TOOL L3

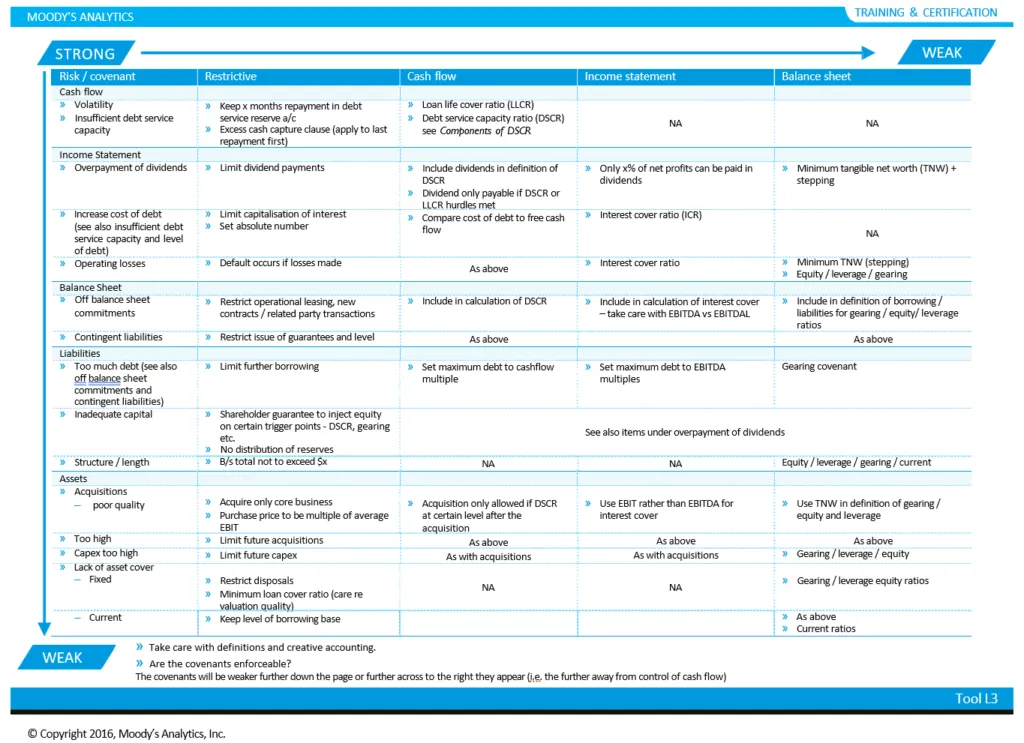

The attached table is intended as a general guideline when you are setting financial covenants to mitigate risk. It should be noted that it is highly unusual to use these covenants on short term transactions as that may prejudice the banks position for early repayment.

In practice you should not view a financial covenant on a stand alone basis. It will be linked with other covenants (financial and non-financial) to form a “cocktail” and it is their combined effectiveness which should be considered as the mitigant against risk.

The power given by a covenant structure and how quickly it will be triggered to give a warning signal will depend on the

- Type of covenant

- Definition

- Numerical level

- Speed and frequency of compliance

In practice this will be governed by the Bank’s negotiating power with the client.

Type of Covenants

Restrictive Covenants are designed to prevent a company taking action undesirable to the Bank

Cash flow, Income Statement and Balance Sheet covenants are designed to monitor the financial health of a business.

If a business is exposed to negative factors then this would normally be reflected first in Cash flow covenants. Next it will impact on Income statement covenants and eventually on Balance sheet covenants.

Definition

The more tightly a financial covenant is defined the more difficult it is for a customer in financial difficulties to use creative accounting to prevent going into default.

There should normally be a condition preventing a change in accounting policies. If such a change is required by a regulatory body then the financial covenants should be calculated according to the previous accounting policies.

Numerical Level

Ideally the level set should give the bank early warning of problems but not be too tight to stop the company carrying out its normal business. The level at which covenants should be set is an art.

The starting point should be historic levels with a margin of safety. However it is increasingly necessary to relate the covenants to financial projections as the term of the transaction lengthens and there is more reliance on future performance. It is therefore quite common (especially in highly leveraged transactions and project finance) to see the level of covenants “step up” as a reflection of the anticipated improvement in a company’s performance.

Speed and Frequency of Compliance

The bank is given more control if it receives information quickly and on a frequent basis. Testing financial covenants from audited accounts received six months after the year end does not allow close monitoring. This is better achieved from say quarterly accounts received within 10 days of the quarter end.

Conclusion

It is important to remember that when financial covenants are breached the Bank has the right to early repayment, but this is unlikely to occur. To what extent the Bank can re-negotiate and reduce its risk will depend on how well the covenants have been defined, set and monitored, and this should be considered when the transaction is being structured

Financial Covenants Table