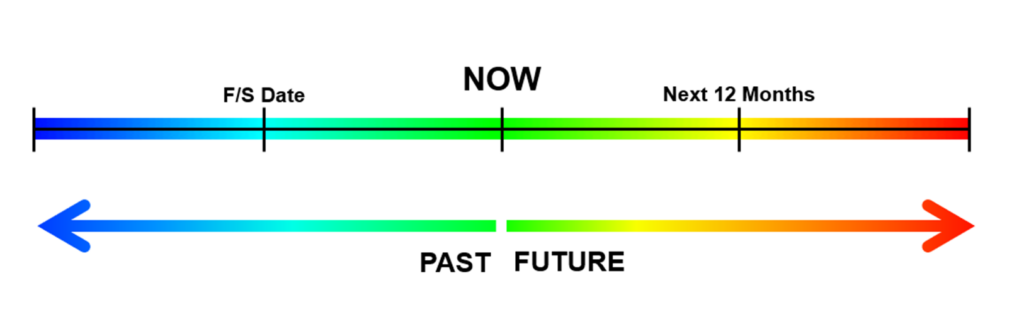

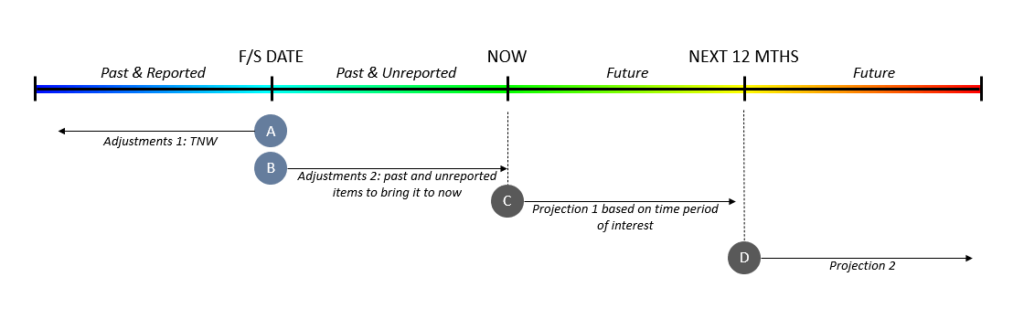

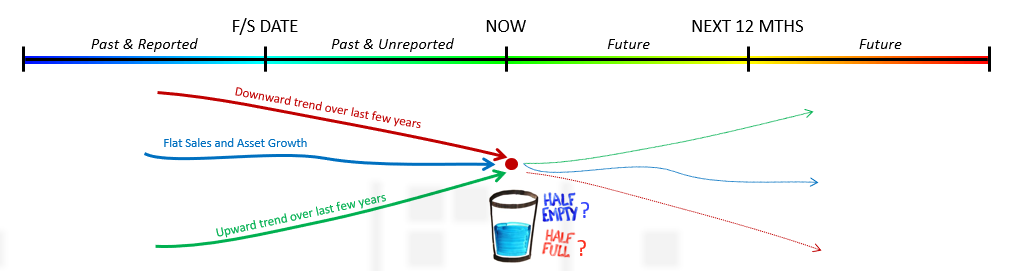

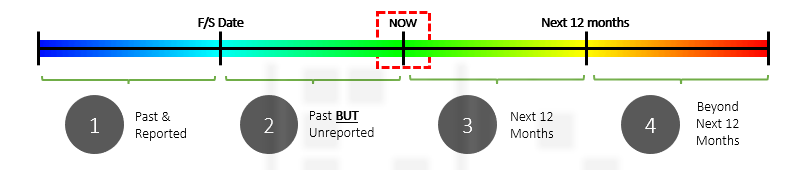

Analysts often rely on information contained in a company’s financial statements as a primary source of information about the company. While a company’s financial information may indeed be useful, it is important to note the timing limitations of financial statements. Financial statements provide information only up to a particular date (the Financial Statement Date). A comprehensive and useful analysis would need to cover the time that has passed since the Financial Statement Date as well.

