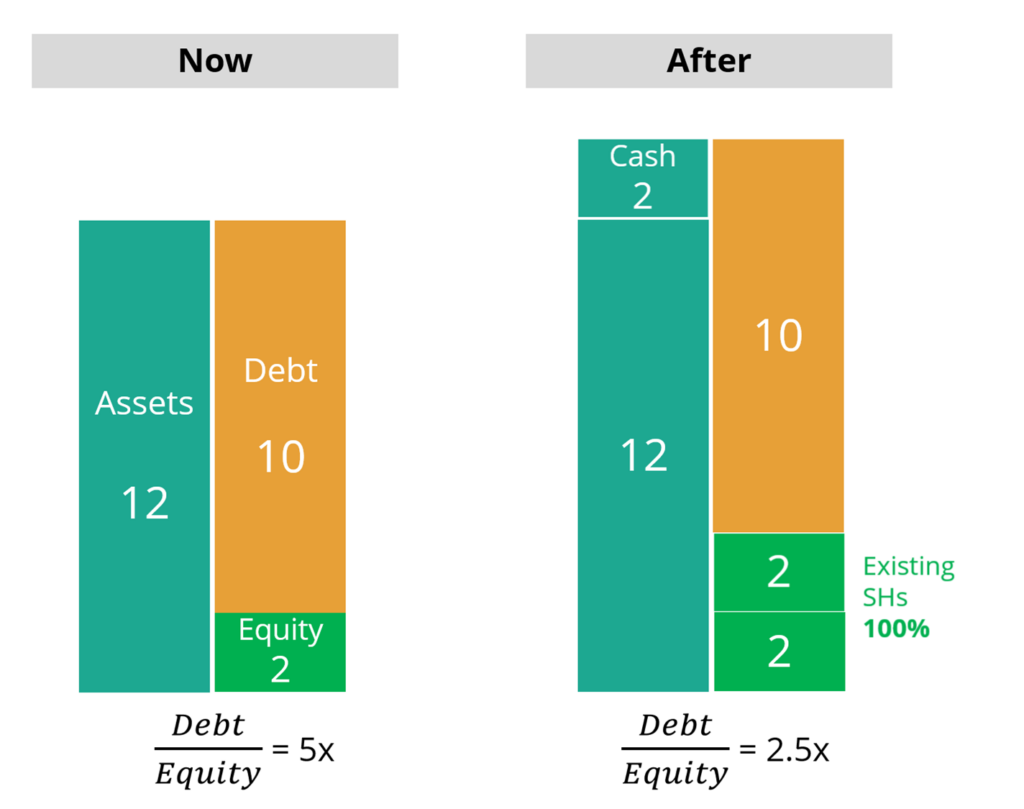

1. Inject Equity by EXISTING Shareholders

- Increases equity

- Improves capital structure; 𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦 ratio reduces

