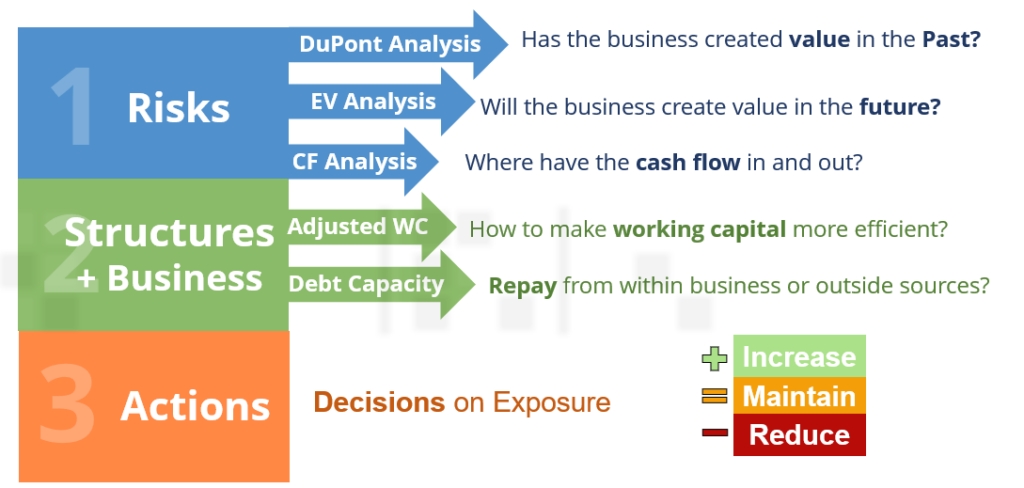

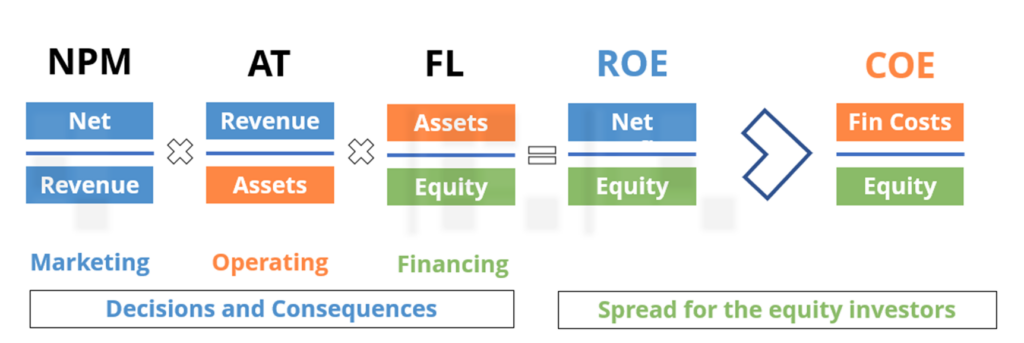

Dupont analysis

Is the business creating value? EWS!

Focus on how the business is creating value

- DuPont ratios breakdowns the levers of value creation

- Net Profit Margin

- Asset Turnover

- Financial Leverage

- Introduce COE, Cost of Equity

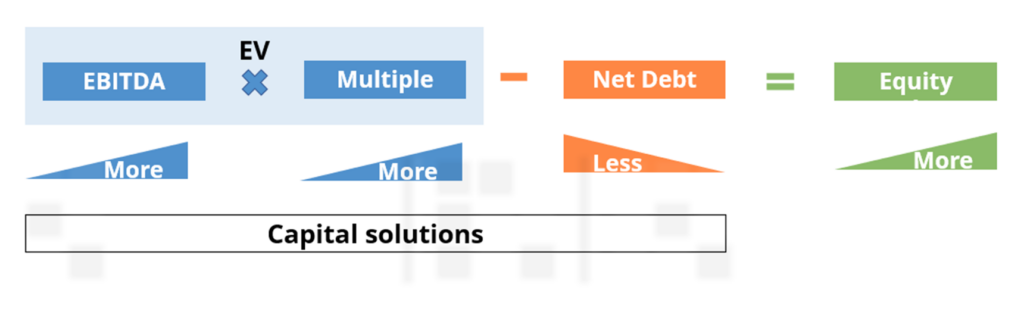

EV analysis

What’s the shareholder value? EWS!