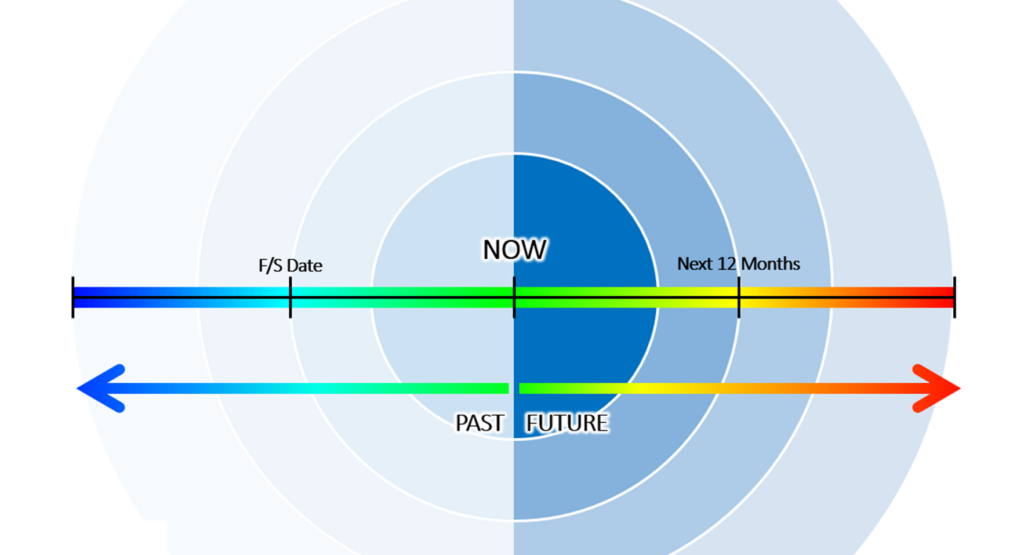

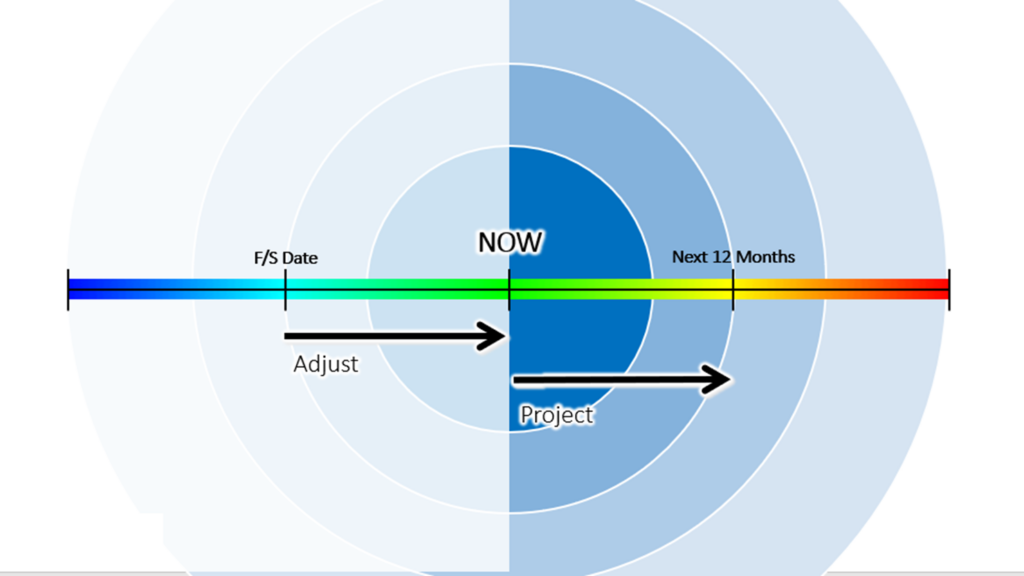

The concept of 4 Buckets of Time helps prompt us to consider a more complete perspective of time.

Timeline is punctuated by 3 points in time:

1. F/S date: Financial Statement Date

2. Now: Current Review date

3. NRD : Next Review Date (typically over next 12 months)

Time changes everything

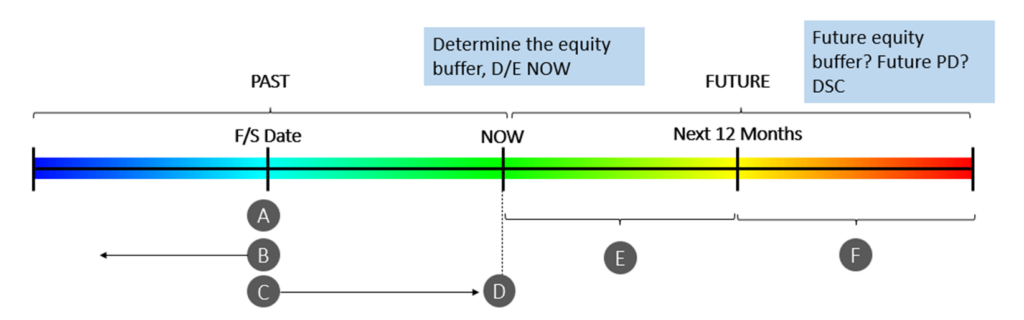

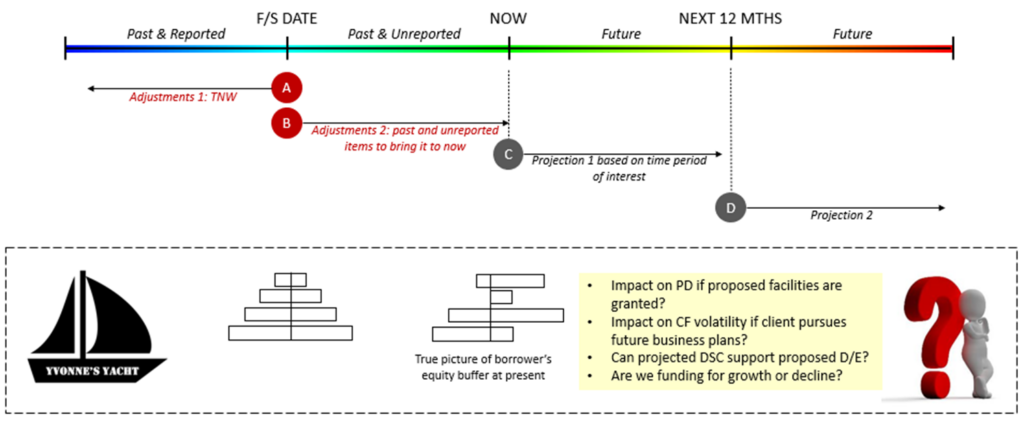

A. Point of reference 1 – past and reported

B. Adjustments 1 – tangible net worth

C. Adjustments 2 – post B/S activities

D. Point of reference 2 – past and unreported

E. Projections 1 – time period of interest

F. Projections 2

Period C to D

- Site visits/calls, AR aging list/operating accounts/interim reports, credit bureau searches, online data (news/google etc.) and litigation searches.

Period E and F

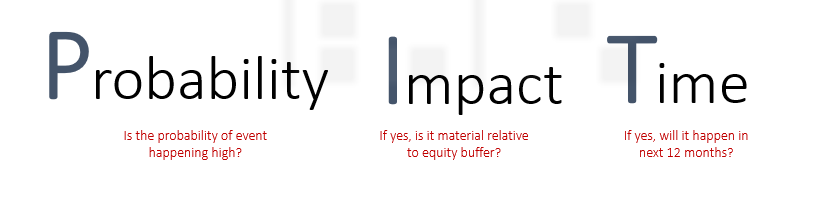

PIT framework to evaluate potential events:

- P = Probability: what is the probability of an event occurring?

- I = Impact: does this event have a material impact on the company’s equity buffeT = Time: when will it materially impact the company? Next 12 months??