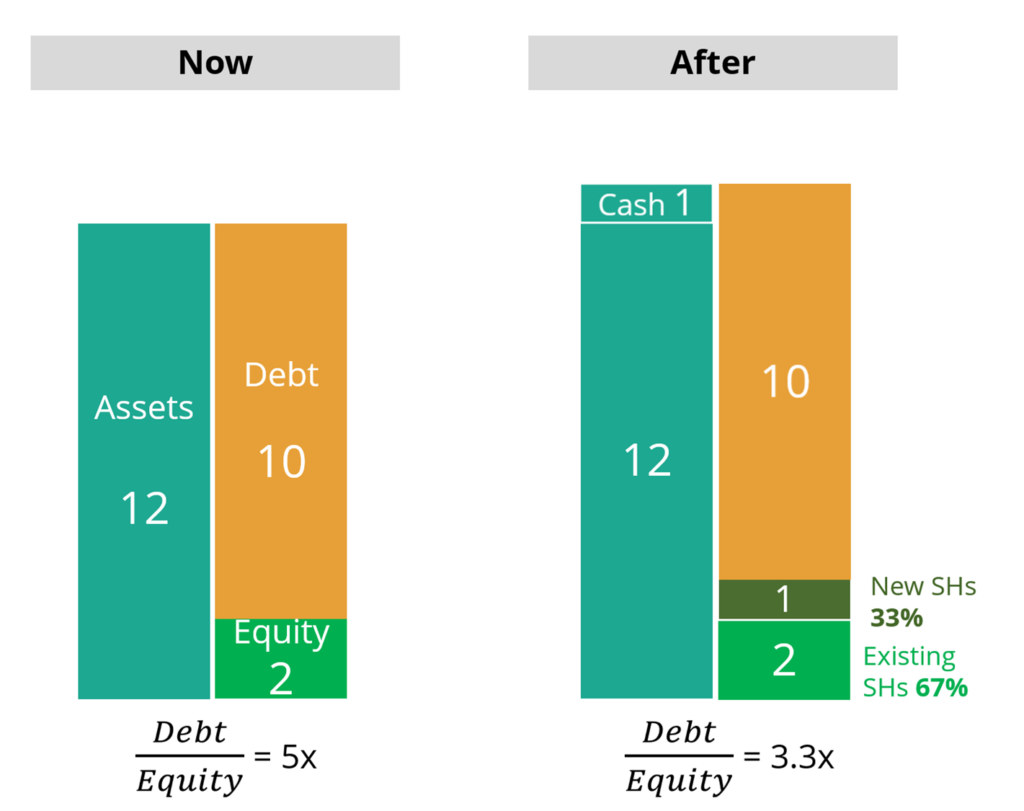

2. Inject NEW MINORITY Equity

- Increases equity by new Shareholders

- Existing Shareholders are diluted but still in control

- Initial Public Offering (IPO)

- Improves capital structure; 𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦 ratio improves