Capital solutions

- Increase EV

- Reduce Net debt

- Result in more Equity

CF analysis

How is the cash allocated? Where have the cash flow in and out?

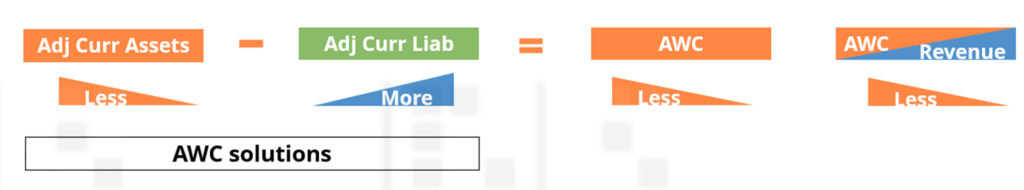

Adjusted WC

How efficient is WC? How to optimise?

AWC solutions

- Reduce currrent assets

- Increase current liabilities

- Result in lower adjusting working capital

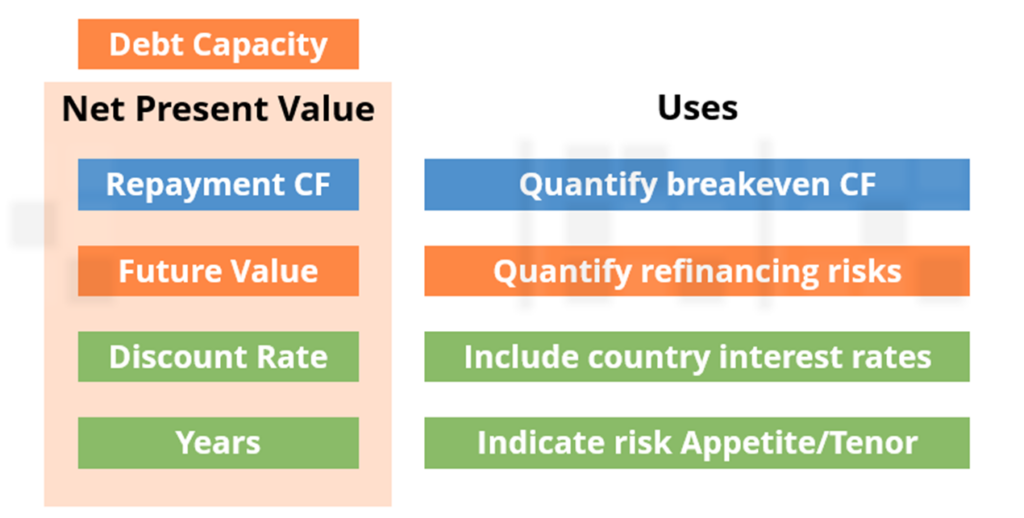

Debt capacity

What are the repayment sources? Repay from within business or outside sources?

Two Questions

- Purpose of Financing (Cash flow out)

- Why do they need the money?

- Repayment Sources (Cash flow in)

- How are they going to repay?

- Between the 2 questions: Difference Comes from Commercial Activity aka UEA

Ultimate Economic Activity

- Investment decisions must make economic sense

- Appropriate returns to debt and equity capital providers

- Return on Assets minimally above return on debt

- Financing of transactions must be in support of true economic activities

- Not fabricated by borrowers through related party transactions

- This comes with an understanding of who the ultimate third party buyers and suppliers are