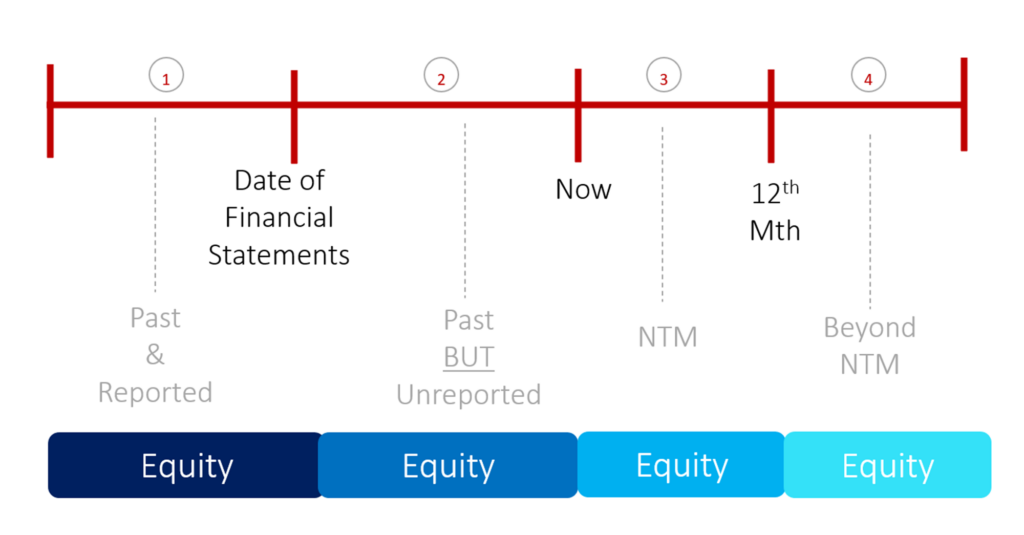

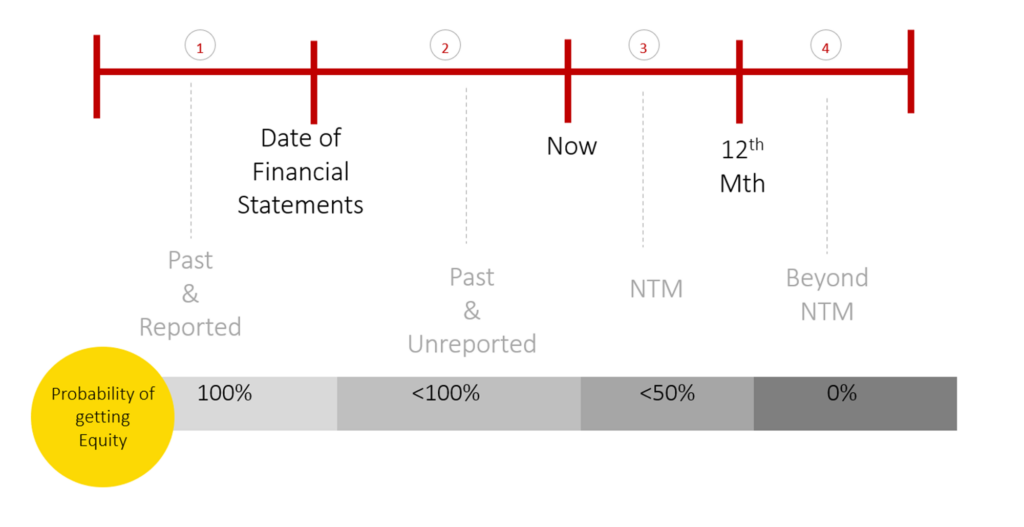

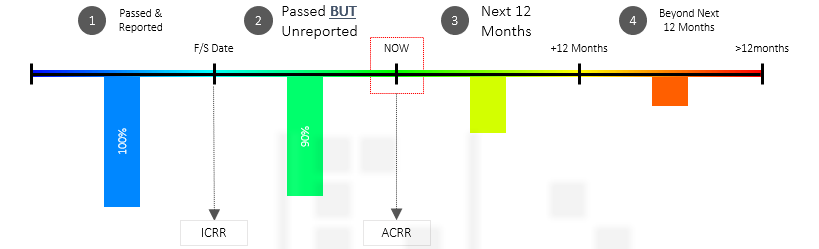

4 points of time

Divided into 4 buckets of time:

1. Past & Reported

2. Past BUT unreported

3. NTM : the future period typically next twelve months from Now to NRD

4. Beyond NTM

4 buckets of TIME/ EQUITY

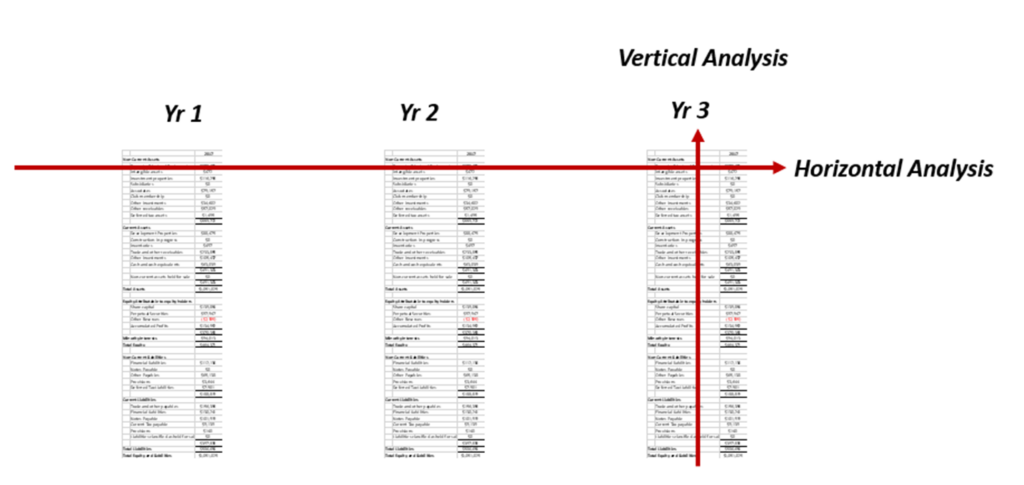

Analysis : Horizontal/Trend vs Vertical/X-section

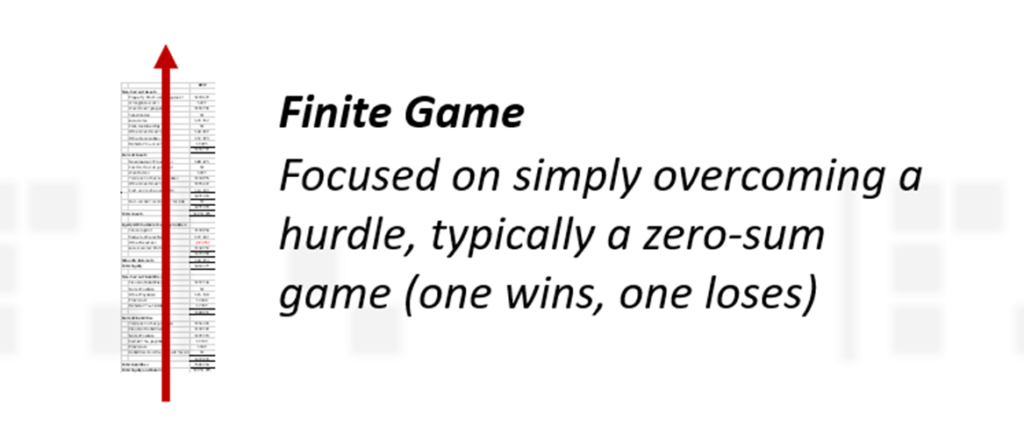

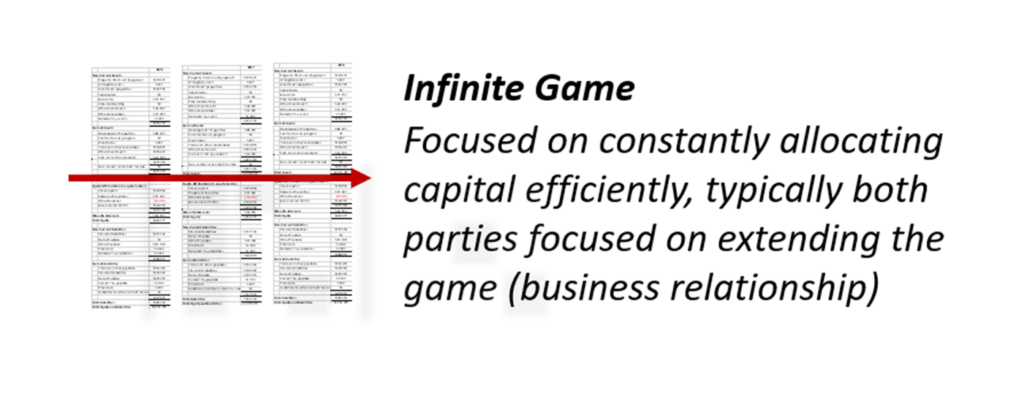

Moving from a ‘finite game’ to an ‘infinite game’ perspective

4 Bucket of time – Revised

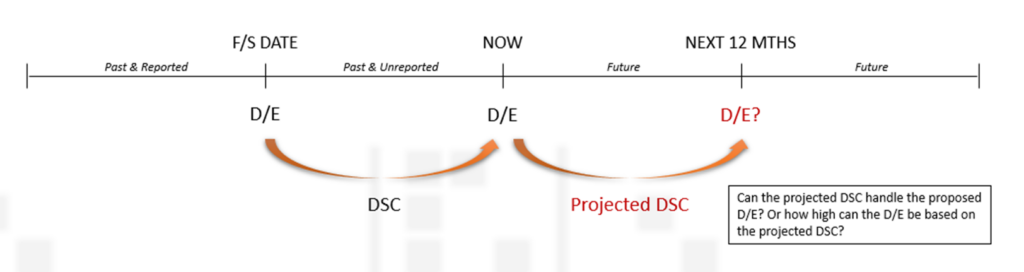

Linking D/E and DSC : Key Financial Risk Ratios

2 Key Financial Risk Ratios

- D/E ratio looks at the capital structure of a firm. It is a balance sheet ratio.

