Underlying Risks in Balance Sheet

Companies trading in Physical Assets (Corporates)

Companies trading in Financial Assets (Financial Institutions)

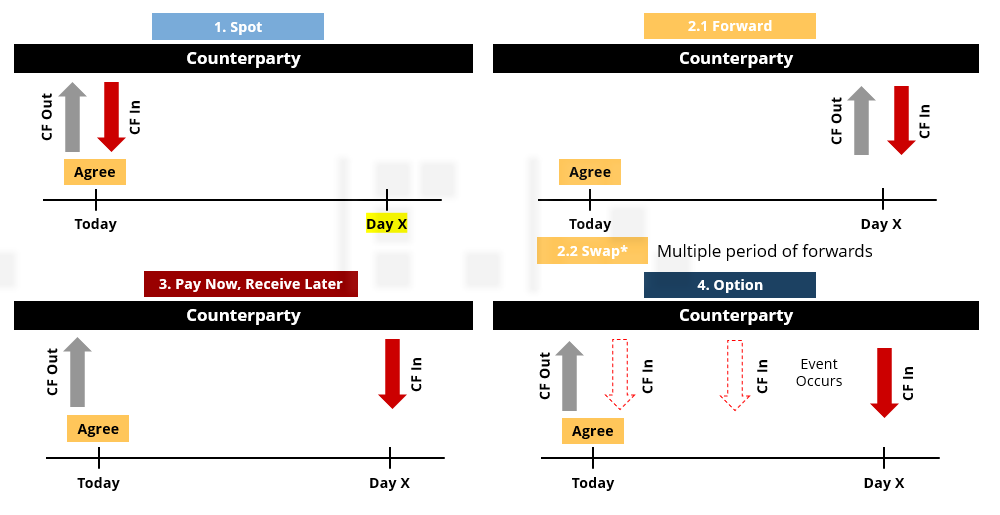

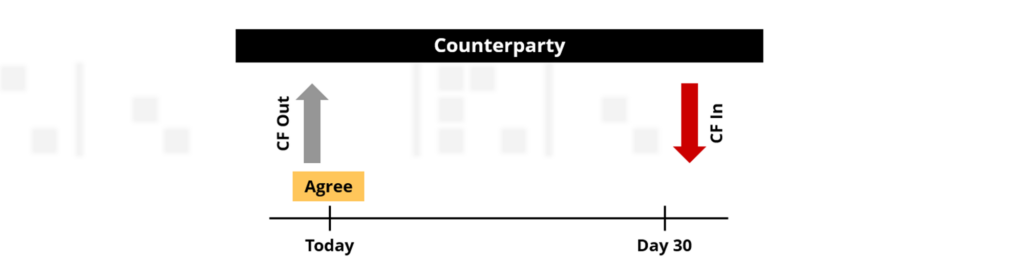

Settlement approach to Product Structures

5 Steps Hedging Process

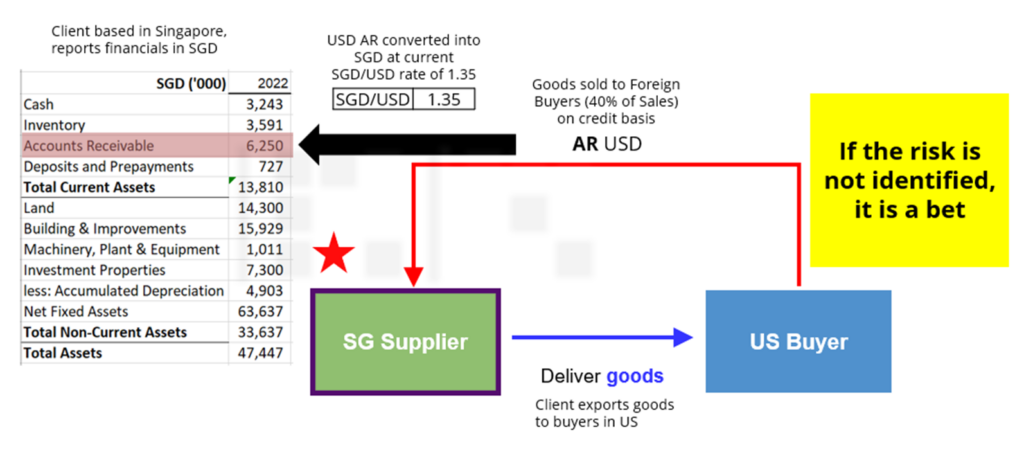

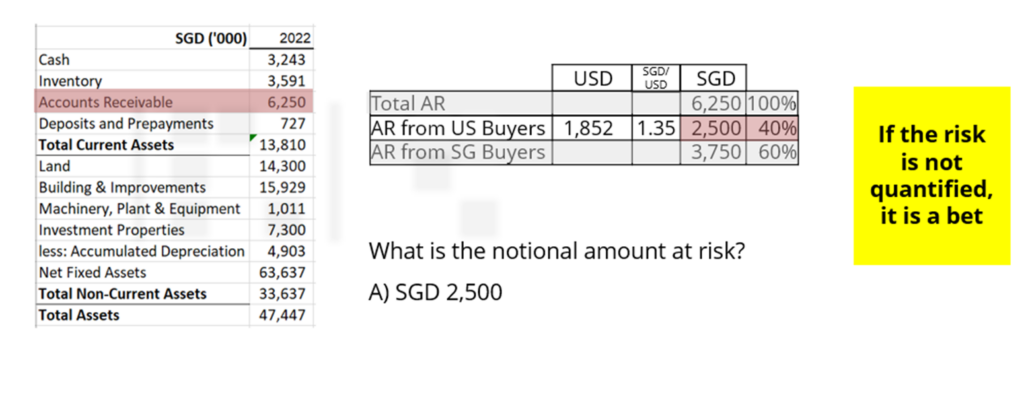

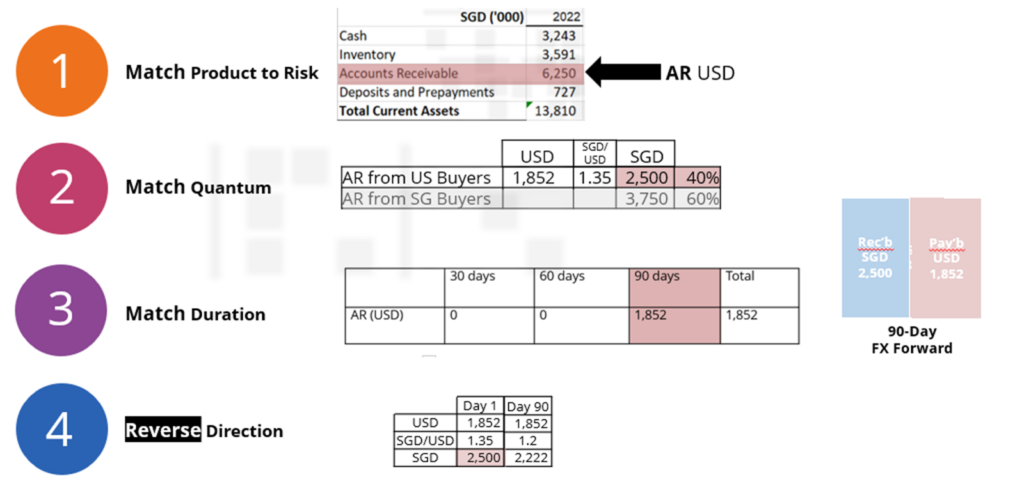

Step 1: Identify the Risks

Client Activity:

Client exporting goods to buyers in US, sells directly to buyers in SGD

US Buyers given 90 days (40%)

SG Buyers given 60 days (60%)

Client sold USD goods to US Buyers

Client records USD AR from US Buyers

Client expect to receive USD AR

Client based in Singapore, pays suppliers and reports financials in SGD

After collecting USD, they need to convert into SGD.

