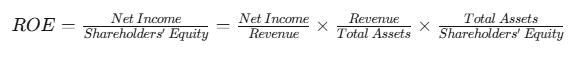

The Basic DuPont Equation

The traditional DuPont Analysis breaks down ROE into three distinct components:

ROE = Net Income / Shareholders’ Equity = Net Income/Revenue x Revenue/Total Assets x Total Assets/Shareholders’ Equity

These three components are:

- Profit Margin = Net Income ÷ Revenue

- Asset Turnover = Revenue ÷ Total Assets

- Financial Leverage = Total Assets ÷ Shareholders’ Equity

This decomposition reveals that a company can improve its ROE through three strategic levers:

- Improving operational efficiency (Profit Margin)

- Enhancing asset utilization (Asset Turnover)

- Optimizing financial leverage (Financial Leverage)

Detailed Component Analysis

1. Profit Margin (Net Income ÷ Revenue)

Definition: The portion of each dollar of revenue that translates into net income.

Subcomponents:

- Gross Margin (Gross Profit ÷ Revenue)

- Operating Margin (Operating Income ÷ Revenue)

- Tax Efficiency (Net Income ÷ Pretax Income)

Strategic Levers:

- Pricing strategy

- Cost structure management

- Product mix optimization

- Operating expense control

Industry Variations:

- Luxury goods: High margins (20%+)

- Software/Technology: Moderate to high (15-25%)

- Retail: Low margins (2-5%)

- Commodities: Very low margins (1-3%)

Lifecycle Patterns:

- Startups often have negative or low margins

- Growth companies see improving but reinvestment-heavy margins

- Mature companies achieve optimal margins

- Declining companies experience margin compression

2. Asset Turnover (Revenue ÷ Total Assets)

Definition: The efficiency with which a company utilizes its assets to generate revenue.

Subcomponents:

- Fixed Asset Turnover (Revenue ÷ PP&E)

- Working Capital Turnover (Revenue ÷ Working Capital)

- Inventory Turnover (COGS ÷ Average Inventory)

Strategic Levers:

- Capacity utilization

- Supply chain optimization

- Working capital management

- Asset rationalization

Industry Variations:

- Retail: High turnover (2.0-3.0x)

- Manufacturing: Moderate turnover (1.0-1.5x)

- Utilities: Low turnover (0.3-0.5x)

- Real Estate: Very low turnover (0.1-0.3x)

Lifecycle Patterns:

- Startups typically have low asset turnover as they build infrastructure

- Growth companies see improving turnover as they scale operations

- Mature companies achieve peak asset efficiency

- Declining companies experience deteriorating utilization

3. Financial Leverage (Total Assets ÷ Shareholders’ Equity)

Definition: The extent to which a company finances its assets with debt versus equity.

Subcomponents:

- Debt-to-Equity Ratio (Total Debt ÷ Total Equity)

- Interest Coverage Ratio (EBIT ÷ Interest Expense)

- Current Ratio (Current Assets ÷ Current Liabilities)

Strategic Levers:

- Capital structure optimization

- Debt financing strategy

- Dividend policy

- Share repurchase programs

Industry Variations:

- Banking: High leverage (10-15x)

- Utilities: Moderate-high leverage (2.5-4.0x)

- Manufacturing: Moderate leverage (1.5-2.5x)

- Technology: Low leverage (1.2-1.8x)

Lifecycle Patterns:

- Startups typically have low leverage due to limited debt access

- Growth companies increase leverage as cash flows stabilize

- Mature companies optimize leverage for shareholder returns

- Declining companies often show excessive leverage as equity erodes

The Extended DuPont Framework

The five-component DuPont Analysis provides even deeper insights by further decomposing the framework:

ROE = Net Income/EBT x EBT/EBIT x EBIT/Revenue x Revenue/Total Assets x Total Assets/Shareholders’ Equity

Where:

- Net Income/EBT = Tax Efficiency

- EBT/EBIT = Interest Burden

- EBIT/Revenue = Operating Margin

- Revenue/Total Assets = Asset Turnover

- Total Assets/Shareholders’ Equity = Financial Leverage

This extended model illuminates additional performance drivers, particularly distinguishing between operating efficiency and financial engineering.

Comparative Analysis Framework

The true power of DuPont Analysis emerges through comparative analysis across:

1. Historical Comparison

Tracking changes in ROE components over time reveals performance trends and strategic shifts:

| Year | Profit Margin | Asset Turnover | Financial Leverage | ROE |

|---|---|---|---|---|

| 2022 | 8.5% | 1.2 | 2.3 | 23.5% |

| 2023 | 9.0% | 1.3 | 2.2 | 25.7% |

| 2024 | 8.8% | 1.4 | 2.0 | 24.6% |

This reveals that while overall ROE fluctuated, the company was shifting toward operational efficiency (higher asset turnover) and away from financial leverage.