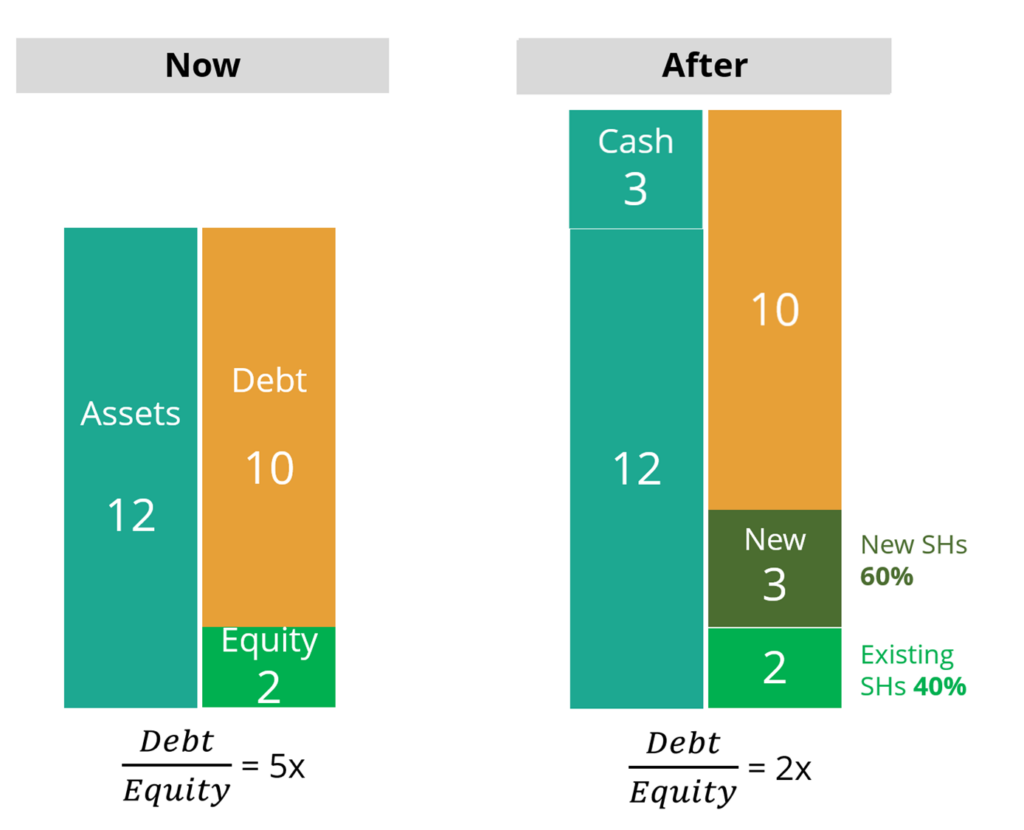

3. Inject NEW MAJORITY Equity

- Increases equity by new Shareholders

- Existing Shareholders are diluted; control passes to New Shareholders

- IPO

- Improves capital structure; 𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦 ratio improves