- UEA to be explained through

- Business model analysis, Management and Stakeholders, Industry Analysis

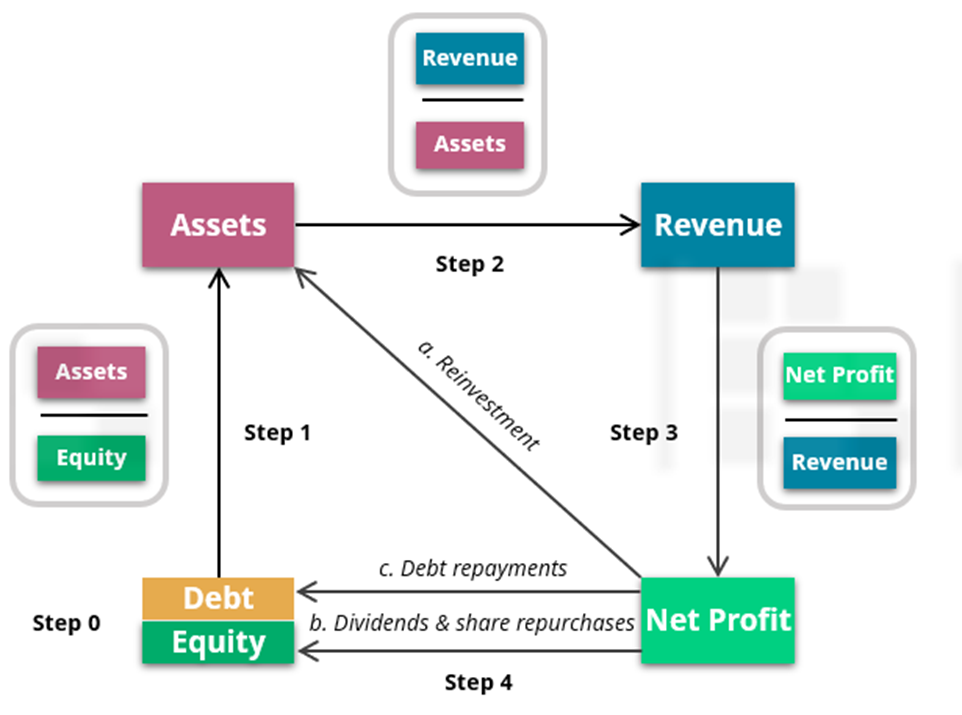

Understanding Business Risks

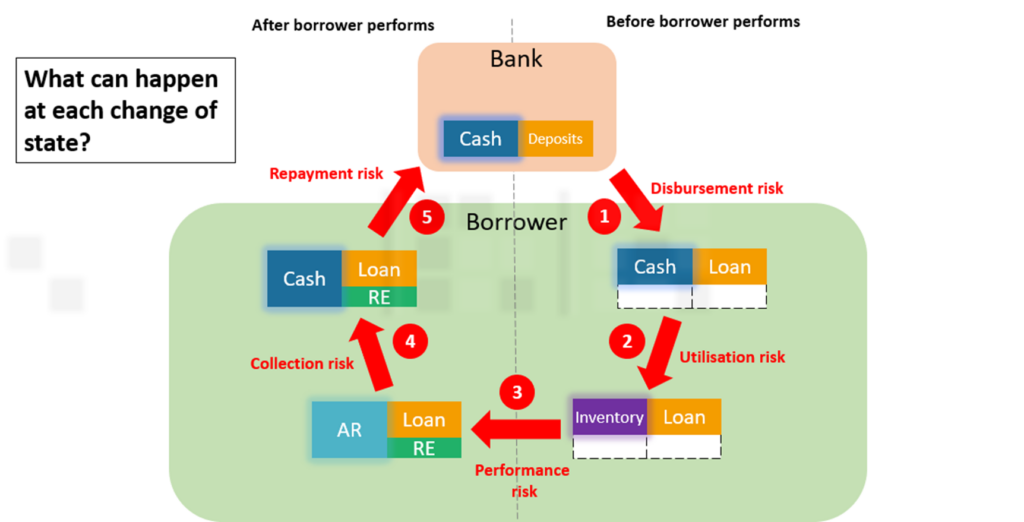

- Ultimate Economic Activity is represented by the Capital Life Cycle

- Understand how a business generates its Net Profits when financed by Debt and Equity

- Understand the differences in perspectives of business owners and bankers when distributing Net Profits

Structuring using 5 States of Cash