Results in SGD/USD FX risk in AR

Step 2: Quantify the Risks

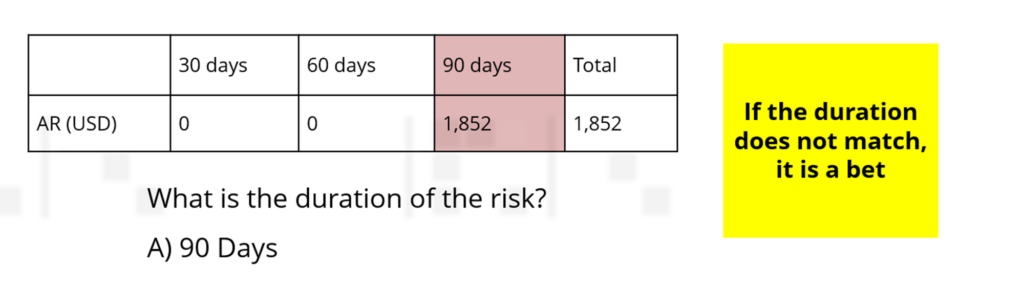

Step 3: Measure Duration of the Risks

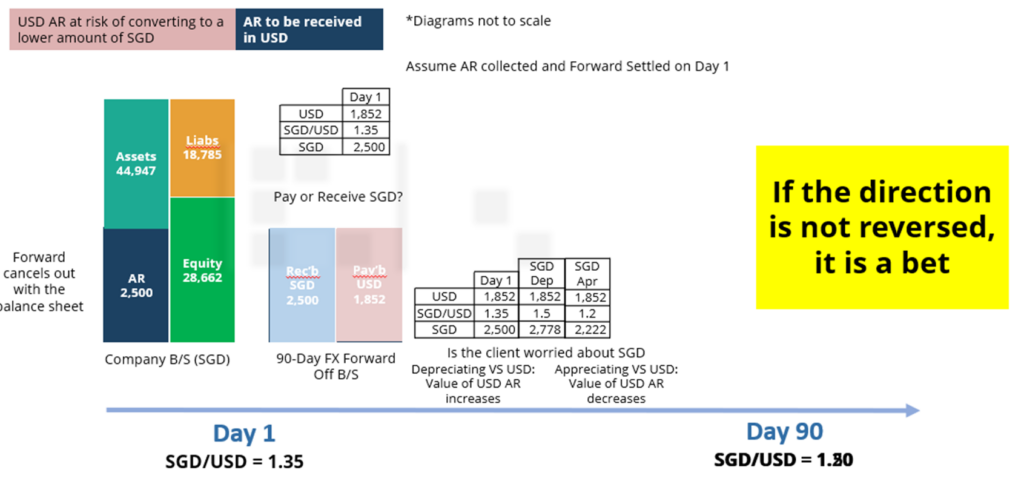

Step 4: Determine Direction of the Risks

Step 5: Reverse the Risks

Underlying Product Structures