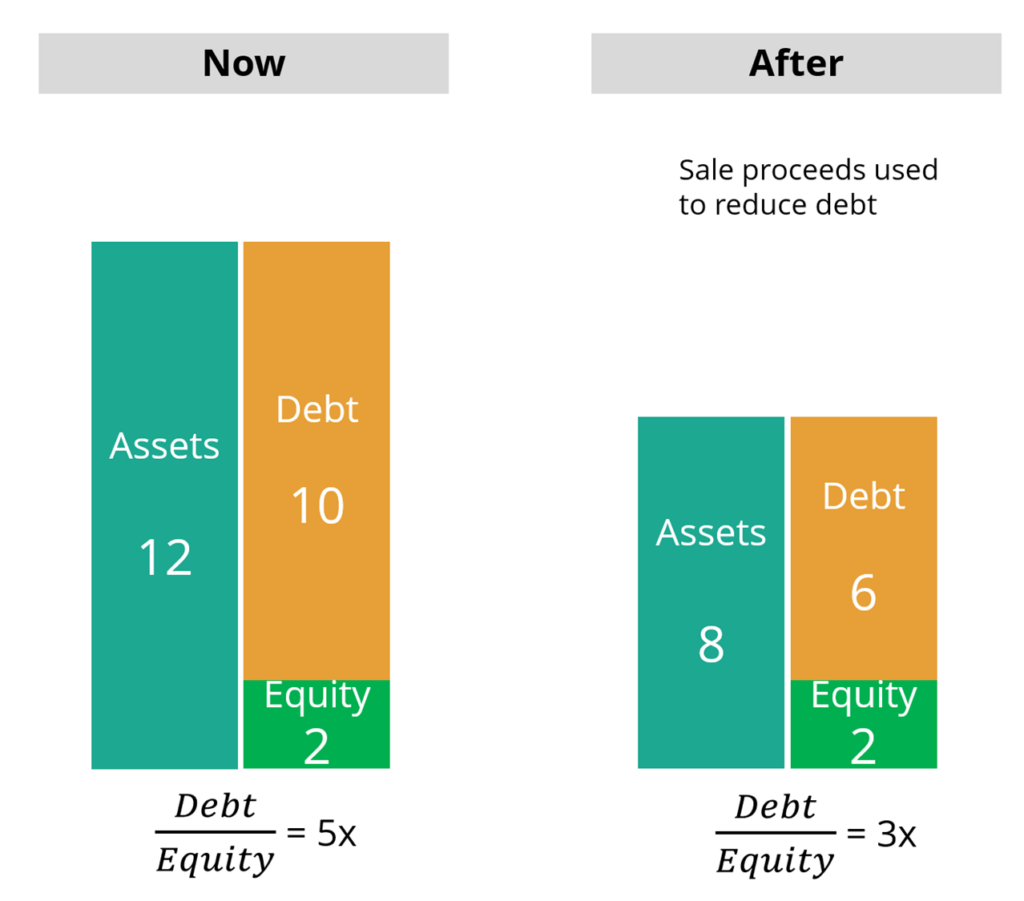

4. Sell NON-PRODUCTIVE Assets

- Scale down balance sheet by selling non-productive assets

- Sale proceeds to reduce debt

- Improves capital structure; 𝐷𝑒𝑏𝑡/𝐸𝑞𝑢𝑖𝑡𝑦 ratio improves

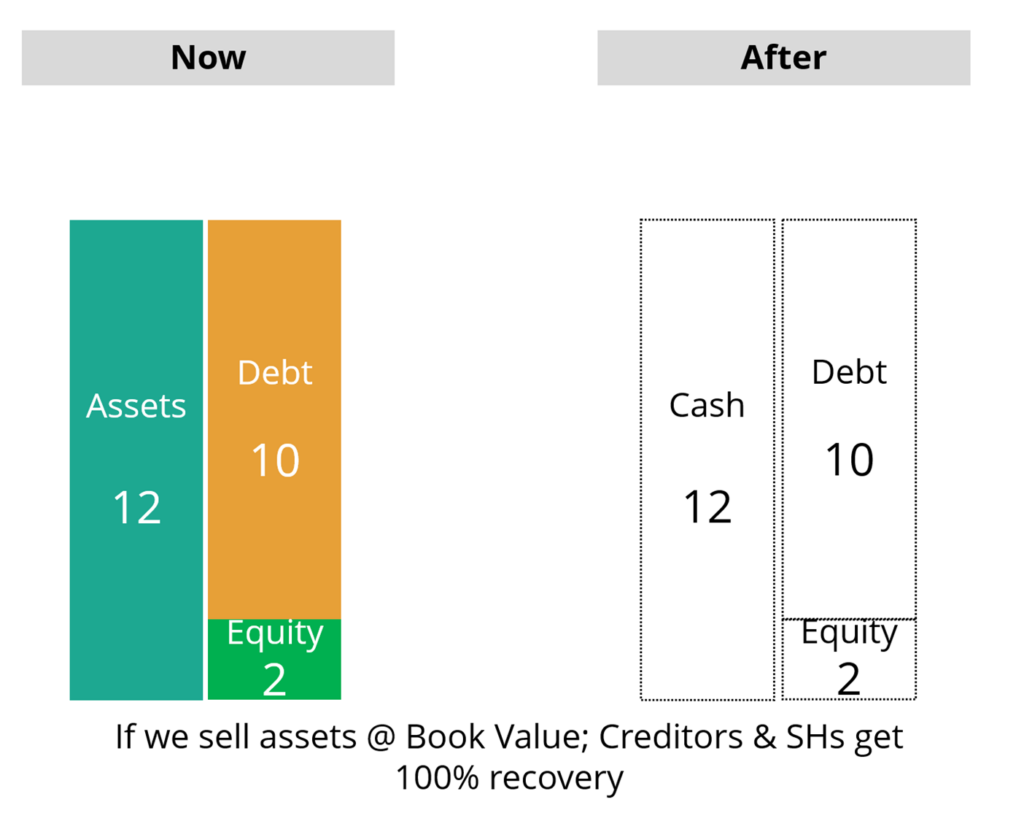

5. Liquidate ALL Assets

- Orderly winding down to maximize realisable value of assets => soft landing

- Sale proceeds repay debt in priority over equity

Alternate source of equity injection

Improve Adjusted Working Capital

- Re-invest

- Repay Debt

Stress Testing the 5-Step Capital Solutions Under Distress

Let’s stress test this 5-step capital solution sequence together.

At first glance, it’s logical on a spectrum from preservation to surrender of control, but to refine it, let’s examine:

1️⃣ Is it consistent with first principles?

What’s the core problem?

- A company with diminishing market equity faces capital scarcity, loss of confidence, and shrinking capacity to raise funds.

- The first-principles objective is to bridge the capital gap while preserving value for current stakeholders—unless forced to surrender.

The two hard constraints:

- Numerator problem: Shrinking earnings/cash flow leading to lower valuation multiples.

- Denominator problem: Fixed obligations (debt, operational costs) require capital solutions to avoid insolvency.