2. Competitor Benchmarking

Comparing ROE components against peers identifies relative strengths and weaknesses:

| Company | Profit Margin | Asset Turnover | Financial Leverage | ROE |

|---|---|---|---|---|

| Our Co. | 9.0% | 1.3 | 2.2 | 25.7% |

| Comp A | 10.5% | 1.1 | 2.3 | 26.5% |

| Comp B | 7.5% | 1.6 | 2.0 | 24.0% |

| Industry Avg. | 8.5% | 1.3 | 2.1 | 23.3% |

This analysis shows that Competitor A achieves similar ROE through superior margins, while Competitor B relies on operational efficiency.

3. Industry Norms Analysis

Different industries naturally gravitate toward different ROE compositions based on structural characteristics:

| Industry | Typical Profit Margin | Typical Asset Turnover | Typical Financial Leverage | Resulting ROE |

|---|---|---|---|---|

| Luxury Goods | 15-20% | 0.6-0.8 | 1.5-2.0 | 13.5-32.0% |

| Grocery Retail | 2-3% | 2.5-3.5 | 2.0-2.5 | 10.0-26.3% |

| Utilities | 10-15% | 0.3-0.5 | 2.5-3.5 | 7.5-26.3% |

| Software | 15-25% | 0.8-1.2 | 1.2-1.8 | 14.4-54.0% |

| Banking | 20-30% | 0.03-0.05 | 10.0-15.0 | 6.0-22.5% |

Strategic Implications of DuPont Analysis

The DuPont framework not only diagnoses performance but also guides strategic decision-making:

1. Improving Profit Margins

Strategies focused on enhancing profit margins include:

- Premiumization and value-added offerings

- Cost reduction initiatives and operational streamlining

- Portfolio optimization toward higher-margin products/services

- Vertical integration to capture more of the value chain

2. Enhancing Asset Turnover

Strategies focused on asset efficiency include:

- Lean manufacturing and just-in-time inventory systems

- Asset-light business models and outsourcing

- SKU rationalization and product line simplification

- Dynamic pricing to maximize capacity utilization

3. Optimizing Financial Leverage

Strategies for capital structure optimization include:

- Debt recapitalization to take advantage of tax shields

- Share repurchase programs to enhance EPS

- Sale-leaseback arrangements for fixed assets

- Working capital financing optimization

DuPont Analysis Limitations

While powerful, the DuPont framework has important limitations:

- Short-term Focus: The model may encourage short-term ROE maximization at the expense of long-term value creation

- Accounting Distortions: Different accounting treatments across firms can limit comparability

- Risk Consideration: The standard model doesn’t explicitly account for risk, particularly in leverage decisions

- Intangible Assets: Modern businesses with significant intellectual property may show distorted asset turnover

- Cash Flow Omission: The framework relies on accounting metrics rather than cash flow measures

Advanced Applications: DuPont Analysis for Corporate Lifecycle Assessment

The DuPont framework provides insights into a company’s position within its corporate lifecycle:

| Lifecycle Stage | Typical Profit Margin Pattern | Typical Asset Turnover Pattern | Typical Financial Leverage Pattern |

|---|---|---|---|

| Startup | Negative or minimal | Low and inefficient | Low, equity-focused |

| Growth | Improving but reinvestment-heavy | Rapidly improving | Increasing as debt access improves |

| Mature | Optimal and stable | Peak efficiency | Optimal for shareholder returns |

| Early Decline | Beginning to deteriorate | Efficiency declining | Often increasing to maintain ROE |

| Decline | Significantly compressed | Poor utilization | Excessively high as equity erodes |

This application of DuPont analysis serves as an early warning system for lifecycle transitions, particularly when specific component movements precede overall ROE changes.

Conclusion

The DuPont Analysis framework transforms ROE from a simple performance metric into a powerful diagnostic tool that reveals the underlying drivers of financial performance. By understanding how profit margins, asset turnover, and financial leverage interact to produce overall returns, analysts can develop more nuanced insights and more targeted strategic recommendations.

The framework particularly excels at:

- Identifying the true sources of performance changes

- Comparing companies with similar ROEs but different operational models

- Detecting early warning signs of business model challenges

- Guiding strategic priorities to enhance shareholder returns

For financial analysts and junior bankers, mastering the DuPont framework is essential for moving beyond superficial performance assessments to deliver genuinely insightful financial analysis and strategic guidance.