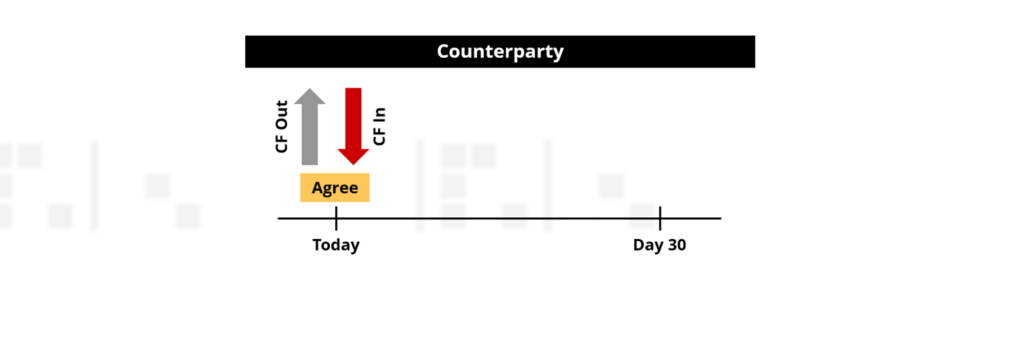

1. Spot

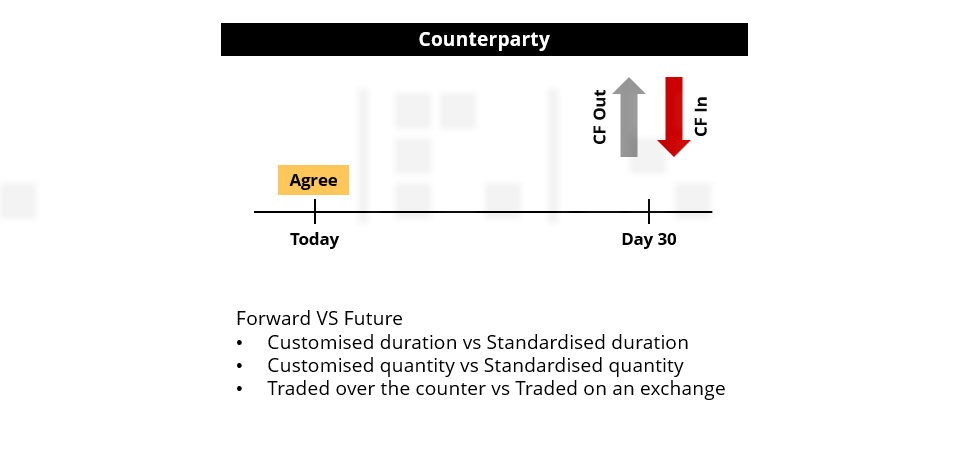

2.1 Forward

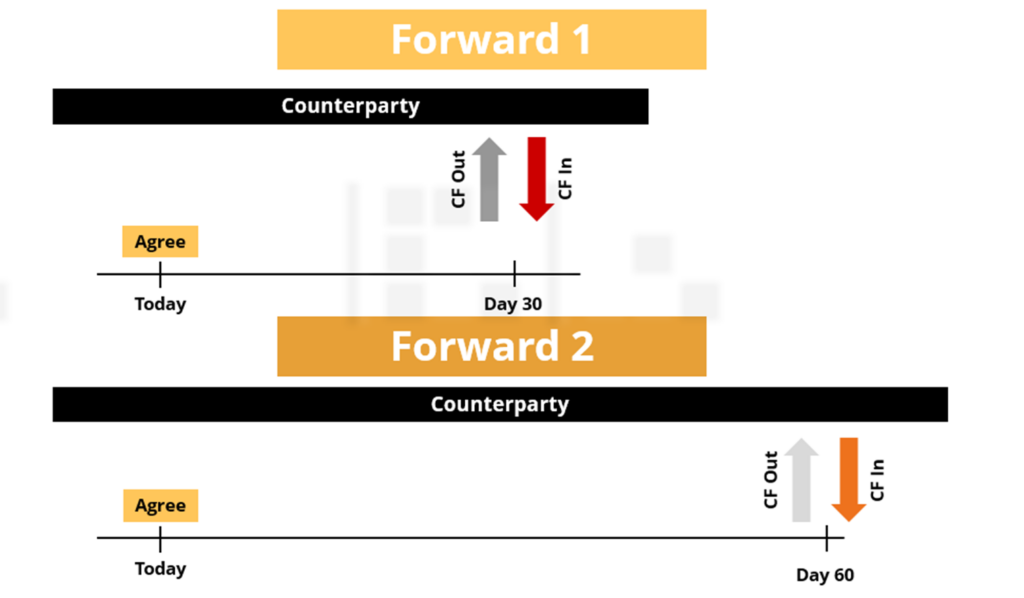

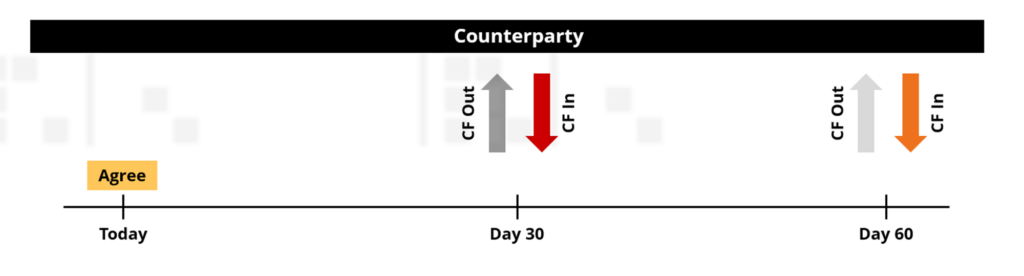

2.2 Swap

3. Pay Now, Receive Later

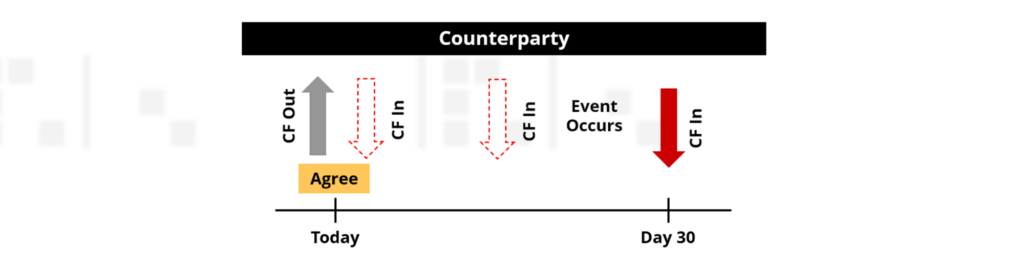

4. Option