2️⃣ Let’s map the 5 steps into a capital structure intervention hierarchy:

| Step | Action | First Principles Goal |

|---|---|---|

| 1 | Existing shareholders inject equity | Preserve current ownership, prevent dilution |

| 2 | Seek new minority shareholders | Bring in fresh capital but still avoid change-of-control |

| 3 | Bring in majority shareholder | Accept change-of-control (M&A, strategic investor, white knight) |

| 4 | Restructure assets (sell non-productive assets) | Shrink the denominator, improve capital efficiency |

| 5 | Liquidation | Last resort: break-up value realization |

3️⃣ What frameworks are implicit here?

Capital Waterfall for Distressed Equity:

| Level | Source of Solution | Nature of Impact |

|---|---|---|

| Equity Recapitalization | Steps 1-3 | Shift in control and ownership |

| Operational Restructuring | Step 4 | Improve asset productivity, free up cash |

| Terminal Solution | Step 5 | Value realization via liquidation |

4️⃣ Are the steps logically sequenced?

Mostly yes—but consider two challenges:

Challenge A: Are steps 1–3 really sequential?

In practice, they compete, not sequence. Why?

- Existing shareholders (Step 1) often refuse to inject more funds if the business model is broken.

- New investors (Step 2/3) may only participate if they can get control or significant influence—so Steps 2 & 3 blur quickly.

Counterpoint:

You may want to model this as a branching decision tree, not a linear path.

Challenge B: Why sell only non-productive assets in Step 4?

- In distress, non-core assets are often easier to sell at fair value than “non-productive assets” (which may be unsellable or heavily discounted).

- First-principles logic would say:

- Sell non-core assets first (even if productive, but less critical to survival)

- Then sell non-productive assets (but accept they may fetch poor prices).

So the distinction between non-productive and non-core may be too rigid. The real axis is “cash-generation vs strategic value vs marketability.”

5️⃣ Can this be a model or tool?

Yes, but to be more robust and transferable, consider framing it as a Capital Control Spectrum or Capital Salvage Model, not just steps.

Capital Salvage Model

| Zone | Action | Control Impact | Capital Raised |

|---|---|---|---|

| Preserve | Shareholder rights issue | Minimal dilution | Small-medium |

| Dilute | New minority equity | Moderate dilution | Medium |

| Surrender | New majority equity | Change of control | Large |

| Rebalance | Asset restructuring | No ownership change, but smaller company | Depends |

| Exit | Liquidate | Control ends, break-up value | Final resort |

6️⃣ Second-Order Thinking: What are the risks of the model?

- Illusion of optionality: In reality, many distressed companies are already at Step 3 or 4 before management acts.

- Behavioral traps:

- Existing shareholders often overestimate their willingness to support (Step 1).

- Management may resist Step 3 due to loss of control bias.

- Selling assets selectively (Step 4) may be impossible in time-constrained distress situations.

- Market signaling: Each step sends strong signals to the market, affecting pricing of subsequent steps. For example, a failed rights issue may poison Steps 2 and 3.

7️⃣ Adjacent domain insights:

- Game theory: Each stakeholder is playing a mixed-strategy game. Control, dilution, and survival are in tension.

- Behavioral economics: Loss aversion makes Steps 1 and 3 emotionally difficult. Many boards freeze until Step 4 or 5 is forced.

- Systems thinking: The sequence interacts with external market conditions—liquidity cycles, asset saleability, and buyer appetite shift the viability of each step.

8️⃣ Summary of recommendations:

| Issue | Proposed Enhancement |

|---|---|

| Linearity of steps | Model it as a decision matrix or branching path, not strictly sequential |

| Asset sale logic | Use cash-flow vs strategic value vs marketability rather than “non-productive” vs “non-core” |

| Framework positioning | Call it a Capital Salvage or Capital Control Spectrum, not just 5 steps |

| Behavioral layer | Add analysis of stakeholder incentives, market signaling, and psychological barriers |