TOOL L8

Certainty of breach?

| Information Source | – Own research / agent bank / client / other? |

| Breach History | – First breach / previous breaches – what action was taken? |

| Number of Breaches | – Which covenant is breached? – Recheck the calculations if a financial covenant – Check for other breaches and warning signs |

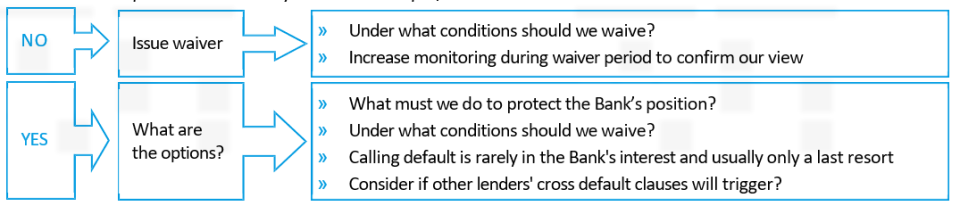

Has the risk profile changed?

Until and unless proven to the contrary, assume the risk profile HAS deteriorated

If a syndicated facility, and the agent is pushing through a waiver you do not agree with, lobby like minded participants to see if you have enough power to block

What do we need to do to protect the Bank’s position?

| Legal position | – Check the documentation / collateral – Consult with lawyers before communicating with client – Ensure actions below do not increase lenders’ liability. |

| Freeze exposure | – Cancel undrawn portion of committed facilities – Withdraw uncommitted limits from the system – Notify other interested departments / branches of the Bank |

| Increased risk profile | – Use the Bank’s increased negotiating power to negotiate additional collateral and a higher interest margin etc |

| Third parties | – Are other banks involved / aware? – What action are they taking? – Impact on our debt priority position? |

| Take Action | – Whether you decide to waive or call default, you MUST take prompt action – no action would be deemed to be an implied waiver in law |

Under what conditions should we waive?

| One-off or permanent | If one-off, how long is the waiver for? |

| Time frame | When must the covenant be back within the limit? When must the additional collateral be perfected by? |

| Interim covenants | Step financial covenants until the original levels are met |

| Information requirements | Set out clearly what information you require and by when |

| Charge a waiver fee | To be paid immediately |