- DSC is a P/L ratio which links back to the balance sheet. Net profit is future equity.

Four Buckets of Time

Four Buckets of Time: time changes everything

Probability, Impact and Time: Analysis for the NTM

Four Buckets of Time: time changes everything 2

After Projection 2

Looking to the future

- There is a SME relevance over the next 12 months – liquidity concerns are more pertinent to smaller companies.

- Identifying companies with credit quality sufficient to repay in the future.

- PIT framework to evaluate NTM and beyond: (3) and (4)

- P = Probability: what is the probability of an event occurring?

- I = Impact: does this event have a material impact on the company’s equity buffer?

- T = Time: when will it materially impact the company? NTM or the foreseeable future?

- This would eventually lead up to an analyst’s evaluation of LGD and EAD.

Determine triggers & early warning signals to monitor

What do you monitor at each segment of time?

- What has happened before i.e. past events

- What is happening across the industry i.e. its peers

- Consider the seasonality of the logistics business i.e. high volume vs low volume season

3 Lines of Defence

Introduction Framework for assessing events in different time frames

The framework illustrate that time changes everything 时过境迁 © about the borrower, i.e. Annual review with no changes does not confirm that there are no changes to financials of the borrower. It also helps user to identify clearly the 4 buckets of time that one should selectively focus upon depending on his/her requirements.

1. Past and reported : why certain outdated financials do not project well for future

Issues

- How complete and reliable is the financial information in the 3 statements?

- Any adjustments for off-balance sheet items required?

- Any misclassification of B/S and P/L items?

- Was the spreading done accurately?

- How many years of historical financial information do you have?

Solutions

- Use more years of F/S to find potential trends useful for future projections to NRD

- Verify accuracy of F/S by cross checking with auditor opinions and key audit matters

- Adjust for material items such as Leases, Contingent Liabilities, Derivative Contracts – another topic to be addressed separately

- Calculate adjusted equity buffer

2. Past But Unreported event: Tools to mitigate – call / sites visits with reports, operating accounts

- Adjustments required to bring F/S as close to “NOW” as possible !!!

Issues

- How are the financials dated as of F/S date relevant to the credit analysis for next 12 months? Note: the financials are dated historical as we speak!

- How do you bridge the information gap between passed and reported financials, and passed BUT unreported in the financials?

- How do you mitigate the issue of small companies who do not produce interim quarterly financials? Can you still rely on dated financials as of the last F/S date?

Solutions

- Updated AR Listing

- Credit Bureau Searches and others for non-SG

- Interim/Management-prepared Financials

- Operating Accounts and Private Bank Checks

- Core reports

- Client/Promoter visits

- Litigation Searches

- Data from Social Media, Google, News report and other publicly available sources

3 & 4. Next 12 Months (to Next Review Date) : Tools for assessing future events – PIT (Probability, Impact and Timing)

Important for a banker to understand that there are different tools to evaluate the next 12 months

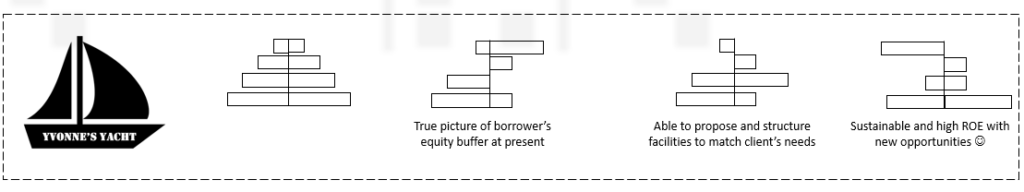

Conclusion

4BOT is a CONCEPTUAL FRAMEWORK to remind us to:

1.Check blind spots when relying on historical (i.e. outdated) financials in MRA

2.Address the information gaps by applying the mitigating solutions

3.Use PIT analysis for assessing future events for NTM and beyond

4. Time changes everything, 时过境迁 about the borrower